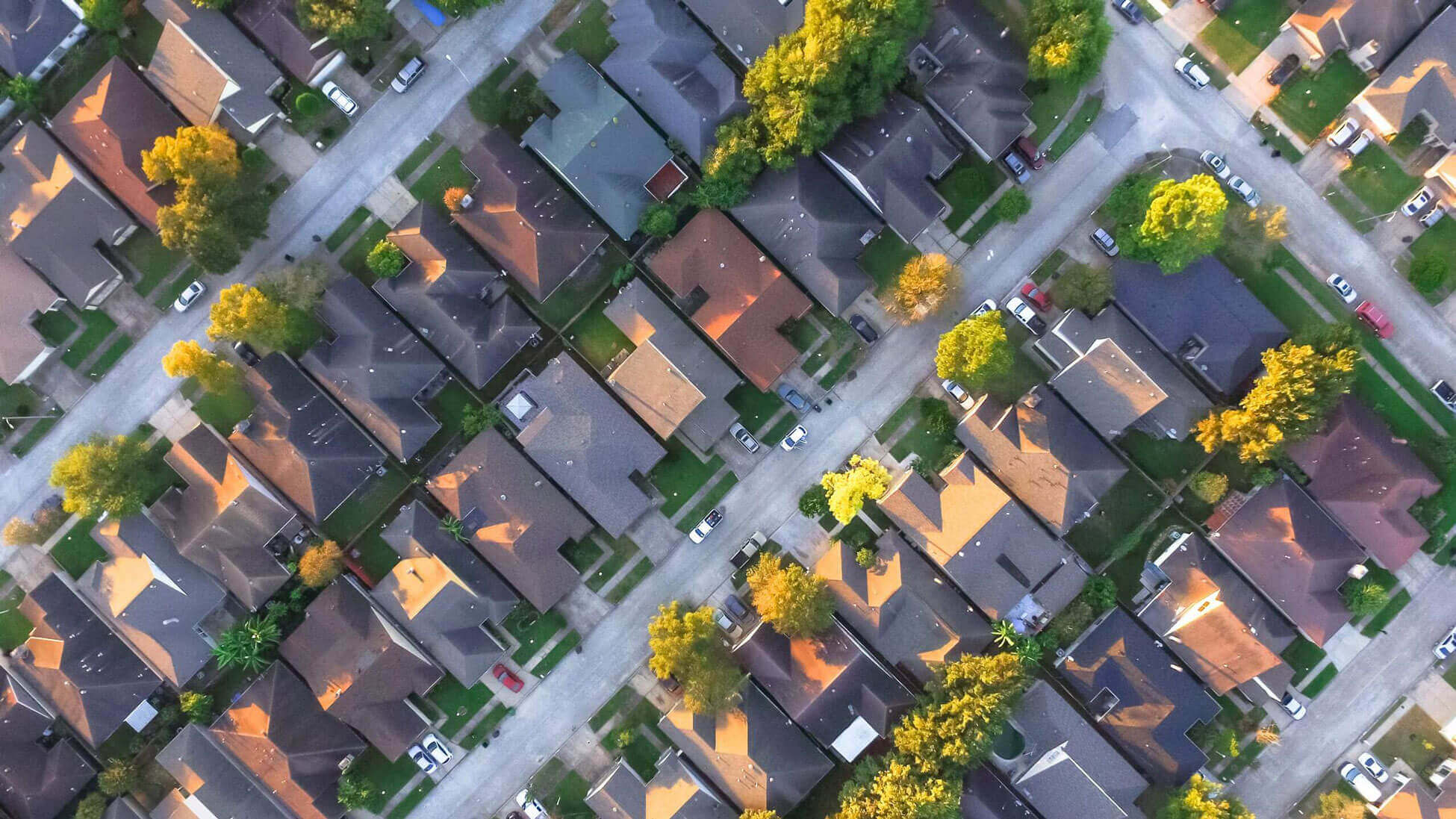

360 Property Data

CoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataCoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataDifferentiate with insights and analysis from CoreLogic property data.

Know MoreProperty. People. Potential. CoreLogic unlocks value for the entire property ecosystem.

Learn MoreHome / Archives for Economy Team / Page 19

The Office of the Chief Economist works on critical research and insights to gauge the temperature of the housing market as a whole. From home price analyses to home equity, from loan performance to single family rent evaluations, they keep tabs on the movement and fluctuation of bellwether metrics that can inform the trajectory of the housing economy–and consequently affect the homeowners who participate in it.

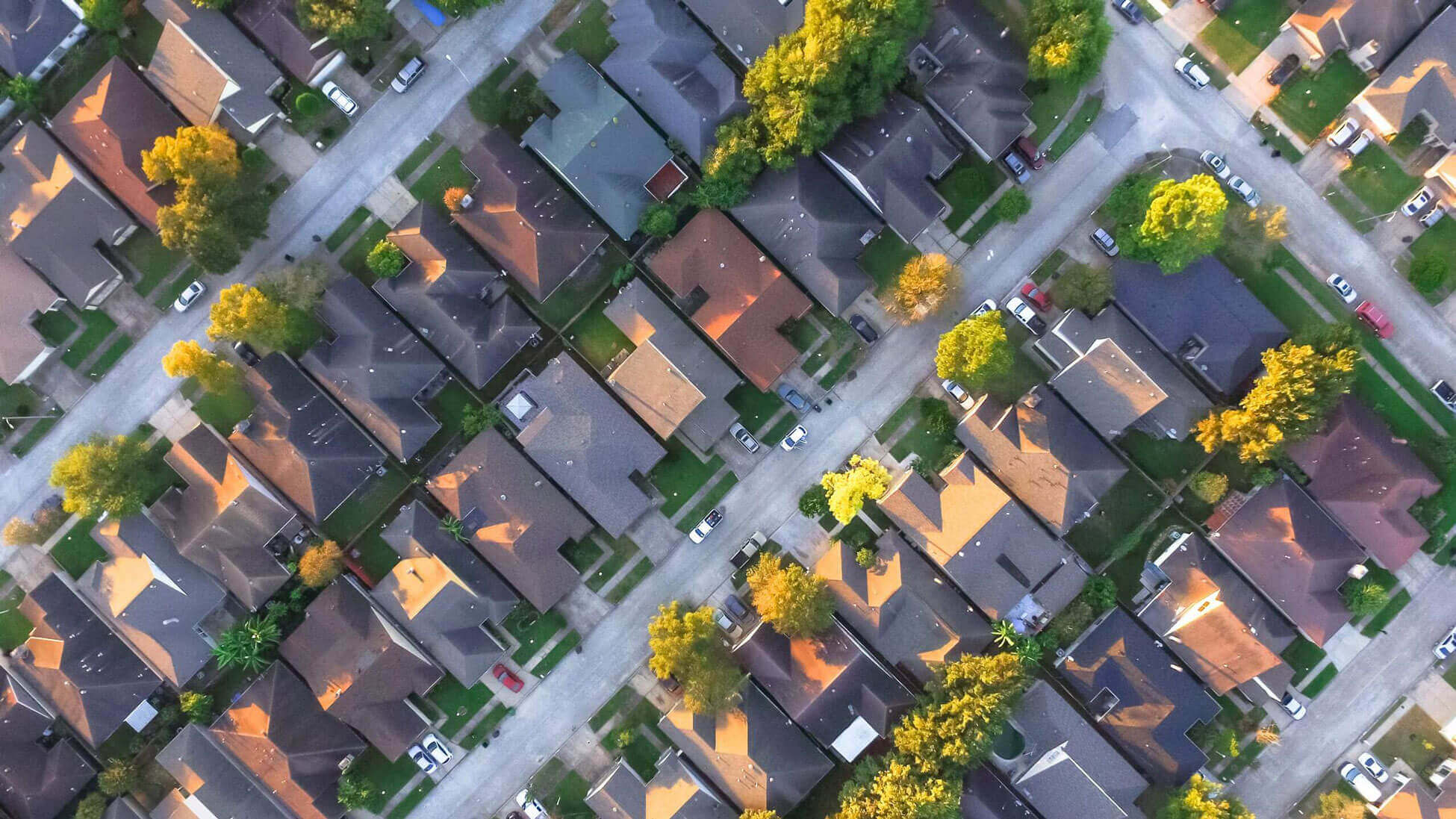

In March 2022, 2.7% of mortgages were delinquent by at least 30 days, down by 2.2 percentage points year over year.

CoreLogic analysis shows U.S. homeowners with mortgages (roughly 62% of all properties*) have seen their equity increase by a total of over $3.8 trillion since the first quarter of 2021, a gain of 32.2% year over year.

In April, U.S. home prices rose by almost 20.9% year over year, according to CoreLogic’s most recent Home Price Index (HPI) Report.

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

In February 2022, 3.2% of mortgages were delinquent by at least 30 days or more, down by 2.5 percentage points year over year.

In March, U.S. home prices rose by almost 21% year over year, according to CoreLogic’s most recent Home Price Index (HPI) Report.