360 Property Data

CoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataCoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataDifferentiate with insights and analysis from CoreLogic property data.

Know MoreProperty. People. Potential. CoreLogic unlocks value for the entire property ecosystem.

Learn MoreHome / Archives for Mortgage Team

For more than 50 years, our solutions have helped millions of people buy the homes they love. We harness the power of our best-in-class property data to develop end-to-end digital mortgage solutions that allow originators to produce loans faster, with fewer steps, and at lower costs—all while improving the borrower’s experience. And once originated, we provide mortgage servicers with the actionable insights they need to make timely, informed decisions about new portfolio threats and emerging opportunities.

A case study on how CoreLogic’s Marketing and Retention Solutions help mortgage brokers close more deals Like most mortgage companies, Empire Mortgage Corporation saw the

Building and nurturing your contact list is essential for long-term success in the mortgage industry. According to a study by STRATMOR, 89% of borrowers made

If you bury someone on your property, do you have to pay taxes? What about other exemptions to reduce tax burdens?

Integrating appraisal modernization changes will require support from technology partners with extensive, accurate, and comprehensive property data.

The CoreLogic Mortgage Fraud Report analyzes the collective level of loan application fraud risk the mortgage industry is experiencing each quarter.

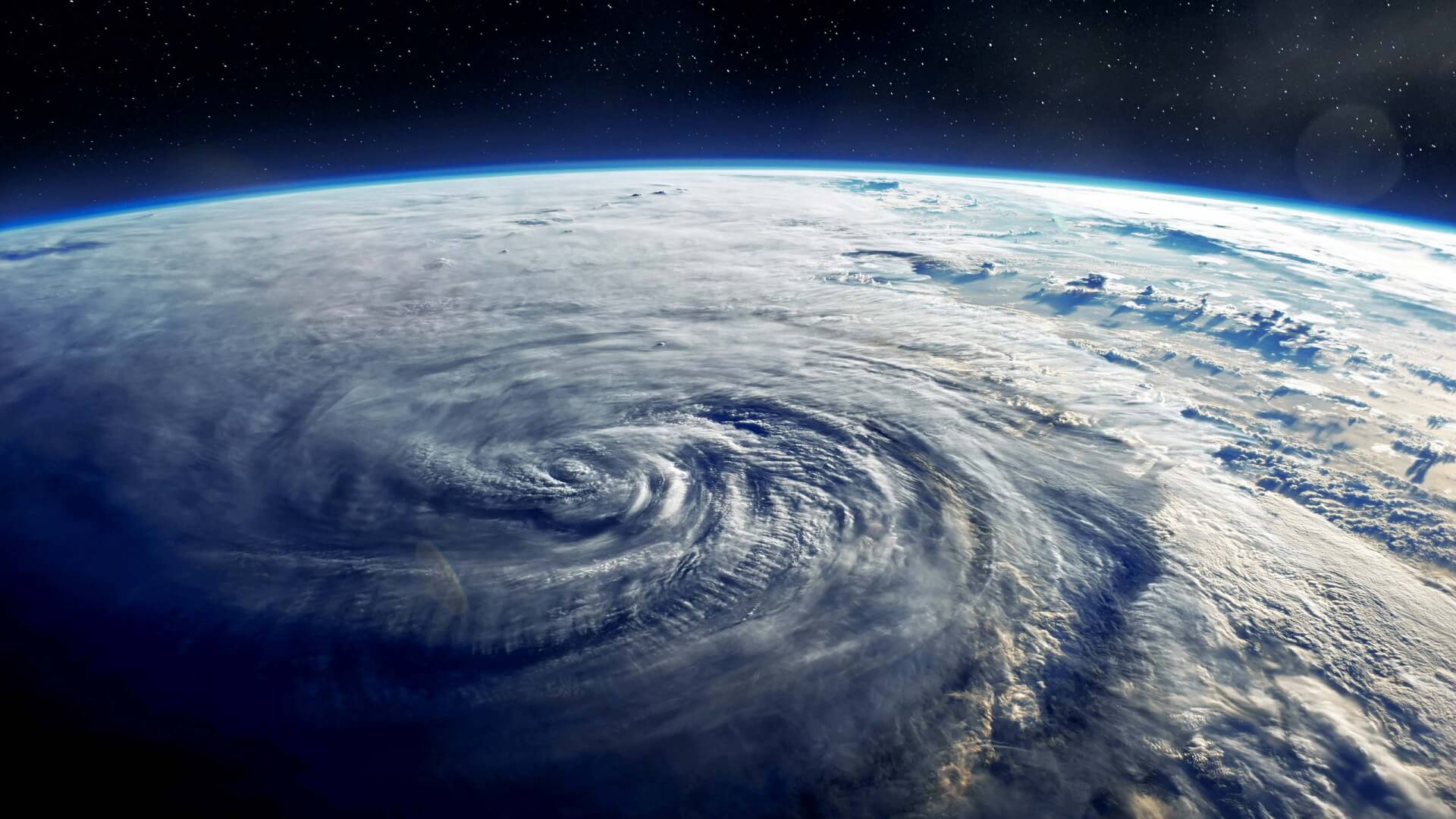

The whitepaper investigates the areas of the U.S. affected by Hurricanes Irma (2017), Harvey (2017), Michael (2018) and Laura (2020).