360 Property Data

CoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataCoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataDifferentiate with insights and analysis from CoreLogic property data.

Know MoreProperty. People. Potential. CoreLogic unlocks value for the entire property ecosystem.

Learn MoreHome / Archives for Peter Carroll

Pete Carroll holds the position of Executive, Public Policy and Industry Relations at CoreLogic. In this role, Carroll directly oversees industry and public-sector engagement programs, drives enterprise strategic initiatives for CoreLogic, and expands opportunities for the company’s thought leadership, insights, brand awareness and solutions expertise within Washington, D.C., and across the Federal Housing Agencies and other stakeholders.

Prior to joining CoreLogic, Carroll was the Executive Vice President of Quicken Loans where he led the development and discussion of Quicken’s positions on a broad spectrum of policy issues. He also worked at Capital Markets, Wells Fargo and the Consumer Financial Protection Bureau (CFPB). He earned his bachelor’s degree in international relations from Connecticut College.

In the final episode of this season, we’re going to talk about how technology like artificial intelligence, machine learning and more are paving the way for the future of mortgage underwriting—and can move the needle meaningfully in closing the Affordable Lending Gap.

Between greater financial literacy education and awareness and existing down payment assistance programs, there are many solutions today to restore trust in the U.S. homeownership system and identify new opportunities to create responsible yet affordable mortgage financing.

Hi! I’m Pete Carroll, executive of public policy at CoreLogic and today, I’m going to talk about what’s impeding access to affordable and responsible mortgage loans.

There is a long, well-documented history of housing discrimination in the U.S., particularly as it pertains to U.S. Housing Policy.

In this new season, we’ll review homeowner “demand” challenges, including restoring trust in the U.S. homeownership system and identifying new opportunities to create responsible, yet affordable mortgage financing.

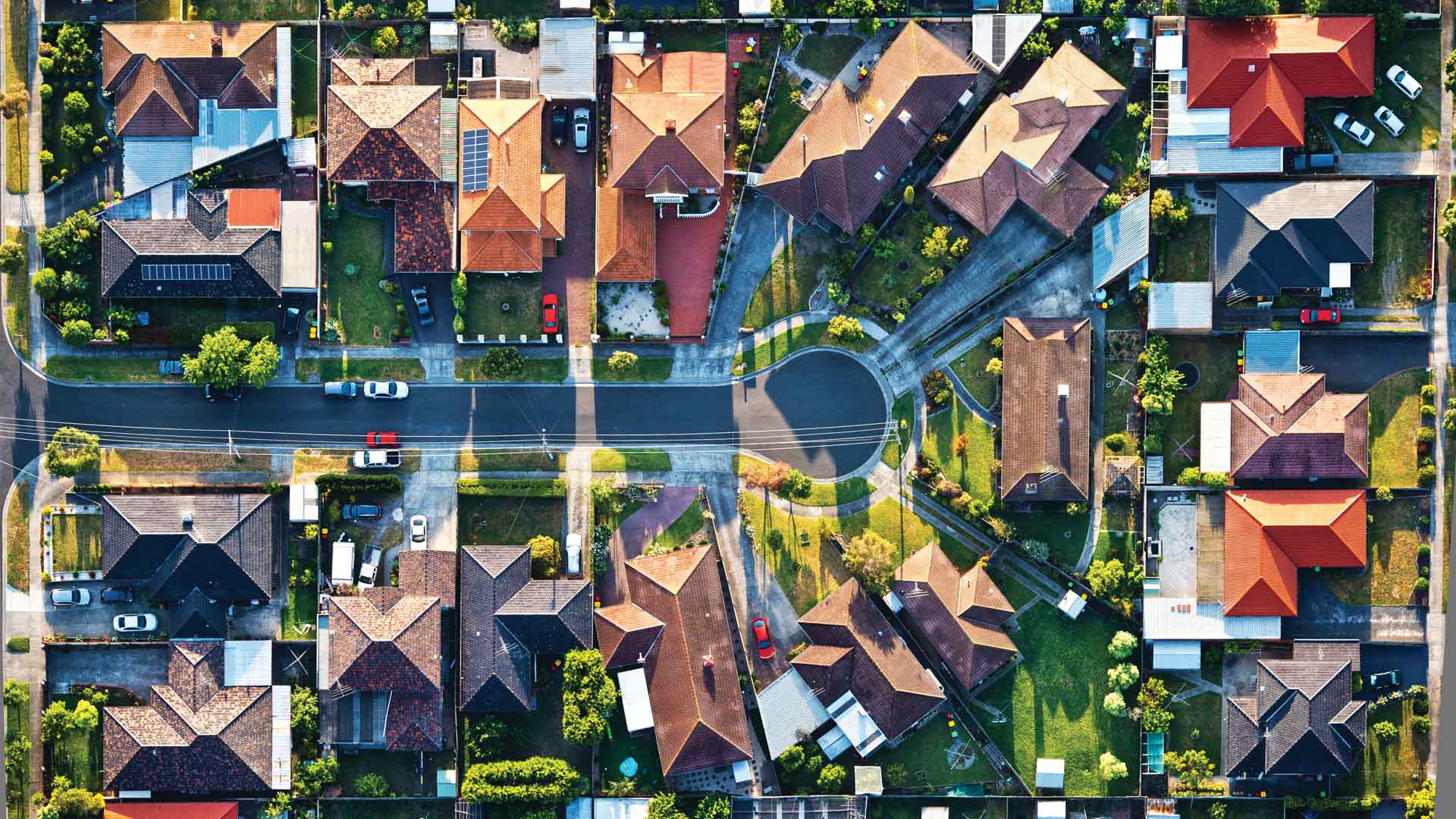

Header image: Attached

New Episode: The U.S. Housing Supply Crisis and Economic Mobility Hi, I’m Pete Carroll, executive of public policy at CoreLogic. In Part 1, we talked