African American, Hispanic or Latino, and low-income borrowers, and borrowers buying properties located in underserved neighborhoods more frequent in the “GSE Patch”

BY ARCHANA PRADHAN HOUSING AFFORDABILITY, MORTGAGE FINANCE

This blog is a continuation of Part 1 and 2 of our blog series – Expiration of the CFPB’s Qualified Mortgage “GSE Patch”. In Part 1 we estimated about 16% or $260 billion of 2018 mortgage loan origination volume was QM-eligible due to the GSE Patch.[1] In Part 2 we reviewed borrowers age, income, employment type and home sales price in the high Debt-to-Income (DTI) group. In this blog we focus on borrower’s race/ethnicity, income category, and borrowers buying properties located in low-income and minority neighborhoods.[2]

Impact on Borrowers Population – By Race/Ethnicity and Income Category

To obtain borrower demographic information on race and ethnicity, we matched CoreLogic loan application data to the most recent Home Mortgage Disclosure Act (HMDA) data.[3] The matched data illustrates that the share of African American and Hispanic/Latino borrowers that applied for a loan in the GSE Patch is higher than the share of non-Hispanic White and Asian borrowers. Similarly, low-income borrowers’ share of GSE Patch loans is higher compared with middle- and upper-income borrowers’ shares. Thus, these applicants who would currently fall in the Patch will only be able to apply for Non-QM loans, absent additional policymaking by the CFPB or modifying their financing choice to fall within the Safe Harbor requirements.

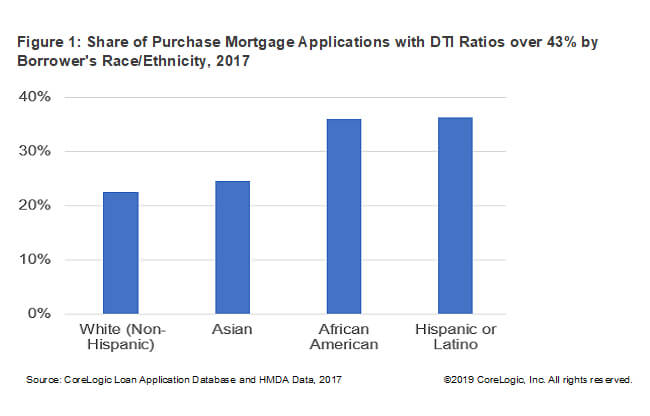

African American and Hispanic or Latino borrowers accounted for the highest share of above 43% DTI loans in 2017 (Figure 1). African American and Hispanic borrowers were approximately 1.6 times more likely to have a DTI over 43% than non-Hispanic white borrowers based on 2017 data.

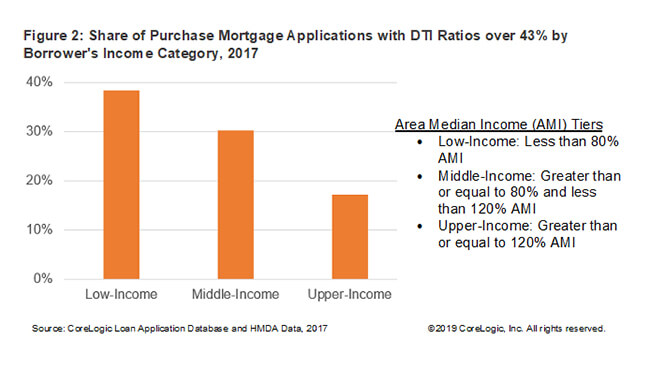

Similarly, low-income borrowers are more likely to be impacted by the removal of the GSE patch. Low-income borrowers accounted for the highest share of above 43% DTI loans, followed by middle-income (Figure 2). Low-income borrowers were more than twice as likely as the upper-income borrowers to have over 43% DTI.

Impact on Borrowers Population – By Property Location Neighborhood Income level and Minority Population

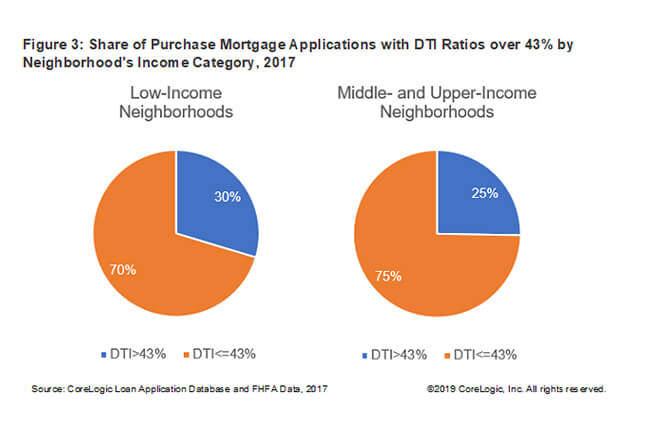

We also explored whether homes purchased using a loan that fell in the Patch were more or less likely to be in an underserved area, using the Federal Housing Finance Agency’s (FHFA) Underserved Areas definition. The data shows that the share of GSE Patch loans is higher for borrowers buying a home located in an underserved area. Borrowers buying a home located in a low-income neighborhood accounted for a higher share of above 43% DTI loans than borrowers buying a home located in a middle- or upper-Income neighborhood in 2017 (Figure 3).[4]

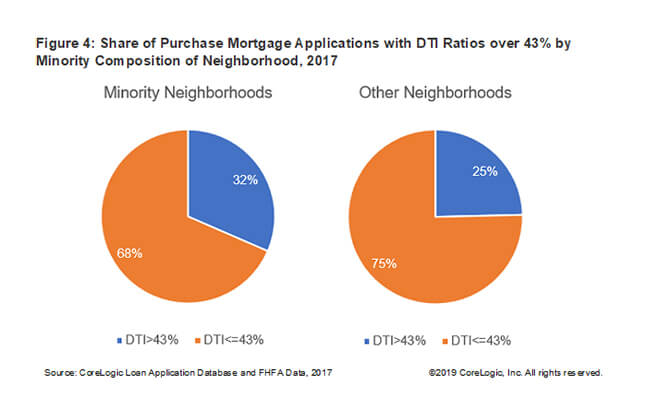

Similarly, borrowers buying a home located in a minority neighborhood accounted for a larger share of above 43% DTI loans higher than other neighborhoods in 2017 (Figure 4).[5]

[1] See analysis assumption and caveats, including range of estimates in Part 1.

[1] See analysis assumption and caveats, including range of estimates in Part 1.

[2] HMDA data provide race and ethnicity information, which are not in the CoreLogic loan application data. But information on mortgage credit profile characteristics, such as DTI ratio, are not in HMDA data.

[3] The most recent HMDA data is available for 2017. The match was based on loan application year, institution, loan purpose, loan type, loan amount, and census tract. The unique match rate was 50%.

[4] As per the FHFA definition, low-income neighborhood is a tract with median income at or below 80% of applicable area median income (AMI). Middle- and upper-income neighborhood is a tract with median income greater than 80% of applicable AMI.

[5] Minority neighborhood is a tract with a minority population of at least 30% and a median income of less than 100% of the AMI. Other neighborhood is a tract with a minority population of less than 30% or a median income of 100% or more of the AMI.

© 2019 CoreLogic, Inc. All rights reserved.