Trends in Refinancing

Mortgage rates have hit record lows in 2020, generating a refinance boom as borrowers seek to save on their mortgage payments. CoreLogic has been monitoring the share of outstanding mortgage debt with interest rates above the current market rates[1] and found that a large share of current mortgage borrowers could benefit from a refinance.

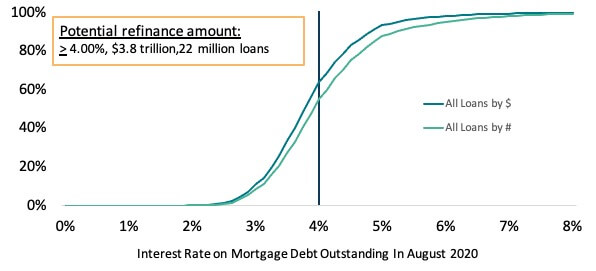

Because a refinance isn’t free, borrowers that want to lower their payments would need to have mortgage loans with rates well above the currently offered rate, which for a 30-year mortgage averaged 2.8% in October 2020. This implies that borrowers holding mortgages with rates of 4% or higher would often have a large refinance incentive. There is a significant portion of outstanding debt with rates where borrowers would be “in the money” to refinance. As of the end of August 2020, about $3.8 trillion in outstanding debt or 22 million mortgages have an interest rate of at least 4%.[2]

While CoreLogic TrueStandings® Servicing shows the amount of debt that has the potential to refinance, only a portion of those borrowers opt to refinance. One disincentive to refinancing is a low mortgage balance, which would lower the potential savings on monthly payments. CoreLogic data as of August shows that the average balance for mortgages with rates between 4-5% is about $175,000, but only about $100,000 for mortgages with rates above 5%.

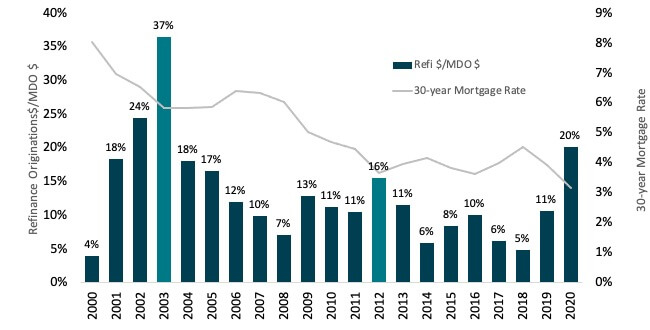

The difference in the share of mortgage debt that refinances over time illustrates the importance of home equity in refinancing. In 2003, a whopping 37% of mortgage debt refinanced, while in 2012 the share was a more modest 16%. The 2003 refinance boom was fueled not only by a drop in mortgage rates but also by cashout refinances, which accounted for about 27% of refinances that year. In 2012, many borrowers were underwater and many were also delinquent on their mortgages, both of which would make it difficult to refinance.

Mortgage rates are expected to remain low, which will make refinances a large part of the mortgage market through next year.

© 2020 CoreLogic, Inc. All rights reserved.

[1] CoreLogic TrueStandings Servicing, a servicer-contributed database, provides information on the current mortgage rate on outstanding mortgage debt.

[2] According to CoreLogic TrueStandings Servicing, 36% of debt outstanding and 45% of mortgages outstanding have an interest rate of at least 4% as of August 31, 2020.

[3] 2020 is based on the average of latest projections from Freddie Mac, Fannie Mae and the Mortgage Bankers Association.