Over-appraisal, under-maintenance, tax/fee nonpayment and LIBOR sunset

One goal of a reverse mortgage is to help elderly homeowners convert part of their home equity into a monthly income supplement. Since the Great Recession, the Home Equity Conversion Mortgage, or HECM, has been the primary—and often the only—reverse mortgage in the market. Insured by the FHA, there are more than 500,000 HECM loans outstanding today.

Defaults in the HECM program have been a drain on the financial resources of the FHA. The FHA has tightened underwriting and added more risk controls, helping to reduce losses. Nonetheless, there are at least four issues that remain important for FHA to address.

First, FHA has recognized that over-appraisal of the collateral has contributed to HECM losses.[i] Given the reliance on the appraised value, it is imperative the appraised value accurately reflects the true market value of each property insured by the federal government.

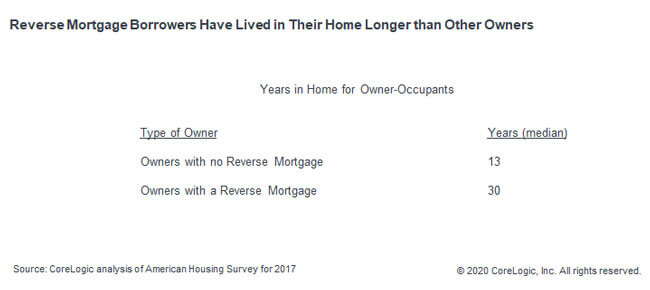

Second, homes depreciate and require maintenance over time to maintain value. The typical HECM borrower has lived in their homes much longer than other owner occupants but often have fewer financial resources to spend on repair, leading to deterioration in the home.[ii]

Third, nonpayment of property taxes and Homeowners Association (HOA) fees can take lien priority over a HECM, and nonpayment of property insurance puts collateral at risk. While FHA has taken steps to address this, the increasing longevity of America’s seniors add additional risk of ultimate nonpayment.[iii]

The fourth key issue is the sunset of the London Inter-Bank Offered Rate, commonly referred to as LIBOR, by the end of 2021. LIBOR-indexed floating-rate loans have been the majority of HECM endorsements for the last decade. Replacement indexes for LIBOR could include the 1-year Treasury yield and the Secured Overnight Financing Rate (SOFR). Both of these have interest rates that are about 25 to 50 basis points below 1-year LIBOR, and could cause qualifying loan amounts to increase above the amount based on LIBOR, adding to HECM risk exposure.

A reverse mortgage, if underwritten well, can provide an important income supplement to elderly homeowners. While FHA has taken important steps to address losses in its HECM program, there are at least four areas that FHA will need to remain focused on in coming years.

Summary:

- There are more than 500,000 FHA-insured HECM loans outstanding today.

- Property over-appraisal has contributed to HECM losses.

- HECM borrowers have lived in their homes longer and often have less resources for home maintenance.

- Nonpayment of property taxes, insurance premiums, or HOA fees can trigger a HECM default.

- More than one-half of HECMs are indexed to LIBOR, which sunsets at the end of 2021.

[i] The appraised value of a HECM property establishes the maximum claim amount (MCA), which is the maximum amount the FHA will insure on the property. As reported by FHA in their annual report to Congress in 2018, loans endorsed between 2005 and 2018 had an average overvaluation of 13%. Given the size and potential frequency of the HECM property overvaluations, appraisal inflation has caused the Mutual Mortgage Insurance Fund (MMIF) to release substantially more funds than intended over the years. The overvaluation was reported in Kevin A. Park, “Reverse Mortgage Collateral: Undermaintenance or Overappraisal,” Cityscape, Vol. 19 No. 1, 2017, U.S. Department of Housing and Urban Development. See https://www.hud.gov/sites/dfiles/Housing/documents/2018fhaannualreportMMIFund.pdf and https://www.huduser.gov/portal/periodicals/cityscpe/vol19num1/ch1.pdf.

[ii] The American Housing Survey (AHS) for the U.S. in 2017 reported the median length of ownership for all owner occupants was 13 years. CoreLogic analysis of public records found that the median length of ownership for owners that took out a HECM in 2017 was 18 years; see https://www.corelogic.com/blog/2019/12/hecm-loans-in-2018-borrower-demographics-and-ownership-tenure.aspx . AHS data also shows that home improvement spending by homeowners aged 65 or older is about one-half that of younger homeowners.

[iii] If borrowers fail to pay them, the lender must advance funds on the borrowers’ behalf to pay these items. Borrowers with a history of delinquencies of these items can still get a HECM under the 2014 FHA guidelines but FHA does require lenders to hold funds in a Life Expectancy Set Aside (LESA) account to pay for the taxes and insurance from the proceeds. The risk to the FHA insurance fund is that the borrower might outlive the amount in the LESA account and once the funds in the LESA are depleted, the borrower is responsible for paying all property charges, and may be unable to make the payments.

© 2020 CoreLogic, Inc. All rights reserved.