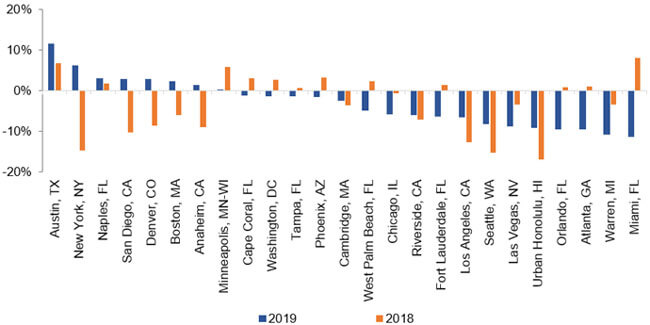

Austin, New York, and Naples experienced increase in condo sales in 2019

For millennials, first-time homebuyers (FTHBs), and down-sizing baby boomers, condos can be the most reasonable option when buying a property. Their values and lifestyle drive them toward buying condos because they tend to be more affordable than single-family homes and because condos typically come with a lower maintenance burden and are mostly located in urban cores.

Based on the top 25 markets, the average sale price of condos in 2019 was 16% lower than the average sale price of single-family residences.[1]

To support that point, CoreLogic Fraud Consortium Loan Application data shows that FTHBs gravitate toward condos. Last year, about 40% of all condo-purchase mortgage applications were submitted by FTHBs, compared to just 33% of all non-condo purchase mortgage applications by the same group. Additionally, the data shows condos were more popular with millennials – 47% of all condo-purchase mortgage applications were submitted by millennials in 2019, up 2% from 2018.

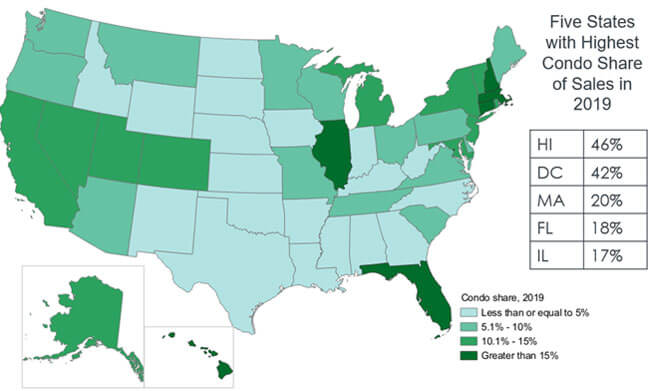

Geographically, in 2019, the condo share of sales activity by state was highest in Hawaii (46%), followed by Washington D.C. (42%), Massachusetts (20%), Florida (18%) and Illinois (17%) (Figure 1). At the metro level, condo sales activity also varied. In 2019, eight of the top 25 condo markets experienced increases in condo sales relative to the prior year (Figure 2).[2] However, in 2018, only 12 of those top 25 condo markets experienced increases in condo sales relative to the prior year.

Among the top 25 markets with the most condo sales, Austin, Texas, had the largest annual increase in condo sales in 2019, with a gain of 12%, followed by:

- New York, N.Y. (6%)

- Naples, Fla. (3%)

- San Diego, Calif. (3%)

- and Denver, Colo. (3%)

Miami, Fla. and Warren, Mich. experienced the largest annual drop in condo sales, with a decline of 11%, followed by:

- Atlanta, Ga. (-9%)

- Orlando, Fla. (-9%)

- Honolulu, Hawaii (-9%)

- and Las Vegas, Nev. (-9%)

Given worsening affordability challenges in many markets, condos could be a viable option for many. However, condo supply remains tight; according to CoreLogic MLS data, months’ supply for condos fell to four months in December 2019 – the lowest since 2006.[3]

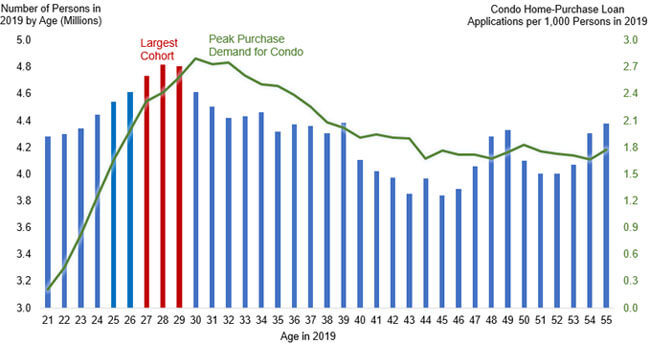

In the coming years, younger millennials (age 30 or below) are likely to drive much of the condo demand as they are a very large group (Figure 3). Still, there will be more condo demand than supply as young millennials approach peak household formation and homebuying age.

For more Insights from CoreLogic, check out our blog – delivering expanded perspective on the housing economy and property markets.

© 2020 CoreLogic, Inc. All rights reserved.

[1] Data Source: CoreLogic TrueStandings

[2] The 25 largest condo markets were defined at the Core Based Statistical Area (CBSA) level and determined based on total condominium sales between 2000 and 2019 according to CoreLogic.

[3] The months’ supply indicates how long it would take to sell all the current for-sale inventory (assuming no new supply hits the market) at the current sales rate.