Largest Cohort Enters the Peak Age for First-Time Homeownership, Makes Up More Than Half of All Home Purchase Applications

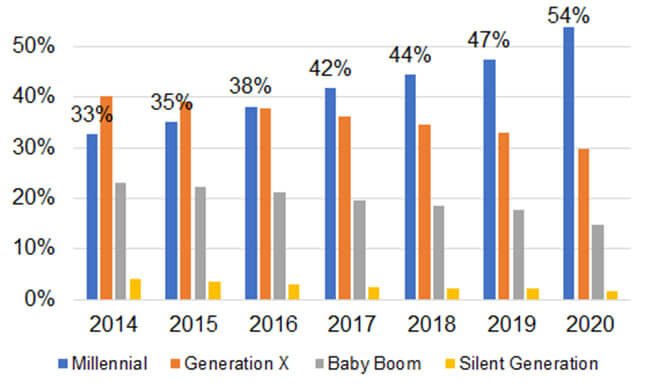

For the last five years, millennials have made up the largest share of home purchase mortgage applications. This demographic tailwind comprises the largest generation of households who are approaching their first-time homebuying years. Older millennials, meanwhile, are in the age-range for a move-up purchase.

As a whole, their share rose even higher in 2020 as millennial homebuyers comprised more than half of overall home-purchase applications.

According to the CoreLogic Loan Application Database[1], prior to 2020, while millennial home purchase applications comprised less than half of all purchase applications, their share grew from 33% in 2014 to 47% in 2019, rising about 2 to 4 percentage points per year. This annual increase is consistent with the cohort of millennials reaching 33 years of age, the peak homebuying age.

But in 2020, the share of millennials in the homebuying market soared 7 percentage points in 2020, reaching 54% of all purchase applications (Figure 1). And while half of the increase is consistent with the natural growth rate seen since 2014, the additional half of the 2020 jump was likely driven by the pandemic. In other words, the increase was accelerated by record low mortgage interest rate and flexibility to work remotely.

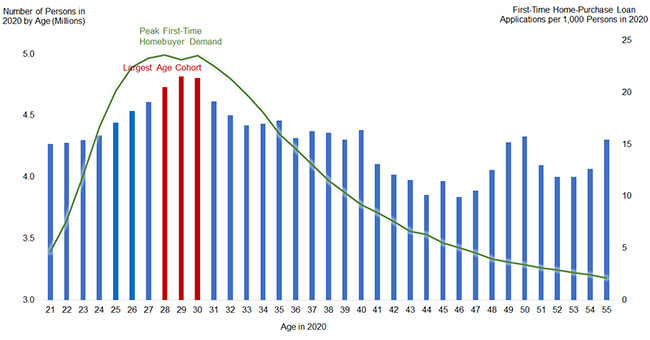

The share of millennial first-time homebuyer (FTHB) mortgage applications is even higher than the share of overall millennial home purchase applications (which comprises both FTHB and repeat buyers). About 79% of all the FTHB home-purchase applications was comprised by the millennial applicants in 2020, up by 5 percentage points from 2019. This is not surprising as the largest cohort of the millennial generation is approaching the peak age of first-time homeownership.

Figure 2 shows U.S. population distribution by age, highlighting the largest demographic cohort reaching the peak age of FTHB on the left axis. The right axis of the chart, displayed by the green line, represents first-time home-purchase loan applications per 1,000 persons in 2020.

Younger millennials below 30 have yet to enter homeownership, so demand from millennials is likely to remain strong over the coming years. At the same time, more older millennials are likely to transition to repeat homebuyers. The share of millennial repeat buyer home-purchase applications was already 35% in 2020, just 4 percentage points lower than Gen X’ share.

That said, while the demographic tailwind remains favorable for the home purchase market, historically low inventories of homes for sale along with continued rapid home price appreciation may create affordability challenges. This may slow the increase of new millennials entering the home purchase market, but it is unlikely to reverse the trajectory, and the share of millennials will likely continue to rise in the coming year.

©2021 CoreLogic, Inc. All rights reserved.

[1] This analysis is based on all home-purchase mortgage applications, accepted or not, from January 2014 to December 2020.