The year-over-year rise in average down payment size was largest for low-tier homes

The average U.S. home down payment reached an all-time high last fall. The average down payment amount dropped during the housing crisis of the Great Recession (2008-2009), but it has since steadily increased. However, since the onset of the pandemic in early 2020, the average down payment surged, reaching a record high in October 2023.

Home prices play a significant part in down payment sizes, and with the substantial appreciation of the last few years, average down payments have followed suit. Homebuyers’ average down payments were up by 8% year over year in December 2023, according to CoreLogic Public Record data. The average down payment for a U.S. home was 16% in December 2023, equaling an average amount of about $84,000.

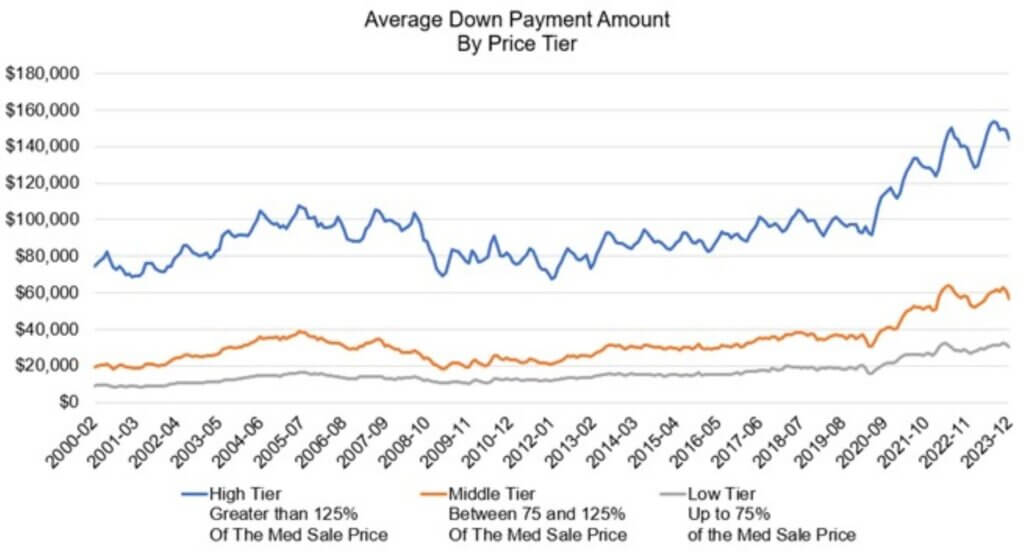

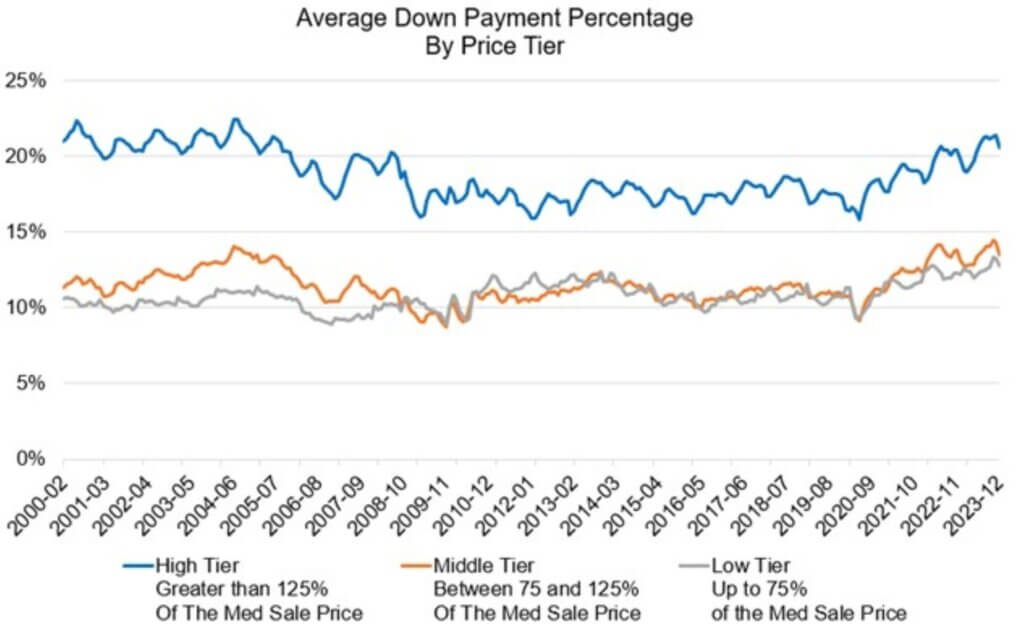

Average Down Payment Amounts and Percentages by Sales Price Tiers [1]

Figure 1 shows that the average down payment amount has increased across all price tiers. In December 2023, the average down payment amount for low-tier homes (those priced at less than 75% of the median sales price) was $29,987, up from $27,011 year over year.

Similarly, Figure 2 shows the average down payment percentage by sales price tiers. In December 2023, the average down payment percentage for low-tier homes was almost 13% of the sales price.

The average down payment amount for middle-tier homes (those priced between 75% and 125% of the median sales price) was $56,371 in December 2023, up from $53,031 on an annual basis and representing 14% of the sales price.

The average down payment for high-tier homes (those priced at more than 125% of the median sales price) was $143,681 in December, up from $133,340 year over year and accounting for around 21% of the price. Mortgages for high-tier homes are mostly high-balance loans or jumbo loans, which generally require larger down payments.

Year-over-year rises in average down payments were highest for low-tier homes (11%), followed by high-tier homes (8%). By contrast, the year-over-year increase was just 6% for middle-tier homes.

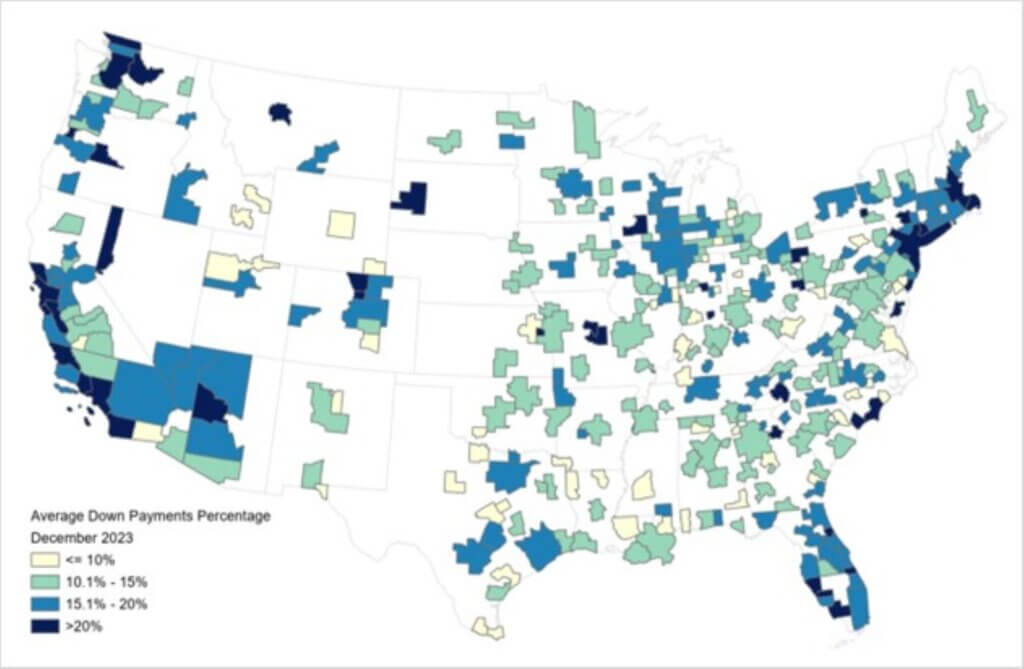

U.S. Metros With the Highest Down Payments in December 2023

Down payment percentages were highest in San Francisco (29%); followed by San Jose, California (28%); Anaheim, California (27%); Naples, Florida (27%) and New York (26%). Figure 3 shows U.S. metros based on down payment percentages. In general, high-cost areas experienced larger down payments, as buyers in these metros usually have higher incomes, which translates to more buying power. The other potential reason is that the buyers would prefer to reduce monthly mortgage payments to offset the impact of higher rates.

For the latest housing market data insights, trends and news, be sure to regularly visit CoreLogic’s Intelligence home page. And our team of housing economists’ frequent analyses can always be found here.

©2024 CoreLogic, Inc. All rights reserved. The CoreLogic content and information in this blog post may not be reproduced or used in any form without express written permission. While all of the content and information in this blog post is believed to be accurate, the content and information is provided “as is” with no guarantee, representation, or warranty, express or implied, of any kind including but not limited to as to the merchantability, non-infringement of intellectual property rights, completeness, accuracy, applicability, or fitness, in connection with the content or information or the products referenced and assumes no responsibility or liability whatsoever for the content or information or the products referenced or any reliance thereon. CoreLogic® and the CoreLogic logo are the trademarks of CoreLogic, Inc. or its affiliates or subsidiaries. Other trade names or trademarks referenced are the property of their respective owners.

[1] Sales price tiers are based on the median price of all home sales transactions at a metro level during a given month.