CoreLogic estimates insurable losses in Turkey could reach $1.0 billion USD.

Just two weeks after a sequence of powerful earthquakes struck near the Turkey and Syria border, a magnitude (M) 6.3 earthquake impacted areas west of Aleppo, Syria. The earthquake is expected to cause material damage in the areas nearest to the epicenter, but losses will be less than the M7.8 and M7.5 earthquakes that caused widespread devastation in southern Turkey and northern Syria on Feb. 5 and Feb. 6.

CoreLogic estimates that insurable losses in Turkey will be up to $1.0 billion USD. The CoreLogic insurable loss estimate includes damage to the building stock in Turkey that is considered insurable and, therefore, does not account for earthquake insurance take-up rates or deductibles.

The insurable loss estimate includes damages to buildings and contents for residential, commercial, industrial and agricultural structures in Turkey. It excludes any loss from damage to infrastructure such as road and rail networks; water and electric power systems; oil and gas pipelines. Additional living expenses, business interruption and contingent business interruption are also excluded. Demand surge is not included.

The modeled insurable loss from the Feb. 20 M6.3 earthquake assumes that no previous damage occurred in Turkey due to the Feb. 5 earthquake sequence.

RQE Model Users: Proxy Events and Modeled Insurable Loss

Clients who license the CoreLogic Turkey Earthquake Model on RQE can download proxy events from the stochastic catalog. Clients can access estimated modeled insurable loss from the Catastrophe Modeling Client Resource Center (CRC) at: https://crc.corelogic.com/.

Event Description and Earthquake Parameters

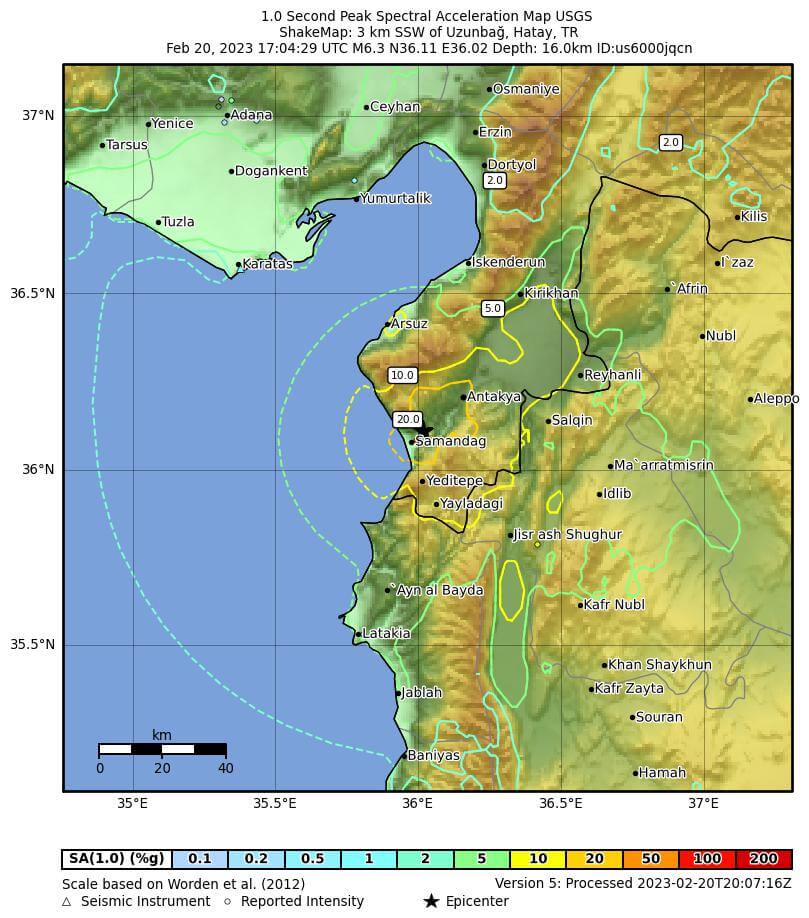

On Feb. 20 at 8:04 p.m. local time (17:04 UTC), an M6.3 earthquake occurred 3 km (1.9 miles) south-southwest of Uzunbağ, Turkey, near the northern border of Syria. According to the U.S. Geological Survey (USGS), the M6.3 earthquake struck at a shallow depth of 16.0 km (9.9 miles) beneath the ground surface. Peak 1-Second Spectral Acceleration (SA 1.0) of up to 20% g (Figure 1) was recorded for the M6.3 earthquake.

Figure 1: Peak SA (1.0) map of Feb. 20 M6.3 earthquake near Turkey-Syria border

The Hazard

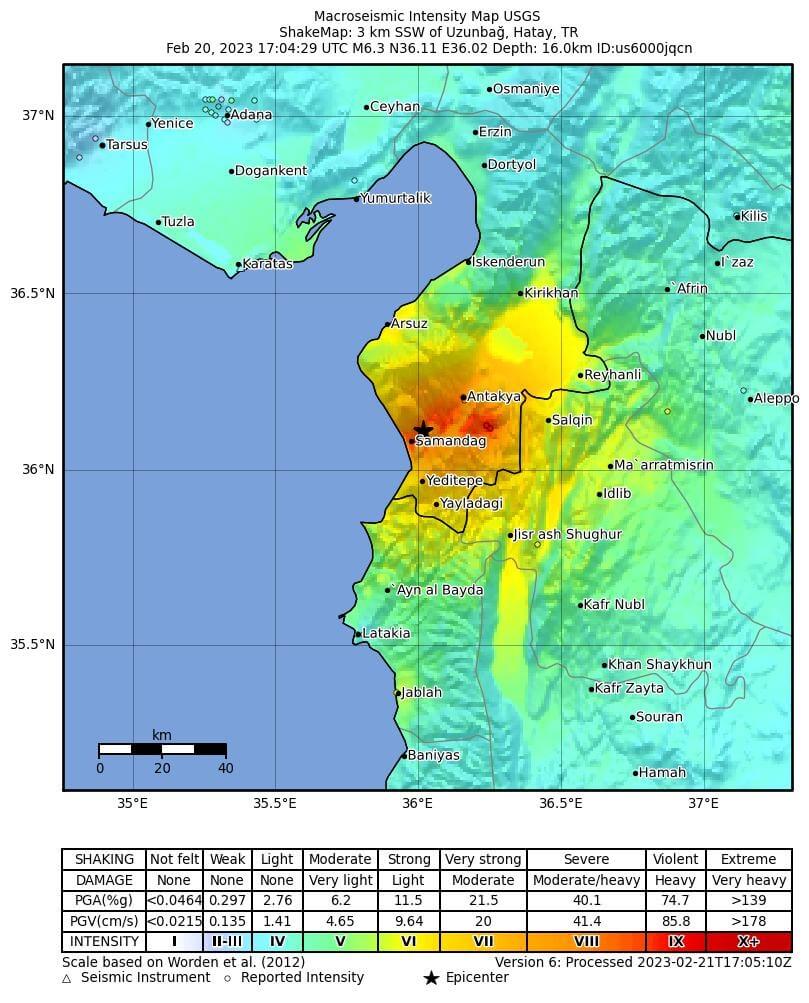

Ground shaking with a maximum intensity of eight on the Modified Mercalli Intensity Scale (MMI) was recorded in Samandağ, Turkey, during the Feb. 20 M6.3 earthquake (Figure 2). According to the USGS, MMI 8 represents severe ground shaking that can cause slight damage to structures designed to mitigate the effects of earthquakes. A higher degree of damage, including partial collapse, is expected in ordinary and poorly constructed buildings.

Figure 2: Ground shaking intensity from Feb. 20 M6.3 earthquake near Turkey-Syria border

According to the USGS PAGER, approximately 750,000 people felt ground shaking with an intensity of at least MMI 7 or greater. Shaking was reported as far as southern Israel; Ankara, Turkey; Cairo, Egypt; and Mosul, Iraq. In southeastern Turkey and northern Syria, structures are predominately constructed with unreinforced brick masonry and low-rise, non-ductile concrete frames. Both forms of construction are extremely vulnerable to ground shaking.

Building Codes and Construction Practices in Turkey

Turkey first developed building codes in 1940. The codes have been updated periodically throughout history with major revisions in 1959, 1975, 1998 and 2007. However, enforcement has been minimal, as illustrated by the reports of destroyed homes coming from Turkey since the devastating earthquakes earlier this month.

History of the Turkish Earthquake Insurance Market

The Turkish Catastrophe Insurance Pool (TCIP) is the primary provider of earthquake insurance for residential property in Turkey. The program was launched in 2000 in response to a major earthquake in İzmit, Kocaeli, that occurred in 1999. Prior to implementation, earthquake losses were covered by homeowner fire insurance, a practice that was both insufficient in its amount of coverage and too costly for purchasers.

Policies issued by the TCIP provide protection against earthquake damage to residential buildings in urban environments and exclude liability claims and additional living expenses.

According to Fitch, the TCIP’s reinsurance tower provides $2 billion USD worth of coverage for losses in excess of $300 million USD.

The impact of the Feb. 20 M6.3 earthquake on the Turkish insurance market may be minimized by the fact that only a fraction of the insurable buildings (i.e. those deemed insurable by the markets in Turkey) are insured. Additionally, Turkish earthquake underwriting guidelines will likely filter out the riskiest structures. While the economic loss from this event might be substantial — USGS PAGER estimates a 35% probability of economic losses reaching $10 billion USD — the impact to TCIP will be far less.

Reported Damage in Turkey and Syria

Initial reports of damage and fatalities as a result of the Feb. 20 M6.3 earthquake indicate further damage to buildings near the epicenter, as well as collapses of structures that survived the Feb. 5 severe earthquake sequence. In the coming days, damage assessments will confirm the number of damaged structures and fatalities, but totals are not expected to surpass the devastation caused by the M7.8 and M7.5 Turkey earthquakes in early February.

The CoreLogic Event Response team is continuing to monitor the developing situation in Turkey. Visit www.hazardhq.com for updates on the Feb. 20 M6.3 earthquake and information on future catastrophes around the globe.