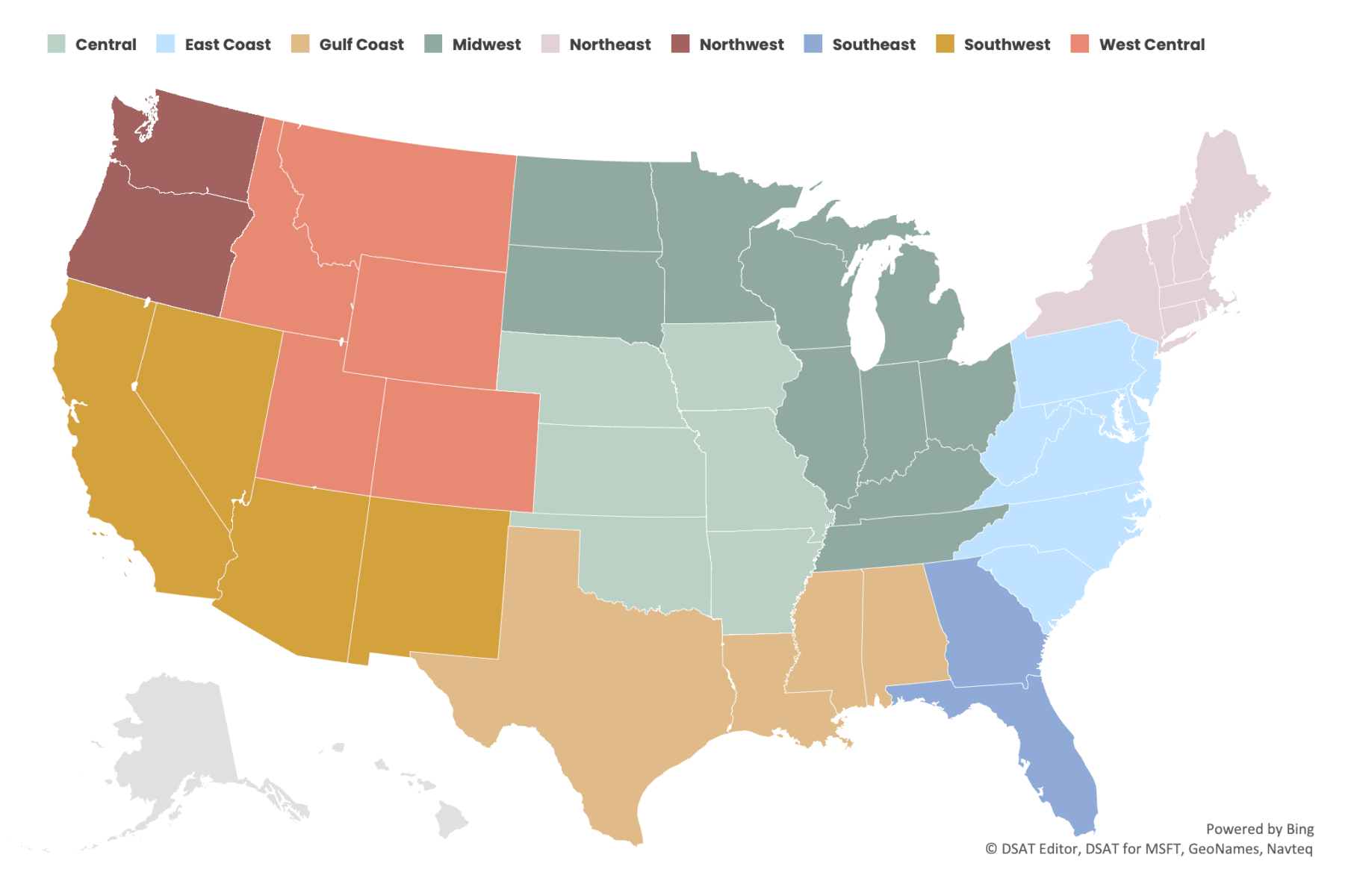

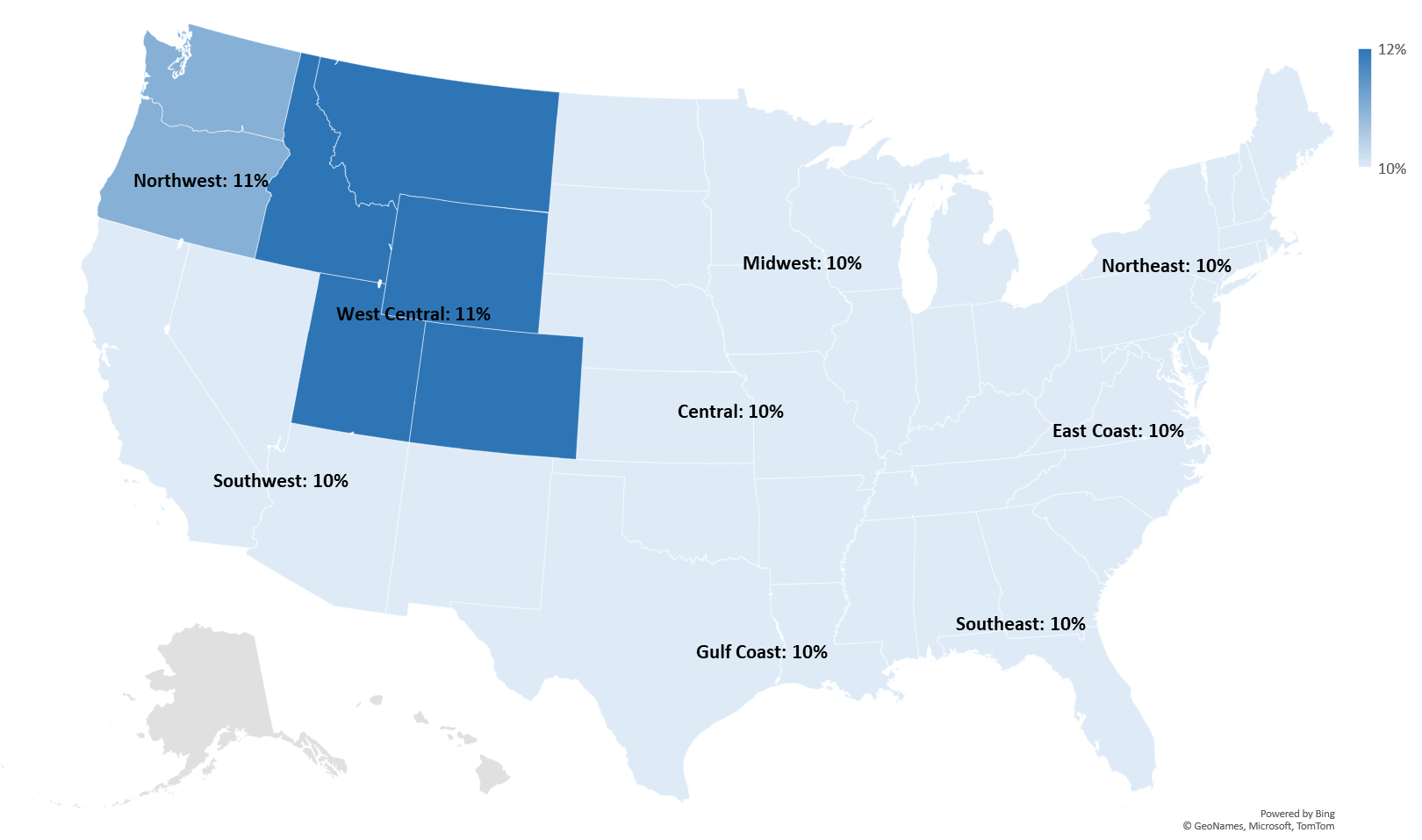

Defined Regions

CoreLogic curates this monthly bulletin of regional construction cost insights, which are reflected in the CoreLogic Claims Pricing Database. We combine the current month’s pricing data with four common loss scenarios to create models illustrating market impacts that are applied across nine regions and compared month over month and year over year.

Our experts provide detailed analyses of changes and trends to provide additional insight into key drivers. View our Construction Database Pricing Methodology whitepaper to gain additional insight into how we populate cost values.

May Pricing Insights

CoreLogic’s pricing team continues to focus on labor rates across several categories. We base our findings on an analysis of recently completed market surveys. Our team is currently utilizing focus groups to add additional value to our pricing feedback loop.

Contribute to our pricing team’s real-time data collection of labor rates. We welcome your input.

Overview

- May pricing data shows stability across most labor categories based on a month-to-month comparison.

- Roofing labor data indicates month-over-month cost increases across storm-prone regions.

- Materials pricing has steadily increased since 2022.

- Window and siding material costs continue to rise month-to-month.

Material

Though most material component pricing remained elevated over the past year, fencing and framing/rough carpentry costs declined month-over-month by -2.6% and -4.2%, respectively. Over the past 12 months, that decline was -4.9% and -10.9% for fencing and framing/rough carpentry costs, respectively. In stark contrast, the costs of electrical (+37.1%), plumbing (+37.2%), siding (+30.7%) and insulation (+21.9%) materials trended upward over the last 12 months. These are significant shifts since these materials, excluding siding, are common for many claims scenarios that are not driven by weather events.

Labor

Roofing labor pricing increased an average of 1.7% month-over-month for all regions. Note that the West Coast, Northwest and Northeast regions had no month-to-month increase, which skewed this average downward. Meanwhile, much larger increases were felt in the Southeast, Gulf and Midwest and Central regions as discussed in the Wind/Hail scenario.

Property Claim Scenarios

CoreLogic has replicated the estimating components found in the following most common loss scenarios to demonstrate how changes in pricing impact typical loss costs.

Fire/Lightning (Large Loss) Insights: 12-Month Trend

Fire/Lightning (Large Loss)

In this category, large loss claims from a fire are modeled for a scenario where all home construction components are affected and losses exceed $100,000.

- The large loss scenario declined slightly across most regions this month as trends in occurrences of this type of scenario move closer to 2022 levels.

- Labor rates remain constant this month and are a driving factor in the stabilization of the Fire/Lightning large loss scenario.

- Cleaning and roofing labor rates increased in the West Central and Northwest regions, and general labor rates increased across most regions.

- Cabinetry and electrical material costs increased from last month by 1.4% and 1.7%, respectively. Framing and rough carpentry materials declined significantly, seeing a -4.2% reduction. These opposing material pricing cost trends, along with stabilized labor rates, explain the near-flat Fire/Lightning pricing this month for labor and materials.

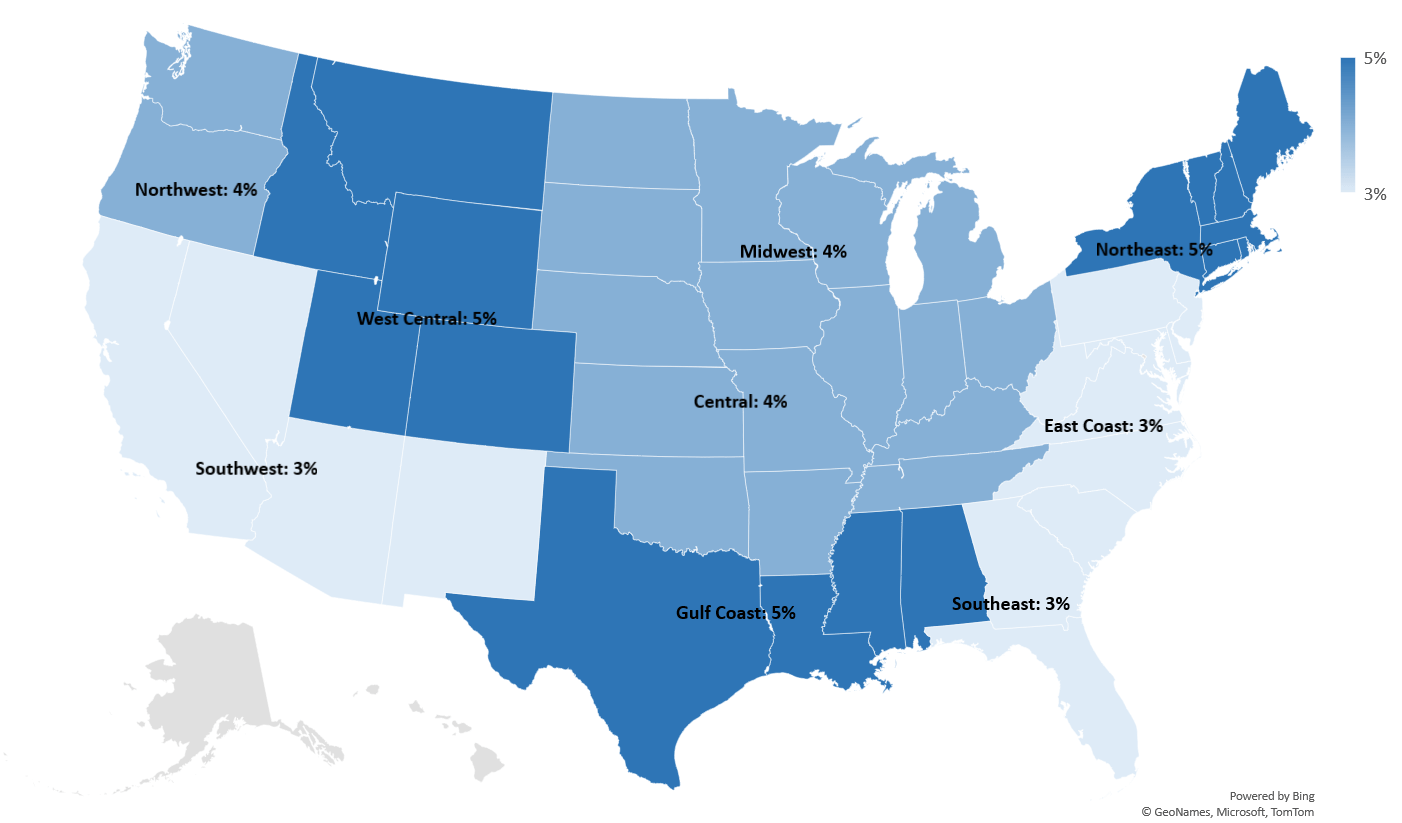

Wind/Hail (Exterior/Roof) Insights: 12-Month Trend

Wind/Hail (Exterior/Roof)

This category represents losses due to weather activity consisting of wind and/or hail. Restoration from this damage requires roof replacement, partial siding replacement and accompanying accessories.

- Wind and hail pricing scenarios continue to increase month-over-month, ranging from 1.2% to 1.8% in the Southeast, Gulf, West Central and Midwest regions.

- These month-over-month increases are fueled by sizeable upward swings in roofing labor pricing in the Southeast (+4.4%), Gulf (+3.7%), Midwest (+2.8%) and Central (+2.6%). Siding labor pricing remained consistent across all regions.

- Window materials increased the most, gaining 4.5% month-to-month. Roofing materials increased less than 1% month-to-month across the country, but the 12-month pricing trend remains elevated at 16.4%. Siding materials increased 2.3% countrywide month-to-month, and the 12-month pricing trend remains high at 30.7%

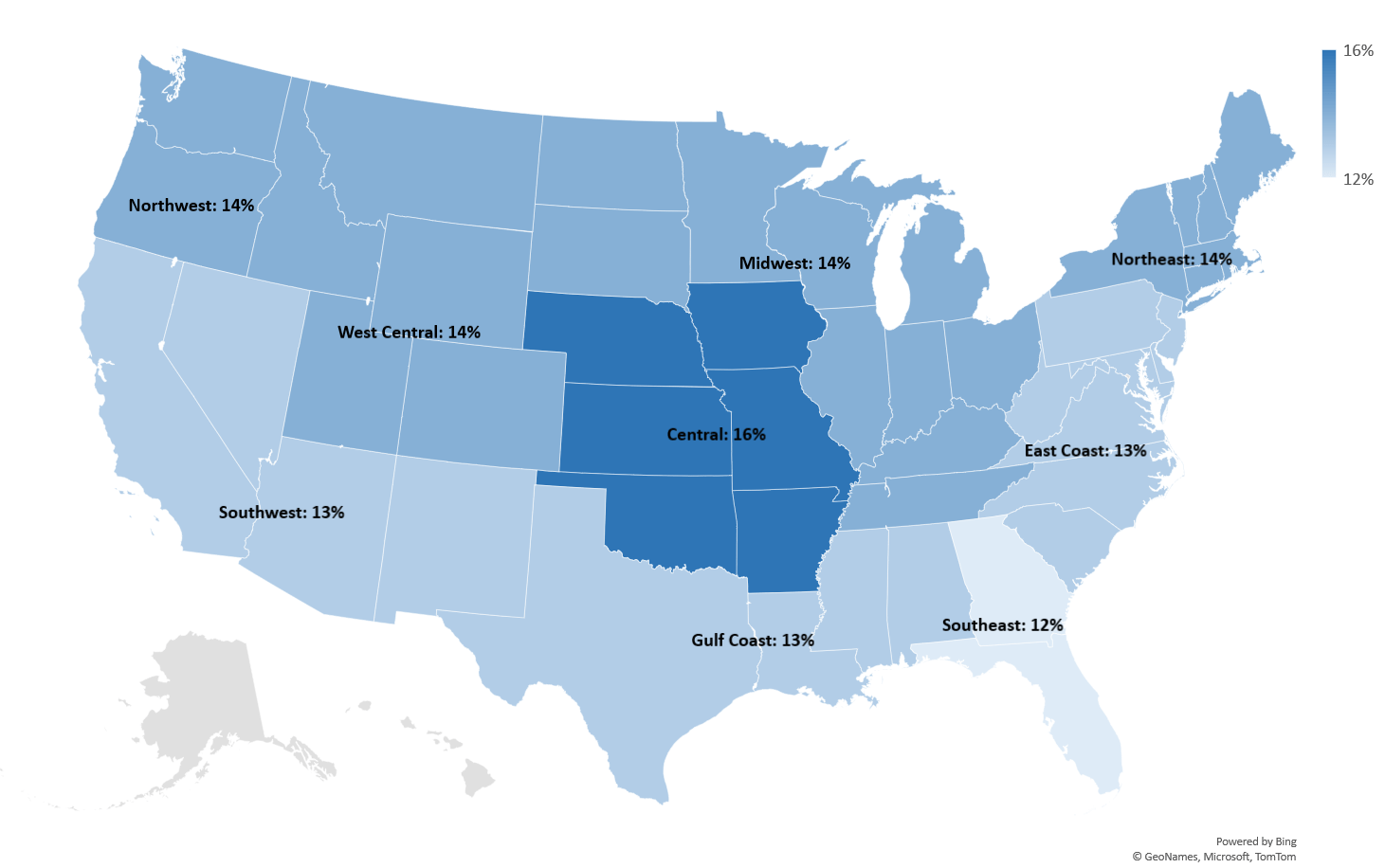

Water (Interior Reconstruction) Insights: 12-Month Trend

- Water loss scenario costs have reduced slightly (by less than 1%) in all regions compared to last month. The 12-month trend is shifting downward from a high of 17.4% in December 2022 to 9.6% this month.

- Drywall and painting material driver rates both increased month-to-month, but the average increase was less than 1% for all regions. The Central U.S. and East Coast were the only two regions that experienced reportable drywall cost increases of 1.9% and 3.2%, respectively.

- We noted no monthly drywall or paint labor cost increases although the 12-month development for drywall and paint labor respectively remain elevated at 21.6% and 3.3%, respectively.

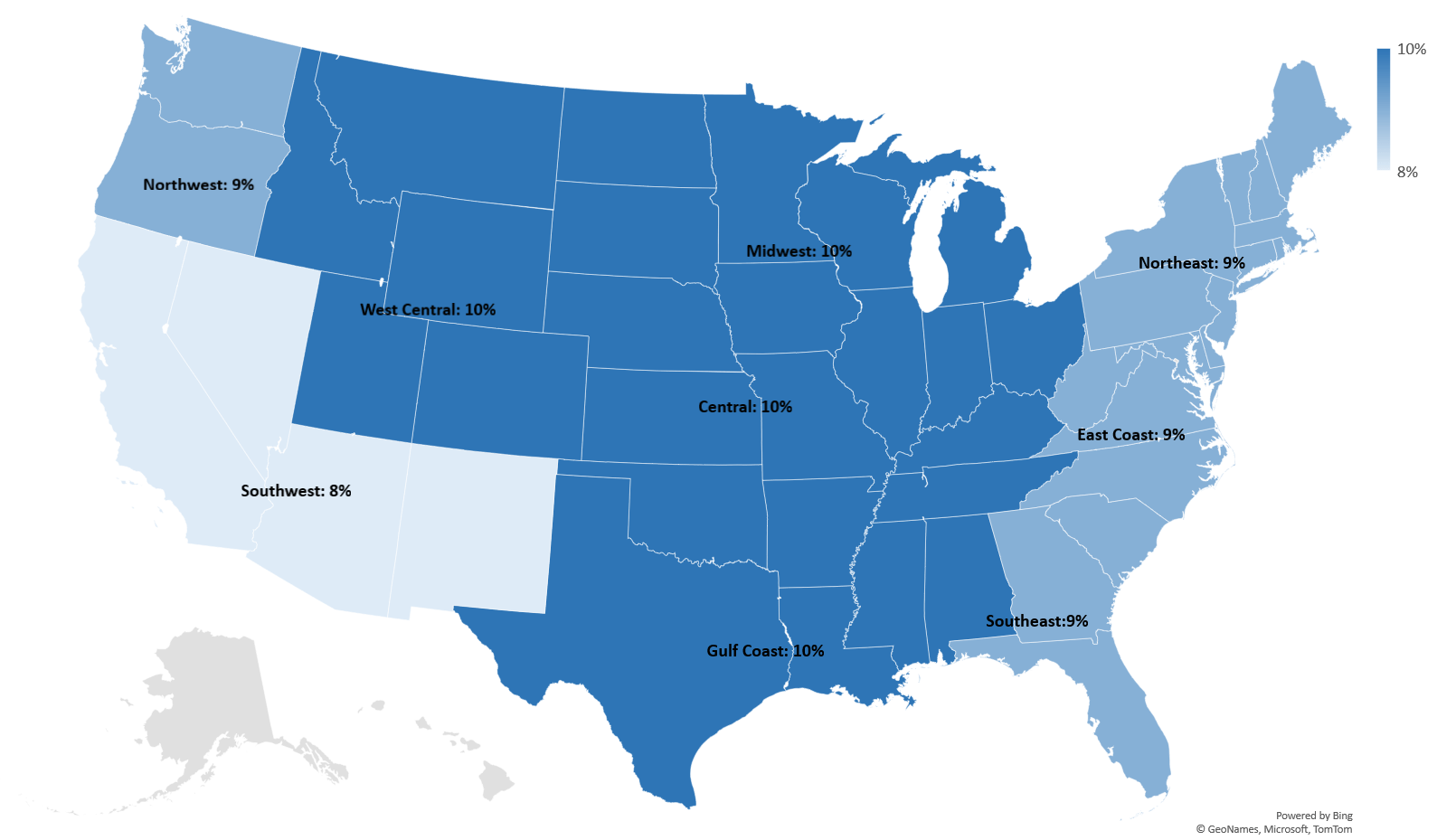

Water Mitigation (Drying) Insights: 12-Month Trend

Water Mitigation (Drying)

Typical drying costs for a residential structure include water extraction, removal of wet material and use of drying equipment.

- There has been no significant movement in overall water mitigation costs month-to-month, and the stabilization of water remediation technician labor rates this month is a contributing factor.

- Water remediation technician labor rates have increased by 14.3% since this time last year. This remains the largest driver of the water mitigation pricing scenario and addresses the overall 10.3% cost increase over the last 12 months.

- CoreLogic’s pricing team is investigating water mitigation equipment rates to ensure that our pricing database reflects the pace of change we have observed in recent market trends.

About CoreLogic Data Research

CoreLogic develops this report using up-to-date materials and labor costs. CoreLogic’s team of analysts continuously researches hard costs such as labor, material and equipment – including mark-ups. CoreLogic updates its database every month accordingly.

Our research also covers soft costs such as taxes and fringe benefits for reconstruction work performed as part of the insurance industry. CoreLogic monitors demographics and econometric statistics, government indicators and localization requirements, including market trends from thousands of unique economies throughout the United States.

Other factors in this process include the following:

- Wage rates for more than 85 union and non-union trades

- Over 100,000 construction data points

- Productivity rates and crew sizes

- Building code requirements and localized cost variables

Additionally, we validate cost data by analyzing field inspection records, contractor estimates, phone surveys, and both partial and complete loss claim information.

Please complete the online form to provide feedback or request information on any items in our construction database. Please contact your sales executive or account manager for additional explanations or questions. A more detailed methodology explanation can be found in our Construction Database Pricing Methodology Whitepaper.

About CoreLogic

CoreLogic is the leading property insights and technology solutions provider enabling healthy housing markets and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and restore their homes. For more information, please visit www.corelogic.com.

NOTE: The building material, labor and other cost information in this bulletin is generated using research, sources and methods current as of the date of this bulletin and is intended only to provide an estimated average of reconstruction cost trends in the specified general geographic regions of the United States. This cost information may vary further when adjusting claim values for specific property locations or specific business conditions.