In six U.S. housing markets, out-of-town homebuyers earn 60% or more than current residents

In some U.S. metro areas, out-of-town homebuyers tend to have higher incomes compared with current residents, making housing affordability more challenging for locals. CoreLogic’s recent blog on migration patterns highlights the ongoing trend of homebuyers relocating to more affordable areas. In 2023, nearly one-quarter of U.S. homebuyers purchased properties outside of their current local metros.

The Top 20 U.S. Metros Where Out-Of-Town Homebuyers Earn More Than Locals

In this analysis, we find that out-of-metro homebuyers generally have higher incomes than their local counterparts in some U.S. markets [1]. Table 1 shows the top 20 U.S. Core Based Statistical Areas (CBSAs) with the most significant monthly income disparity between potential out-of-metro and local homebuyers (excluding investors, second-home purchasers and cash buyers).

| CBSA | Average Monthly Income: 2023 | Average Monthly Income: Local Applicants 2023 | Average Monthly Income: Out-of-Metro Applicants 2023 | Income Difference Between Out-of-Metro Applicants and Local Applicants: 2023 |

| Miami-Fort Lauderdale-Pompano Beach, FL | $12,012 | $11,305 | $18,971 | 68% |

| Louisville/Jefferson County, KY-IN | $7,353 | $6,774 | $11,120 | 64% |

| New Orleans-Metairie, LA | $8,315 | $7,476 | $12,038 | 61% |

| Reno, NV | $10,511 | $9,348 | $14,983 | 60% |

| Naples-Marco Island, FL | $14,232 | $11,674 | $18,655 | 60% |

| Corpus Christi, TX | $7,642 | $6,816 | $10,897 | 60% |

| Boise City, ID | $9,551 | $8,508 | $13,515 | 59% |

| Kansas City, MO-KS | $7,794 | $7,270 | $11,470 | 58% |

| Cincinnati, OH-KY-IN | $7,719 | $7,167 | $11,200 | 56% |

| Grand Rapids-Kentwood, MI | $7,605 | $6,939 | $10,633 | 53% |

| Salisbury, MD-DE | $8,031 | $6,708 | $10,271 | 53% |

| Des Moines-West Des Moines, IA | $7,037 | $6,557 | $10,013 | 53% |

| Fayetteville-Springdale-Rogers, AR | $8,825 | $7,966 | $12,084 | 52% |

| Pittsburgh, PA | $8,026 | $7,621 | $11,408 | 50% |

| Memphis, TN-MS-AR | $8,257 | $7,806 | $11,373 | 46% |

| Augusta-Richmond County, GA-SC | $6,921 | $6,230 | $9,088 | 46% |

| Nashville-Davidson-Murfreesboro-Franklin, TN | $10,238 | $9,502 | $13,772 | 45% |

| Las Vegas-Henderson-Paradise, NV | $9,449 | $8,786 | $12,611 | 44% |

| Anchorage, AK | $9,136 | $8,497 | $12,227 | 44% |

| Detroit-Warren-Dearborn, MI | $7,615 | $7,275 | $10,190 | 40% |

Table 1: Income difference between out-of-metro applicants and local applicants: January – October 2023

Using the Miami metro as an example, the average monthly income for out-of-metro applicants was almost $19,000, a stark contrast to the $11,300 average income for local homebuyers, representing a significant 68% difference. Notably, a considerable number of out-of-state buyers relocated to South Florida from high-cost areas such as New York. Miami locals who can’t afford the current prices and want to stay in the state seem to be moving to more cost-friendly areas such as Port St. Lucie, Cape Coral, Jacksonville and Lakeland.

The Louisville, Kentucky/Jefferson County, Indiana metro shows similar income-based migration patterns where out-of-metro buyers earned an average of about $11,100 each month compared with about $6,800 for local homebuyers, a substantial 64% difference. Similarly, the income difference between out-of-metro loan applicants and local applicants in the New Orleans-Metairie, Louisiana metro was 61%.

Typically, out-of-metro buyers in these areas earn higher incomes, resulting in larger budgets than some locals. In general, the median home price for out-of-metro buyers was higher than the median price for locals.

Out-of-Metro Homebuyer Trends From 2019 to 2023

U.S. migration patterns reflect housing affordability issues and gained momentum post-pandemic, as higher incomes persisted. CoreLogic data shows that the share of out-of-metro applicants increased from the pre-pandemic rate of 16% in 2019 to 23% in 2023. Remote work is also playing a significant role in this shift.

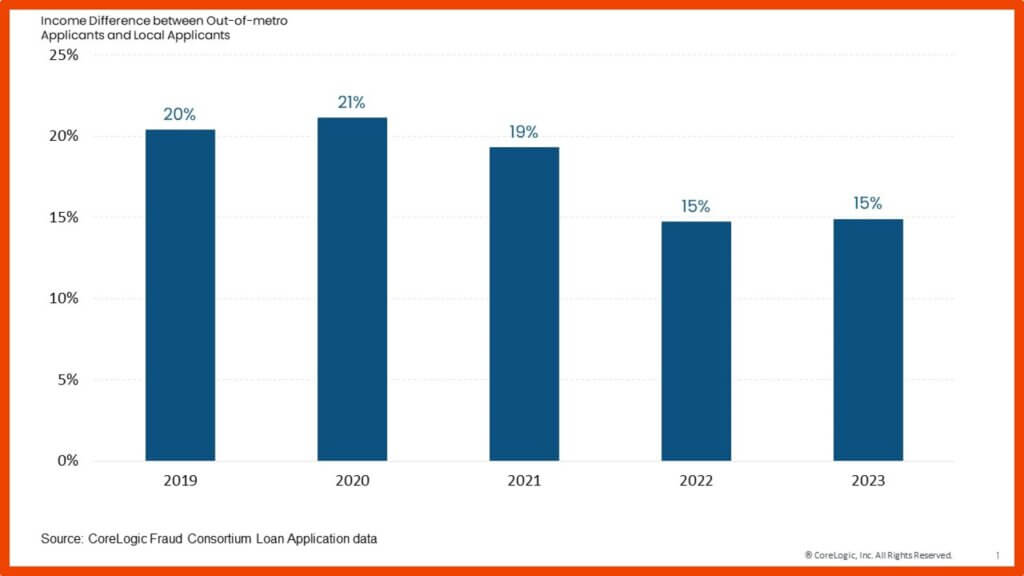

Figure 1 shows the national trend of income difference by year, dating back to 2019. While the average U.S. income is 25% higher in 2023 compared with 2019, the income gap between out-of-town buyers and locals has retracted from 20% to 15% in 2023 and was unchanged from 2022.

However, it is worth nothing that local households in some metros have higher incomes than those who are moving in. These areas include San Jose, California; Modesto California; Bakersfield, California and Boulder, Colorado.

CoreLogic’s economic team regularly weighs in on the latest housing market data and trends, all of which are accessible at the Office of the Chief Economist home page. CoreLogic’s specific insights on housing affordability topics can always be found here.

[1] The analysis is based on all home purchase mortgage applications, accepted or not, from January 2023 through October 2023. Investors and second-home buyers are excluded from this analysis. This doesn’t include cash buyers as well. The metros are analyzed at CBSA levels.