Elevated Flash-Flood Risk For More Than 67,000 Homes in Broward County

A stalled low-pressure system over the Gulf of Mexico dropped substantial levels of precipitation across the coastal states along the Gulf of Mexico on Wednesday, April 12, leading to widespread flash flooding in major metropolitan areas, such as Broward County.

CoreLogic estimates that more than 67,000 single-family and multifamily homes in Broward County, Florida, which are worth approximately $17.1 billion in combined reconstruction value (RCV), are at elevated risk of flash flooding.

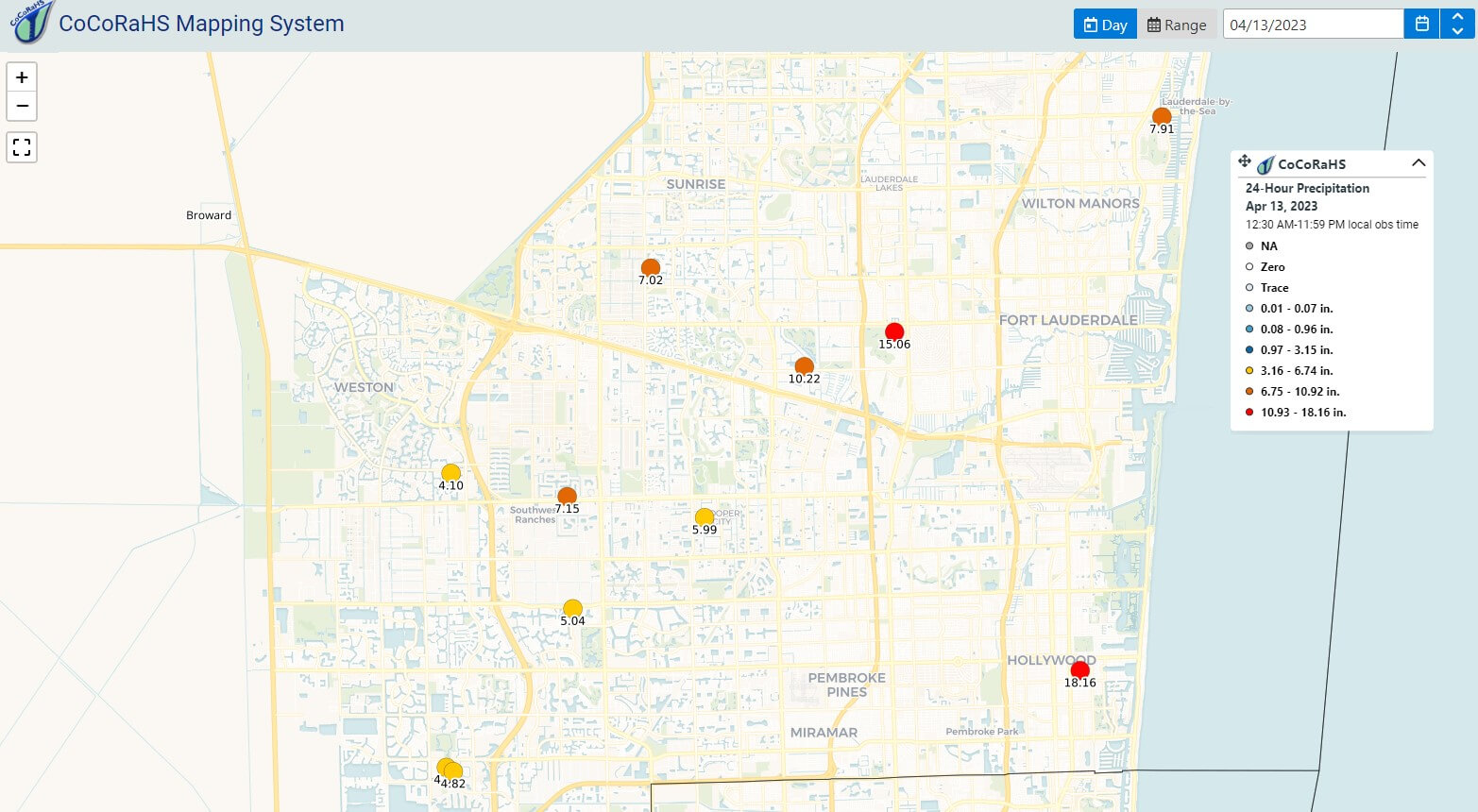

According to the Community Collaborative Rain, Hail & Snow Network (CoCoRaHS), as of 7 a.m. ET on Thursday, April 13, more than 18 inches of rain fell in Broward County over a 24-hour period (Figure 1).

Intense rainfall over short periods of time can lead to flash flooding, especially in urban environments where the proportion of paved surfaces to undeveloped land is higher. Developed land prevents water from infiltrating the ground, which results in pooling on the surface. This can occur rapidly during storms, such as those that impacted Broward County on Wednesday.

In Fort Lauderdale, schools were closed, and the Fort Lauderdale-Hollywood International Airport halted operations. Many people were trapped in their vehicles on impassable roads surrounded by water.

Flash-flood water can easily penetrate homes and cause damage to structures and other fixtures, such as furniture, HVAC and electrical systems.

CoreLogic Flash Flood Risk Score: A Complete View of Risk

According to FEMA, approximately 25% of all flood-derived economic losses occur in areas outside the floodplain and are a result of flash flooding, especially in urban environments. However, FEMA does not model flash flooding in areas that are not in close proximity to major bodies of water.

The CoreLogic Flash Flood Risk Score gives a comprehensive view of risk by incorporating flash flood risk both inside and outside the Special Flood Hazard Area (SFHA), as well as areas within the 100-year flood zone that have a 1% annual probability of flooding, as designated by the Federal Emergency Management Agency (FEMA).

Homes within the SFHA and with federally backed mortgages are required to purchase flood insurance, which covers any property loss incurred by flash flooding. According to CoreLogic, approximately 20% of the SFRs and MFRs in Broward County are within the SFHA. However, residences outside the SFHA are not required to purchase flood insurance. As a result, many forgo flood insurance and will have to pay for expensive reparations and restorations out of pocket.

Please email [email protected] with questions regarding the flash flooding in Broward County on April 12. Also, reach out to us about any CoreLogic event response notifications.

Visit www.hazardhq.com for updates and information on hazard events across the globe.