With mortgage rates at a 20-year high, buyers defer purchases and sellers defer listings

Quick Takes:

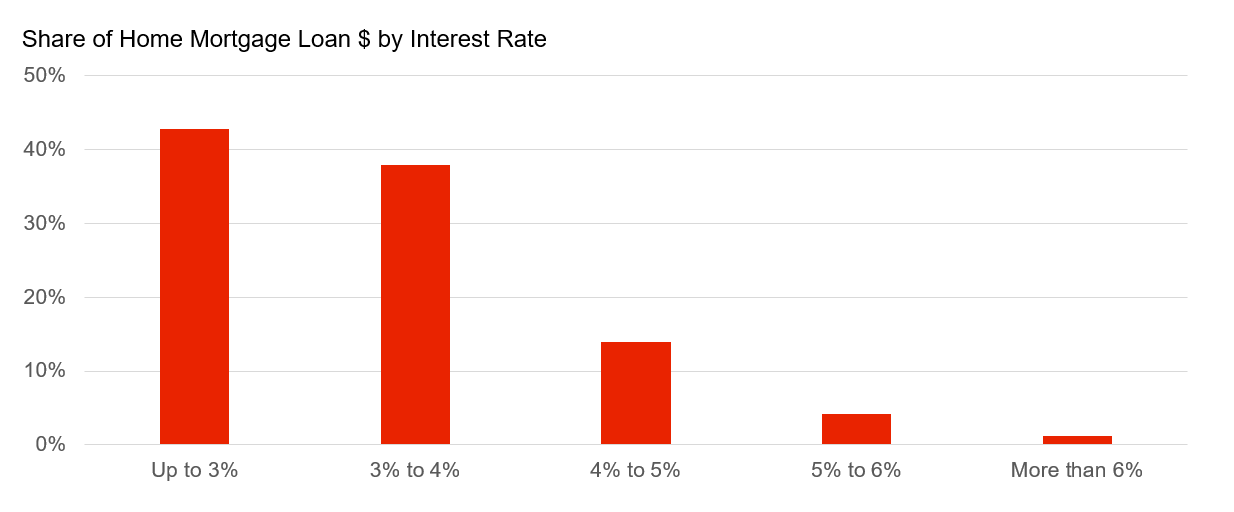

- With current mortgage rates at over 6%, the vast majority (99%) of outstanding mortgage debt has a lower mortgage rate locked in.

- The median mortgage rate on outstanding mortgage debt is 3.1%.

- New listings for home sales fell starting in July 2022.

U.S. mortgage rates rose nearly four percentage points from the beginning of 2022, reaching 6.95%[1] for the week of Nov. 3. Higher mortgage rates discourage new buyers, as they result in larger monthly payments that can put homeownership out of reach for some or put others on the sidelines waiting for mortgage rates to fall before purchasing.

While lower homebuyer demand has caused a drop in home sales and an increase in inventory, the number of for-sale listings remains slim. Even though unsold inventory was up through August 2022 compared with the same time period in 2021, the level was still below the average inventory levels seen from 2015-2020.

New listings started to decrease in July 2022 as fewer sellers listed their homes. For the months of July through September, the number of new listings was 14% lower than for the same period in 2021.

One reason that fewer owners are putting their homes on the market is because of something called the “lock-in effect.” Homeowners who hold low-interest-rate mortgages are reluctant to sell in an environment with rising rates because that means relinquishing the low mortgage rate on a current property and taking out a higher-rate mortgage on a new purchase.

During the 2020-2021 refinancing boom, when mortgage rates fell to their lowest level in 50 years, millions of borrowers were able to refinance and lower their mortgage rates. This moved the median rate of outstanding mortgages from 4.0% in August 2019 to 3.1% in August 2022.

Figure 1: Higher Mortgage Rate Leads to Strong Lock-In Effect

The figure above shows the share of outstanding mortgage debt by current mortgage rate[2]. Ninety-nine percent of outstanding mortgage debt is locked in at a rate that is lower than the current 6% or higher rates, disincentivizing homeowners from selling.

[1] Rate for a 30-year mortgage according to Freddie Mac Primary Mortgage Market Survey

[2] Source: CoreLogic True Standing Servicing for all loan terms as of August 2022