More competitive adjustable-rate mortgage rates and new loan limits have attracted homebuyers and investors

Rapidly climbing and high mortgage rates have led to the inevitable: the rising cost of home financing is discouraging potential homebuyers. Total home sales have declined for 6 consecutive months since December 2021 – with the pace of declines accelerating in May 2022 to 14.9% year over year, up from 14.6% in April and 9.4% in March. (Data source: CoreLogic public records)

And falling home sales meant another inevitable: tumbling mortgage originations. In May 2022, purchase mortgage originations (in loan value) dropped 9.4% year over year following a sizeable decline in April at 8.4%.

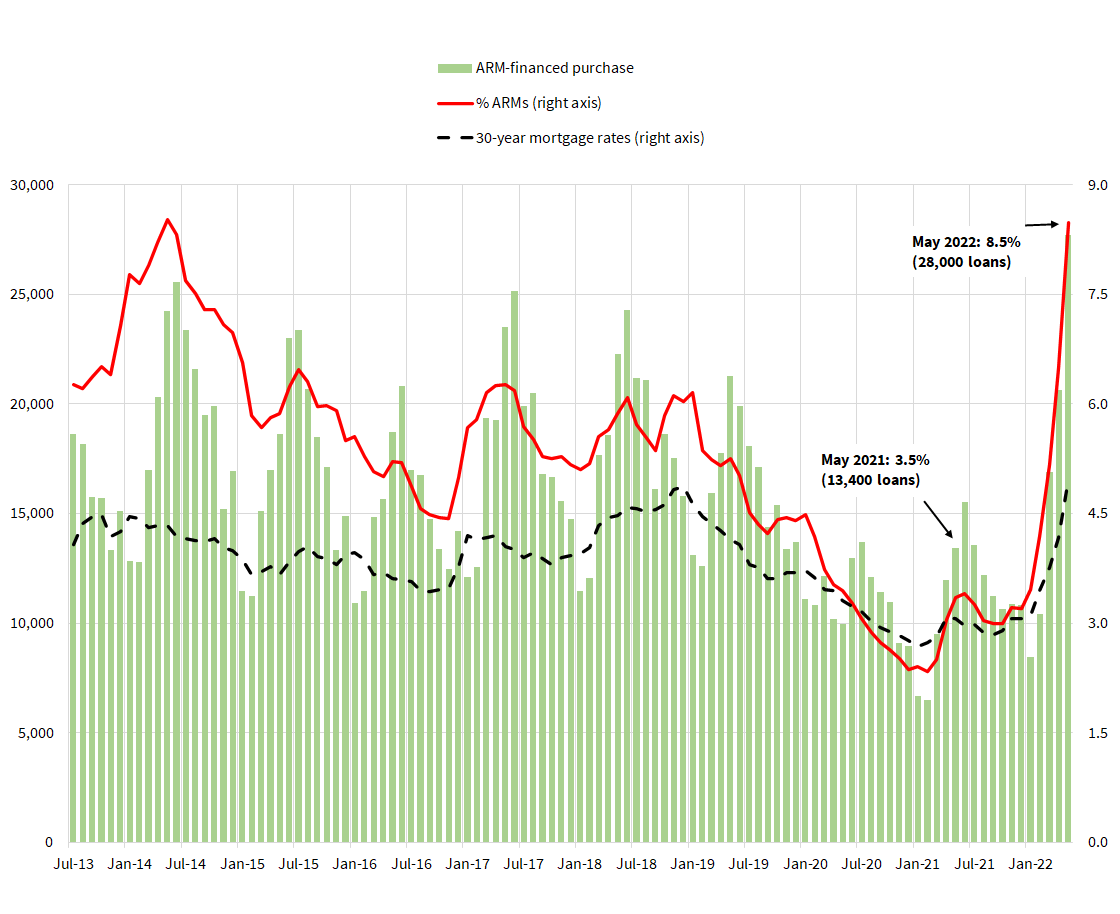

However, not all is bad news in the mortgage market. Adjustable-rate mortgages (ARMs) are up significantly amid rising interest rates and homebuyers and investors are flocking to ARMs for better affordability and yields. Plotted in Figure 1 are ARM-financed monthly home purchases, overlayed by ARM’s share of total mortgaged home purchases.

Figure 1: Originations of Adjustable-Rate Mortgage for Home Purchases at 8-Year High

Despite market headwinds, 2022 has delivered extraordinary loan growth for the ARM market, coinciding with rapidly rising mortgage rates (dotted line). In the first 5 months ending in May, total ARM-financed home purchases have increased by a staggering 75% from the same period a year ago. In May, of close to 454,000 mortgaged home purchases, nearly 28,000 or 8.5%, were financed with an ARM, compared to 13,400 or 3.5% of mortgaged home purchases in May 2021.

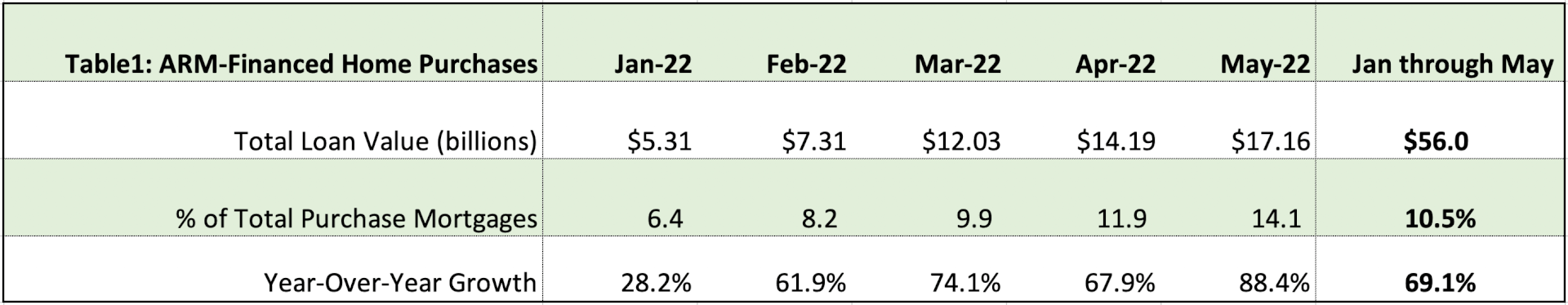

Sizing the origination of ARMs in terms of loan value – which provides a more relevant metric for investors – paints a similar picture of rapid growth and gaining market share. At the start of 2022, ARM-backed investment value stood at single-digits at $5.31 billion or 6.4% of total purchase mortgage-backed investment. In a matter of 4 months by May, ARM-backed investment value reached $17.16 billion, more than doubling its previous market share to 14.1%. From January to May, purchase-ARM financing provided $56 billion in investment value, representing a whopping 69.1% increase year over year.

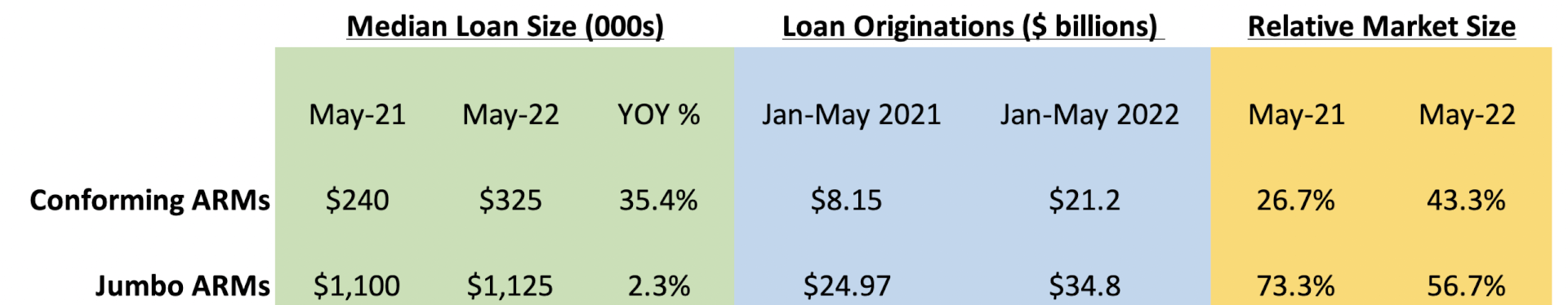

Table 1:ARM-financed Home Purchases

Why such phenomenal growth in ARMs all the while home sales and mortgage originations are fast sliding from the headwinds of rising and high interest rates?

Disparate increases in interest rates between fixed- and adjustable-rate mortgages have made ARMs relatively more affordable and competitive over fixed-rate loans.

The adjustable-rate mortgage is typically not most homebuyers’ go-to means for financing their homes due largely to uncertainty in future interest rates. ARM’s loan volume never exceeded 10% in the past 10 years, even as ARM products have become safe, sound and transparent in the post financial crisis era.[1]

As a close substitute to fixed rate mortgages (FRMs), ARM’s appeal to borrowers is largely driven by cost savings in lieu of a fixed rate loan. In recent months, as mortgage rates began to rise rapidly, ARM rates became relatively more inexpensive than 30-year FRM rates.

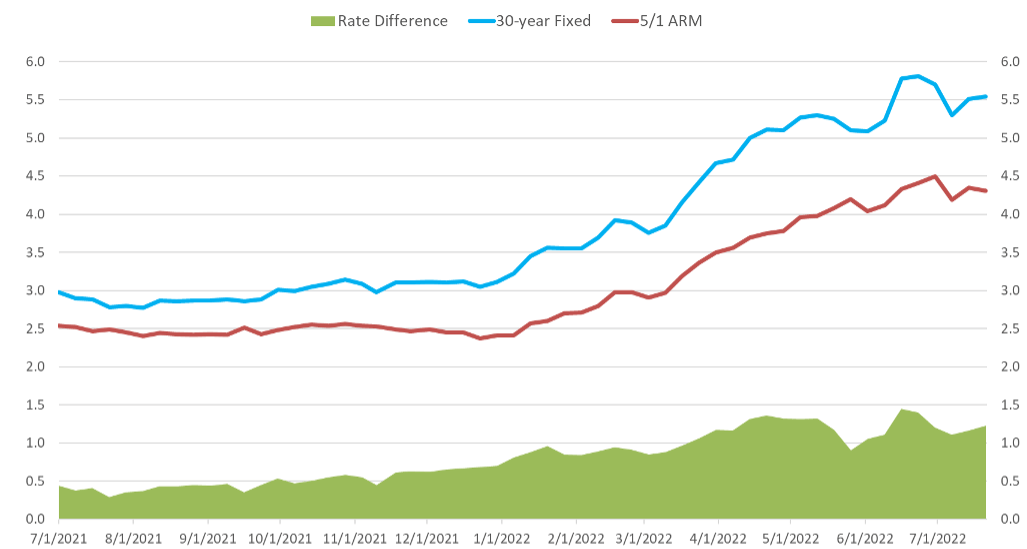

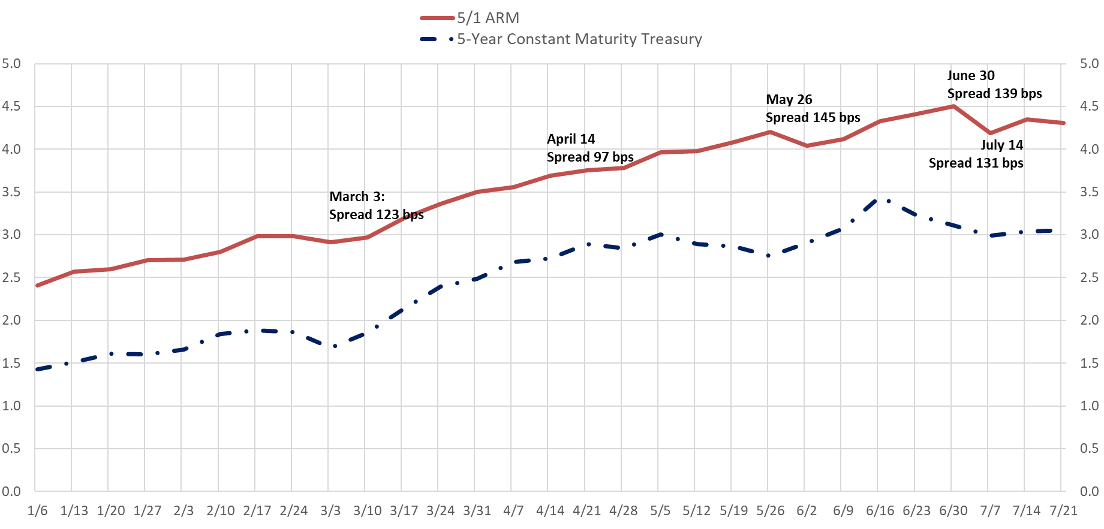

To illustrate, interest rates on a 30-year FRM and 5/1 ARM are plotted together in Figure 2, along with the rate differentials since July 2021, a few months before the Federal Reserve raised the target interest rate. Coinciding with rapid climbs in mortgage rates that began in early 2022, 5/1 ARM rates moved at a much slower pace, widening the spread and resulting in increasingly lower ARM rates relative to 30-year FRM.[2]

Figure 2: Rising Cost Savings from ARM Amid Rising Interest Rates

So just how much less expensive have ARMs become in 2022? In April, the interest rate for ARMs averaged at about 3.7% while 30-year FRMs shot up to 4.98% – a difference of 128 basis points, making ARM rates as much as 25.7% less expensive than alternative FRM rates. In May and June, the rate differentials stayed above a whole percentage point at 1.18% and 1.24% respectively. The latest July data continues to show a wide margin in favor of ARMs.

Higher conforming loan limits that took effect in 2022 have boosted the supply of ARM credit.

On the demand side, rising interest rates have increasingly widened the rate advantage for ARMs to attract homebuyers seeking more affordable financing.

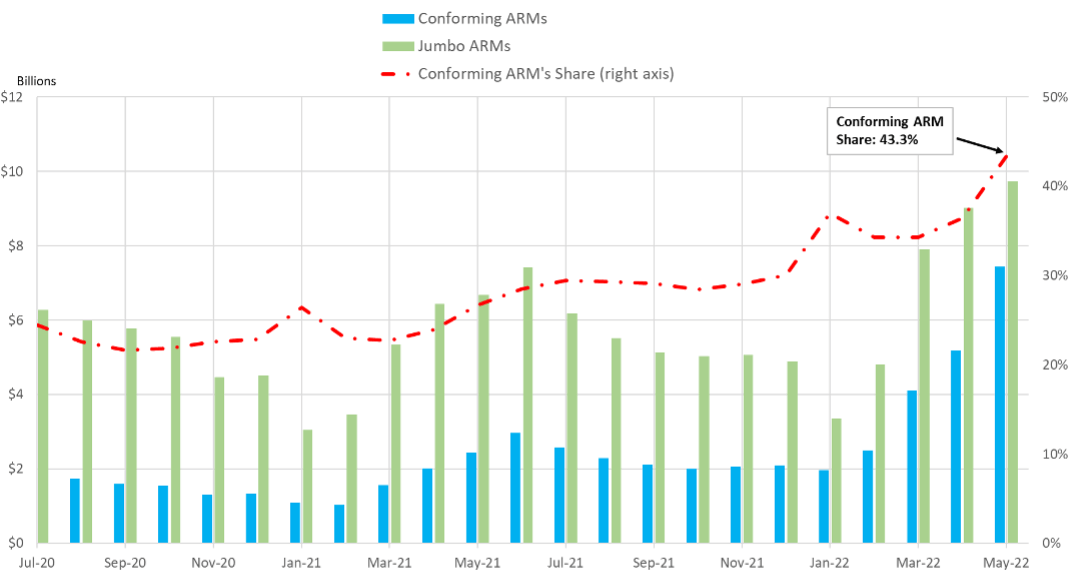

On the supply side, the new and higher conforming-loan limits that went into effect in 2022 have also made it possible for lenders to meet a rising demand for ARMs by qualifying more borrowers for ARM loans that could be backed by Fannie Mae, Freddie Mac and Ginnie Mae. In 2022, an 18% increase in loan-size limits puts the conforming loan limit in most areas to $647,200 and $970,800 in high-costs markets. Monthly conforming and non-conforming ARM originations are shown in Figure 3, while Table 2 summarizes respective median loan size before and after the policy change as well as origination values and relative market shares.

Figure 3: Conforming ARMs Got A Big Boost From Higher Loan Limits

Table 2

Conforming-ARM loan size increased 35.4% from a year ago, driven also in part by fast-rising home prices, whereas jumbo-ARM loans only saw a modest increase at 2.3%. In the first 5 months of 2022, lenders originated $21.2 billion conforming ARM loans (nearly 60,000 in volume), compared to $8.15 billion (about 30,000 loans) during the same period in 2021, delivering a remarkable 160% gain in market value.

Non-conforming ARM originations recorded a more modest expansion valued at nearly $34.8 billion (about 24,300 loans), representing 39.3% year-over-year growth. The squeeze into the jumbo market from higher loan limits – such that those previously would come under the jumbo category (i.e., loans between $548,250 – $647,200 or between $822,375 -$970,800 depending on market areas) could now qualify for loans backed by Fannie Mae or Freddie Mac – have likely mitigated the growth in jumbo ARM market.

Spurred by competitive interest rates, it is no surprise that conforming ARMs have had the most to gain from higher loan limits. By May 2022, conforming ARM’ market share (in loan value) has climbed to 43.3% of purchase-ARM originations, an expansion of 16.6% since May 2021.

ARMs offer attractive investment yield to investors who, in turn, are keeping credit flowing into the ARM market.

ARMs typically attract two types of borrowers: those expecting to move and sell the house before the initial rate expires and those more financially-savvy who are attracted to ARM’s lower rates. The latter often refinance the loans into another ARM or a fixed-rate mortgage when the interest rate on the loan is up for an adjustment. Consequently, the duration of ARMs or ARM-backed MBS is generally capped within the length of their initial constant-rate period, which commonly is 5 years as 5/1 ARMs are more commonly available from lenders.

Institutional investors of ARMs such as banks, insurance companies and pension funds are often duration investors who are attracted to ARMs shorter duration but higher yields than similar duration instruments such as 5-year treasury securities. Bank lenders, for example, frequently retain high-balance ARMs on their balance sheet.

Figure 4: 5/1 ARMs Offer Attractive Yield to Investors

Weekly 5/1 ARM rate and yield on 5-year constant maturity treasury securities through July 2022 are stacked in Figure 4. During March, April and May, the spread over 5-year treasury securities reached as much 123, 97 and 145 basis points (bps). In June and July, at their widest point, the spread was as deep as 139 bps and 131 bps.

With mortgage rates remaining high and FRM-ARM rate spread deep through June and July, the upcoming data can be counted on to deliver more record-breaking ARM volumes. Following the Federal Reserve Board’s recent move to raise the benchmark interest rate –and with the market expecting another rate hike in September, the interest rates in the coming months will likely continue to sustain ARM’s appeal to investors seeking higher investment yield and homebuyers shopping for more affordable home financing.

[1] During the subprime mortgage boom and bust, ARM products experienced high defaults; their teaser rate features and poor underwriting standards were often cited for poor performance and inadequate borrower understanding of the loan products.

[2] While future interest rate expectations could be a factor contributing to faster rises in 30-year FRM rates, rising investor appetite for ARM-backed investment has likely put downward pressure on the yields and ARM rates.