Loan Performance Insights Report Highlights: April 2020

- The nation’s overall delinquency rate was 6.1% in April.

- While all states showed increases in their overall delinquency rates, those increases were highest in New York, New Jersey, Florida and Nevada.

In April 2020, 6.1% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure)[1], the highest overall delinquency rate since January 2016, according to the latest CoreLogic Loan Performance Insights Report. The April 2020 overall delinquency rate jumped 2.5 percentage points from the prior month as the impact of the coronavirus pandemic and resulting recession made it difficult for borrowers to make their monthly mortgage payments. The increase in April ended a 27-month streak of consecutive year-over-year decreases in the overall delinquency rate.

The share of mortgages that were 30 to 59 days past due – considered early-stage delinquencies – was 4.2% in April 2020, up from 1.7% in April 2019. The share of mortgages 60 to 89 days past due was 0.7% in April 2020, up from 0.6% in April 2019.

The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.2% in April 2020, down from 1.3% in April 2019. For the fifth consecutive month, the serious delinquency remained at its lowest level since June 2000. The foreclosure inventory rate – the share of mortgages in some stage of the foreclosure process – was 0.3% in April 2020, down from 0.4% from April 2019 and the lowest foreclosure rate in at least 21 years[2].

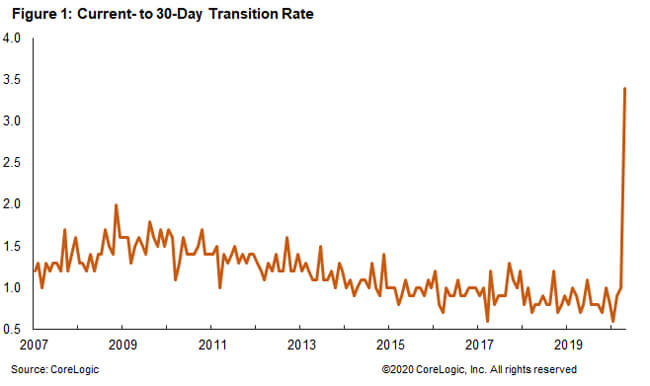

In addition to delinquency rates, CoreLogic tracks the rate at which mortgages transition from one stage of delinquency to the next, such as going from current to 30 days past due (Figure 1). The share of mortgages that transitioned from current to 30 days past due increased to 3.4% in April—the highest reading in at least 21 years. In comparison, the previous peak in the current- to 30-day transition rate was 2% in November 2008.

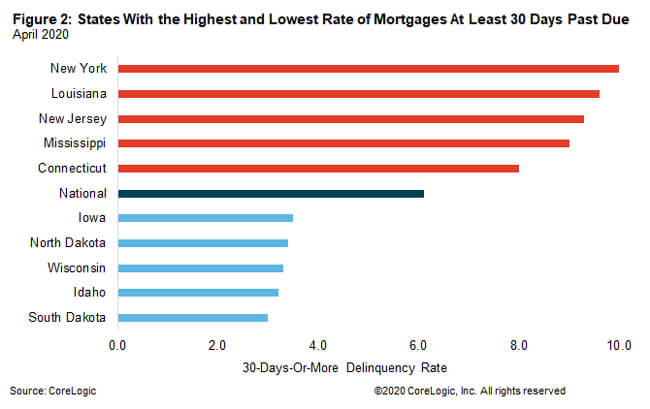

Figure 2 shows the states with the highest and lowest share of mortgages 30 days or more delinquent. In April 2020, that rate was highest in New York at 10% and lowest in South Dakota at 3%. All U.S. states posted annual gains in their overall delinquency rate in April 2020. The states that logged the largest annual increases were New York (+4.7 percentage points), New Jersey (+4.6 percentage points), Nevada (+4.5 percentage points) and Florida (+4 percentage points).

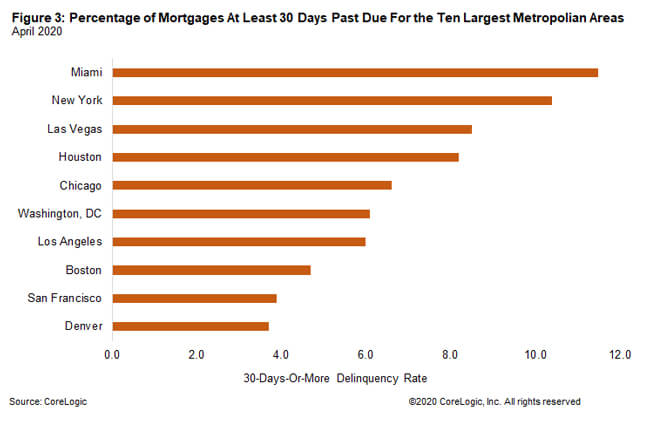

Figure 3 shows the 30-plus-day past-due rate for April 2020 for 10 large metropolitan areas.[3] Miami had the highest rate at 11.5% and Denver had the lowest rate at 3.7%. Miami had the largest increase in the overall delinquency rate of any metro, increasing 6.7 percentage points from a year earlier. Outside of the largest 10, nearly every metro recorded an increase in the overall delinquency rate, with tourist destinations such as Kahului, Hawaii, Atlantic City, New Jersey and Las Vegas, Nevada all showing gains of over 5 percentage points in the overall deliquency rate.

© 2020 CoreLogic, Inc. All rights reserved.

[1] Data in this report is provided by TrueStandings Servicing. https://www.corelogic.com/products/truestandings-servicing.aspx. The CARES Act provided forbearance for borrowers with federally backed mortgage loans who were economically impacted by the pandemic. Borrowers in a forbearance program who have missed a mortgage payment are included in the CoreLogic delinquency statistics, even if the loan servicer has not reported the loan as delinquent to credit repositories.

[2] The data in this report date back to January 1999.

[3] Metropolitan areas used in this report are the ten most populous Metropolitan Statistical Areas. The report uses Metropolitan Divisions where available.