Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through May 2021.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

“The rise in home prices has built a substantial home equity cushion for homeowners with a mortgage, reducing the risk of a foreclosure. The CoreLogic Home Price Index recorded an annual increase of 17% in June. This price rise builds home equity. For most borrowers in forbearance, the equity gain means they’ll still have some remaining — even if missed payments are added to their loan balance.”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

30 Days or More Delinquent – National

In April 2021, 4.7% of mortgages were delinquent by at least 30 days or more including those in foreclosure.

This represents a 2.6-percentage point decrease in the overall delinquency rate compared with May 2020.

Helpful Home Equity

Many are concerned about a pending foreclosure crisis when government provisions lift. Fortunately, the average homeowner in forbearance has sizeable equity in their home, which has helped create an additional financial buffer for those struggling to make mortgage payments. Thanks to these strong equity gains, and the availability of loan modifications and federal resources, we expect most borrowers have had enough support to stave off a foreclosure wave. Additionally, a recent CoreLogic survey of mortgage holders reports 85% of respondents said they maintained employment through the pandemic, which has helped many homeowners avoid delinquency and prevented a broad-scale mortgage crisis.

“The pandemic has created many challenges but, in the case of delinquencies, the impacts have been relatively muted thanks to numerous government support programs and the sharp snapback in economic activity over the past several quarters. Looking forward, we expect a robust economy and near-zero interest rates to hold delinquency levels at reasonable levels.”

– Frank Martell

President and CEO of CoreLogic

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for May was 4.7%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.2% in May 2021, down from 3% in May 2020. The share of mortgages 60 to 89 days past due was 0.3%, down from 2.8% in May 2020. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 3.2%, up from 1.5% in May 2020. While still high, this is the lowest serious delinquency rate since an initial jump during the pandemic in June 2020.

As of May 2021, the foreclosure inventory rate was 0.3%, unchanged from May 2020.

Transition Rates – National

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.7%, down from 2.2% in May 2020.

Overall Delinquency – State

Overall delinquency is defined as 30-days or more past due, including those in foreclosure.

- In May, all U.S. states and metro areas logged a decrease in annual overall delinquency rates, with New Jersey (down 4.8 percentage points), New York (down 4.2 percentage points) and Florida (down 4 percentage points) leading the pack with the largest state declines.

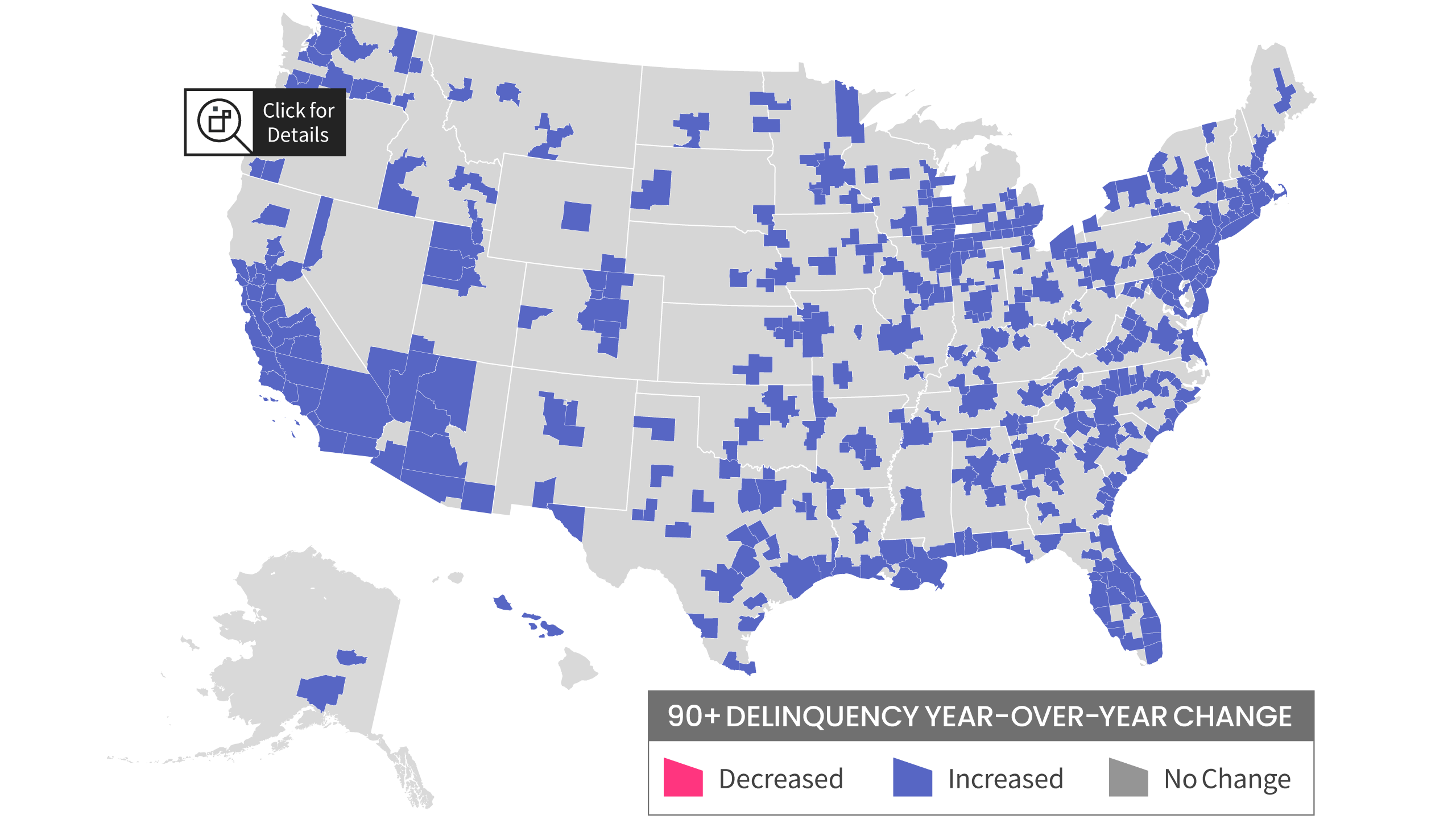

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were 384 metropolitan areas where the Serious Delinquency Rate increased.

There were 0 metropolitan areas where the Serious Delinquency Rate remined the same or decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights.

CoreLogic Insights – On the Go or Download Apple App Store or Google play

Methodology

The data in the CoreLogic Loan Performance Insights report represents foreclosure and delinquency activity reported through May 2021.

The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. Approximately one-third of homes nationally are owned outright and do not have a mortgage. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

About the CoreLogic Consumer Housing Sentiment Study

3,000+ consumers were surveyed by CoreLogic via Qualtrics. The study is an annual pulse of U.S. housing market dynamics concentrated on consumers looking to purchase a home, consumers not looking to purchase a home, and current mortgage holder. The survey was conducted in April 2021 and hosted on Qualtrics.

The survey has a sampling error of ~3% at the total respondent level with a 95% confidence level.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Amy Brennan at [email protected]. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. The data are compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Contact Us

For more information, please email Amy Brennan at [email protected].