Affordability and high-paying jobs attract first-time homebuyers

After the national share of mortgage applications from first-time homebuyers (FTHBs) fell to a three-year low of 34% in the third quarter of 2022, that number bounced back to 39% in February 2023.

FTHB share varies across housing markets, and like any homebuyer, their choices are affected by several factors, such as:

- Housing affordability

- Employment opportunities

- Flexibility to work remotely

- Local tax rates

- Preference for open spaces

In general, FTHBs have more buying power in affordable markets. However, our data shows that this group’s share is much higher in some high-cost metros, especially where there are high-tech job opportunities.

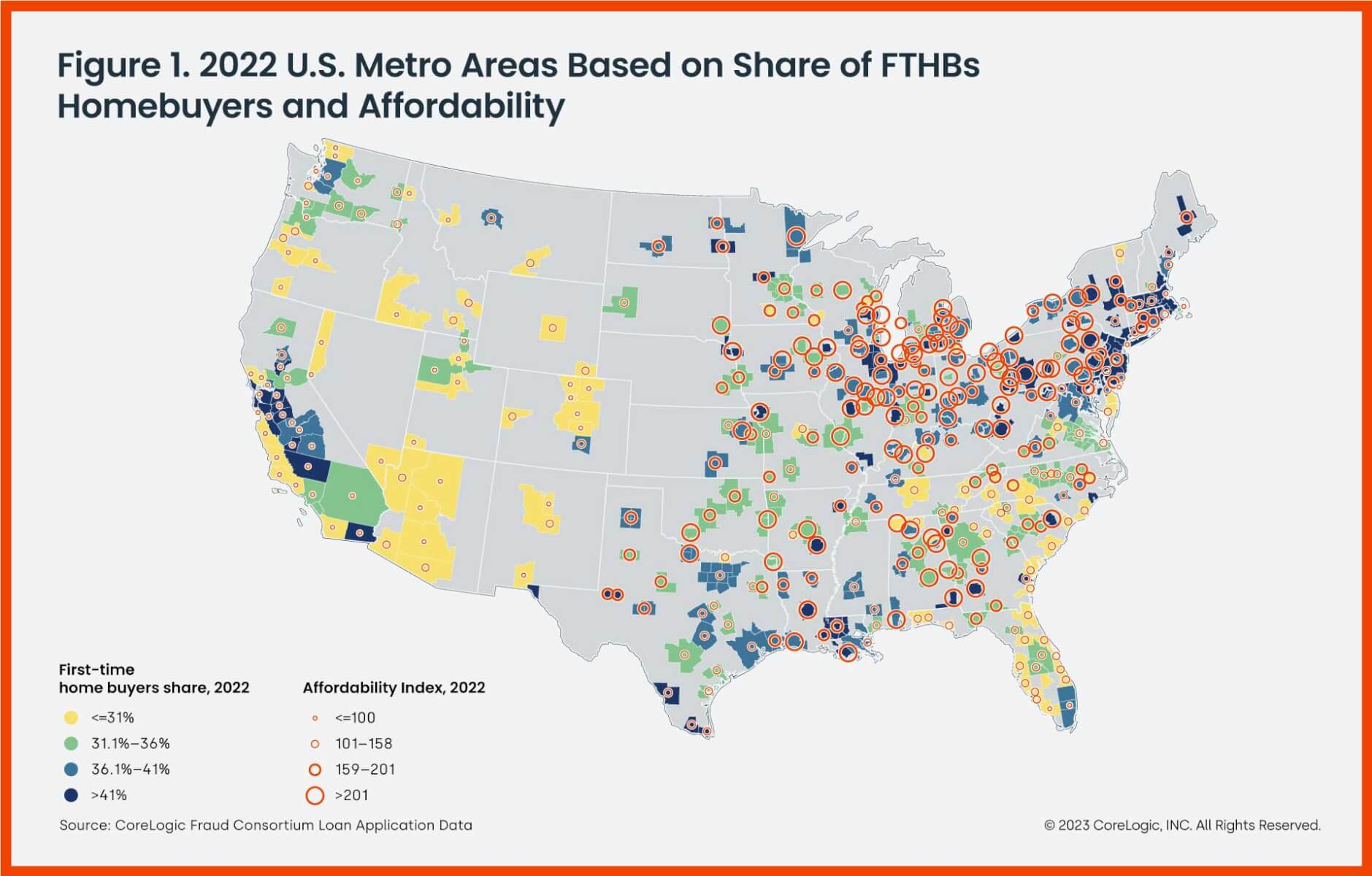

Figure 1 shows U.S. metros based on their FTHB application share in 2022. FTHBs made up a higher share of the potential homebuyers in Midwestern markets and in metros with high-tech job opportunities.[1]

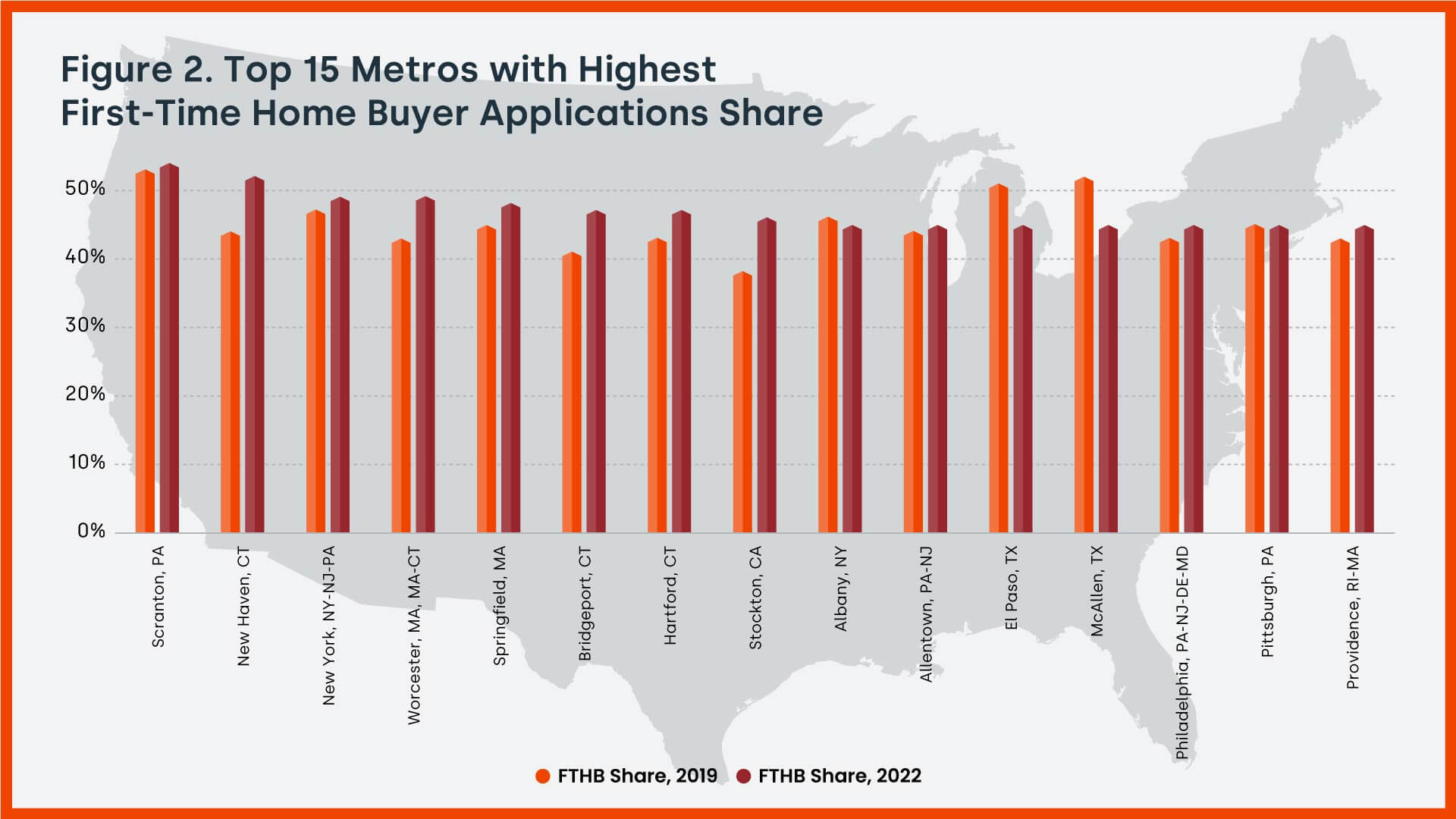

In addition, Figure 2 shows the share of FTHBs for the top 15 metros in 2022, compared to 2019. Out of the top 100 metros based on the 2021 population, Scranton, Pennsylvania, had the highest percentage of FTHBs (54%) applying for a home mortgage, followed by New Haven, Connecticut (52%); New York (49%); Worcester, Massachusetts (49%); Springfield, Massachusetts (48%); and Hartford, Connecticut (47%). Some coastal metros were also among the markets with high FTHB shares. Metros with the highest share of FTHB applicants offer high-tech job opportunities and/or they are affordable.

Conversely, metros in Florida and Arizona had the lowest percentage of FTHBs applying for a home mortgage. North Port, Florida, had the lowest percentage (15%), followed by Boise City, Oklahoma (19%); the Florida cities of Palm Bay, Deltona, and Cape Coral (23%); Phoenix (24%); and Jacksonville, Florida (26%).[2]

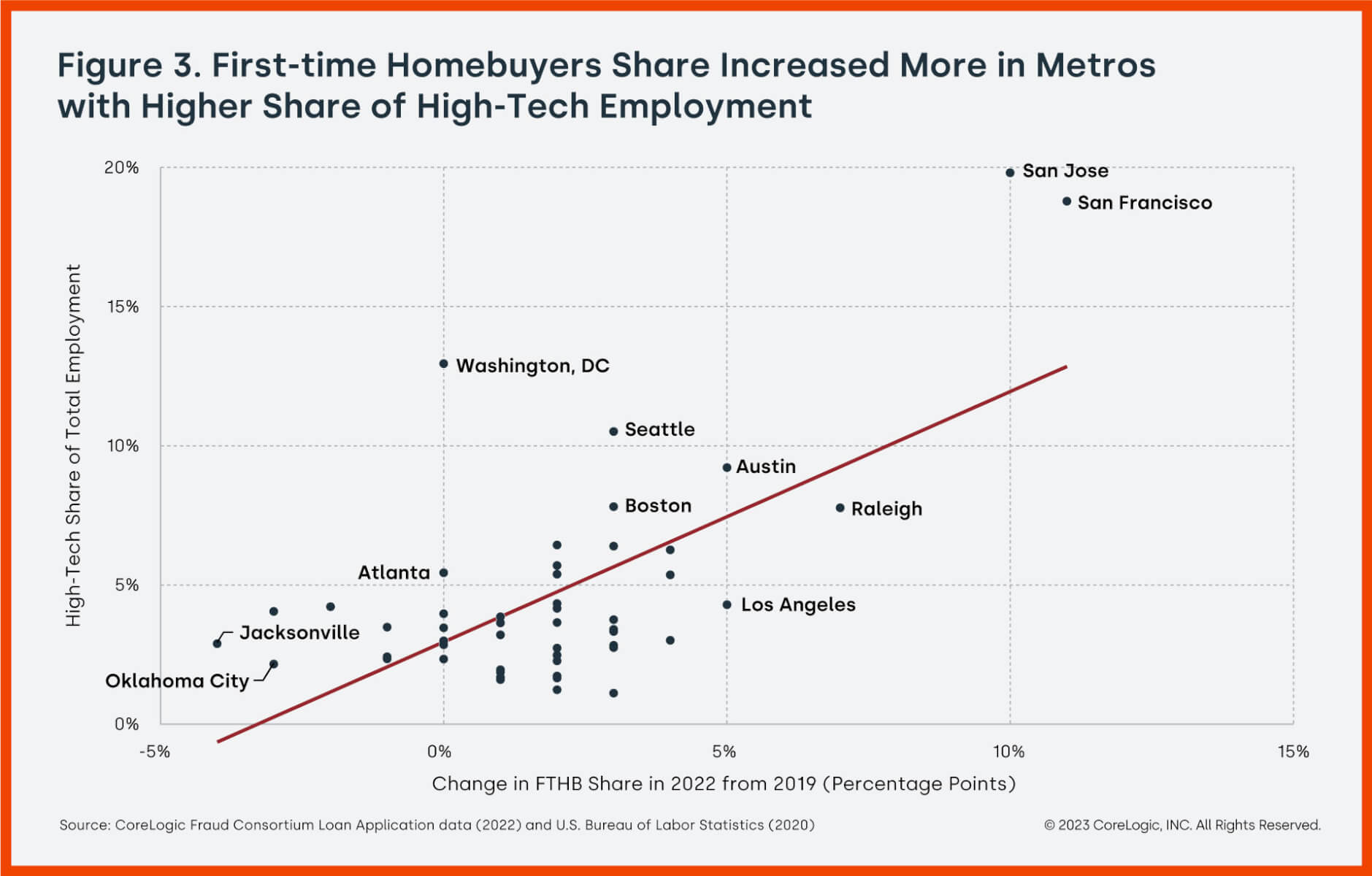

Figure 3 plots the relationship between FTHB share and the market share of high-tech jobs with respect to the total employment for the top 50 most populous metros in 2021.[3]There is a positive relationship between the change in FTHB share and high-tech employment share.

High-cost costal metros, such as San Jose and San Francisco, that offer high-tech job opportunities experienced the highest increase in FTHB share over the three-year period.

It is worth noting that FTHBs in San Jose, San Francisco and Boston had the highest average credit scores, made the highest average incomes and contributed the biggest down payments. This buyer profile could be a result of higher wages among high-tech industry jobs, which have been attracting millennials, most of whom are FTHBs.

Our previous research shows that fewer repeat buyers are applying for mortgages due to the phenomenon known as the lock-in effect. However, among the repeat buyers who are currently in the market, there is a trend to sell houses in higher-cost areas and move to lower-cost metros with warm weather and amenities. As a result, the FTHB share is greater in high-tech metros, such as San Jose, San Francisco and Boston, and lower in more affordable metros in Florida and Arizona.

[1] This analysis is based on all home-purchase mortgage applications, accepted or not, from January 2019 to December 2022. Investors and second-home buyers were excluded from the analysis. This doesn’t include cash buyers as well.

[2]Out of the top 100 metros based on 2021 population.

[3] High-tech share of total employment in area is based on 2020 data.