California and Florida metro areas have the least affordable rental costs in the country

It is generally less expensive to rent a home than to buy one, so for most Americans, the path to homeownership starts with renting while saving for a down payment.

However, homeownership is becoming more elusive than ever for many people, as surging rents over the last few years have put an increasing financial burden on budgets. The fact that many Americans are priced out of homeownership by escalating home prices and high mortgage rates compounds rental cost issues.

At the height of inflation in 2022, a household that rented a median-priced, single-family home and earned an income near the U.S. median would have spent about 40% of their gross family income on annual rent payments, compared with 35% in 2019. [1]

Single-Family Residences Are the Largest Rental Stock

There are more renters living in single-family residences (SFRs) than those residing in multifamily residences (MFRs). Over 2.5 million more renters occupy SFRs than MFRs, according to the latest U.S. Census Bureau survey. The split of occupancies between the two residence types is about 50% for SFRs and 45% for MFRs, with the remaining 5% mostly residing in mobile homes. [2]

Rental costs for SFRs are generally more expensive than those for MFRs. As of September 2023, U.S. median monthly rent payments on new leases for single-family detached or attached homes were about $2,600 (regardless of number of bedrooms), although that figure can vary greatly by state and metro.

For instance, in the Los Angeles metro, the median rent payment for an SFR was $4,750 per month in September, while in Atlanta and Detroit, the going rate was $2,175 and $1,800, respectively. By comparison, the median U.S. MFR apartment rent payment in September was about $1,363. [3]

A Snapshot of the Highest- and Lowest-Cost SFR Markets

Like home prices, rents in high-cost areas are expectedly more expensive than moderate- to low-cost regions (Table 1). At $4,750, the Los Angeles metro tops the nation for median monthly rental costs, followed closely by San Diego at $4,500. Bay Area rents are not far behind those in Southern California, with San Jose and San Francisco showing $4,300 and $4,200 monthly rental costs, respectively.

At the other end of the spectrum, large metros like Cleveland, Oklahoma City, St. Louis, Detroit and New Orleans have much lower prices and thus more affordable monthly rent payments.

Examining Rent-to-Income-Ratios by U.S. Metros

Since wages are higher in more expensive areas than those in low-cost markets, a more accurate measure of rent affordability is the rent-to-income ratio, which is the portion of income that must be set aside for housing costs each month – regardless of the rent or income level. Areas with higher rent-to-income ratios are typically less affordable than those where rent payments consume a smaller share of income.

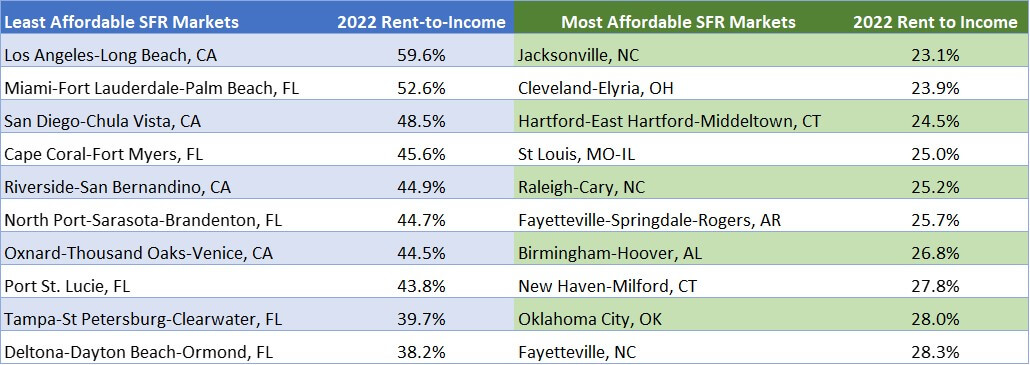

Table 2 shows the amount of income spent on rent based on an area’s median market rent and median household gross income. The top 10 spots for the most unaffordable rental markets are in California and Florida, which are the No. 1 and No. 3 most-populous U.S. states, respectively.

Households in the Los Angeles metro spend nearly 60% of their monthly incomes on rent payments (on an annual median income of about $88,000.) The San Diego metro isn’t much more affordable, with tenants spending just slightly shy of 50% of the metro’s median household income ($98,928) on rent payments.

Miami now ranks as the second-least affordable rental market in the country, where the area’s median rent price consumes almost approximately 53% of the area’s median household income of $70,769. The onset of COVID-19 saw both rent and home prices soar in Miami and across Florida, as the state became a migration hot spot that attracted employees for its job opportunities and temperate climate. U.S. Census Bureau data shows that more than 1.4 million people moved to Florida from other states in 2021 and 2022, which has fueled the increasing cost of housing there. Meanwhile, low interest rates and surging inflation have also contributed to rent increases and deteriorating housing affordability.

At the other end of the spectrum, markets showing the best affordability also tend to be those with relatively inexpensive rental costs. For instance, in Jacksonville, North Carolina (which has a population of more than 200,000 and a median household income of $62,460), the typical annual rent payment in 2022 amounted to just 23.1% of the metro’s income. Similarly, with a population of more than 2 million and a median household income of $65,198, Cleveland is another of the country’s most affordable rental markets, with the average household spending about 24% on housing costs.

Rent continues to rise at a moderate pace in 2023, while inflation and escalating home prices continue to diminish purchasing power for many Americans. In high-rent-burdened markets such as Los Angeles and Miami, a meaningful improvement in affordability will require either rents to fall or household incomes to rise faster than the pace of rents (or both) — which is just simple math.

But there is nothing simple about what would take the economy, the housing market and policies to improve that math. For millions of low-to-moderate-income households, who make up nearly 70% of the nation’s renters, any relief that may happen cannot come soon enough.

CoreLogic tracks ongoing U.S. rental price trends in our Single-Family Rental Index, which is typically released on the third Tuesday of each month. Additionally, CoreLogic’s team of economists weigh in on recent home price trends on the first Tuesday of each month in our Home Price Insights report, and on the last Tuesday of the month in the US CoreLogic S&P Case-Shiller Index. And you can always keep up with the latest insights from CoreLogic’s team of expert economists at this home page.

[1] CoreLogic blog, October 2, 2023

[2] 2022 American Community Survey 5-Year Estimates on units in structure