While 11 metros saw reacceleration in annual prices, Midwest pandemic laggers, Cleveland, Chicago and Detroit are now the hottest housing markets

While housing market activity started 2023 with buoyancy, sales of existing homes disappointed going into the summer, as for-sale inventory remained stubbornly slim and mortgage rates kept trending higher. June sales were about 21% below 2019 and 20% below 2022. Nevertheless, comparing the rest of 2023 with the second half of 2022 will be less meaningful, as housing activity came to a halt in the summer of 2022 with the surge in mortgage rates.

Nevertheless, home sales still continue to tell a tale of two markets: one of the West, which is constrained by a severe lack of existing inventory, and the other of the Southeast and South, where the relative availability of new homes for sale is allowing for more transactions.

On the other hand, home prices are not necessarily following the similar two-markets tale as they did in previous months. Prices in many of the previously declining West Coast markets are rebounding and showing some renewed vigor, particularly as those metros have the biggest shortage homes for sale. Heating competition among buyers is also reflected in an increasing share of U.S. homes selling for more than asking price, 39%, compared with an average of 25% pre-pandemic. As a result, the median price premium (the ratio of sales price to list price) is back to positive at 1%, after declining since last September.

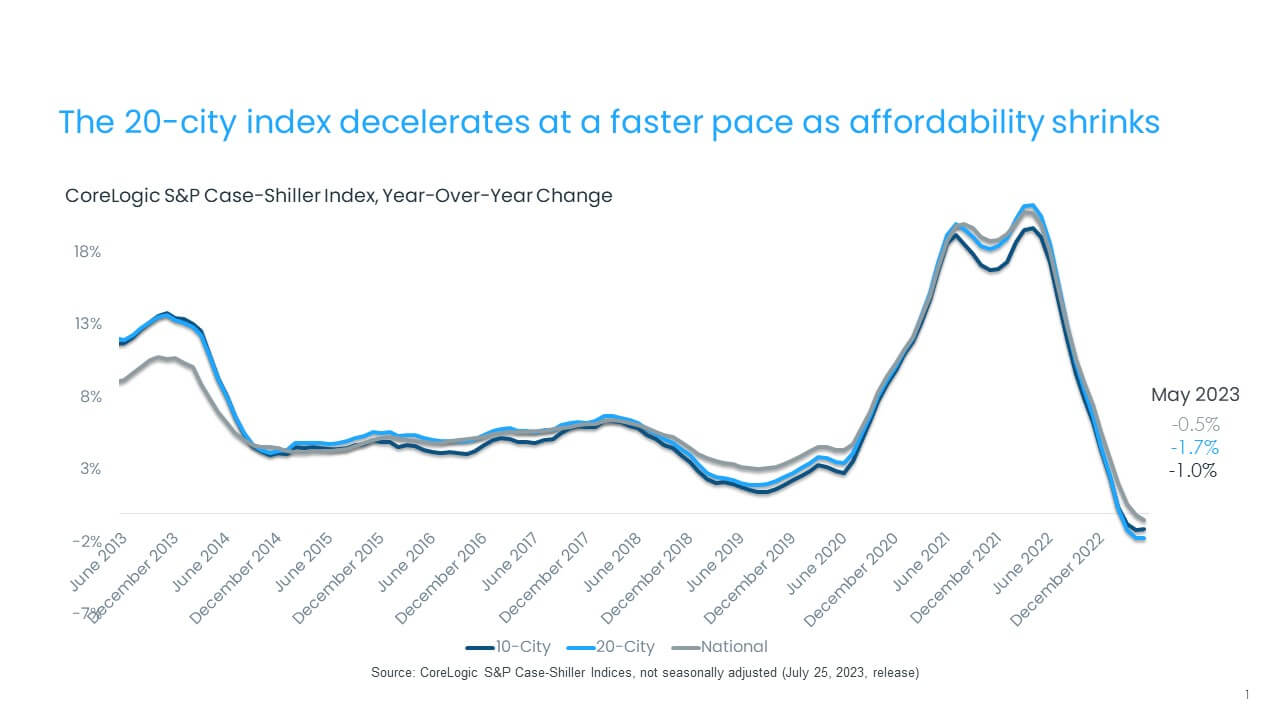

In May, the CoreLogic S&P Case-Shiller Index fell by 0.5% year over year, the second month of annual losses. However, the annual decline reflects price drops that occurred in 2022 (Figure 1).

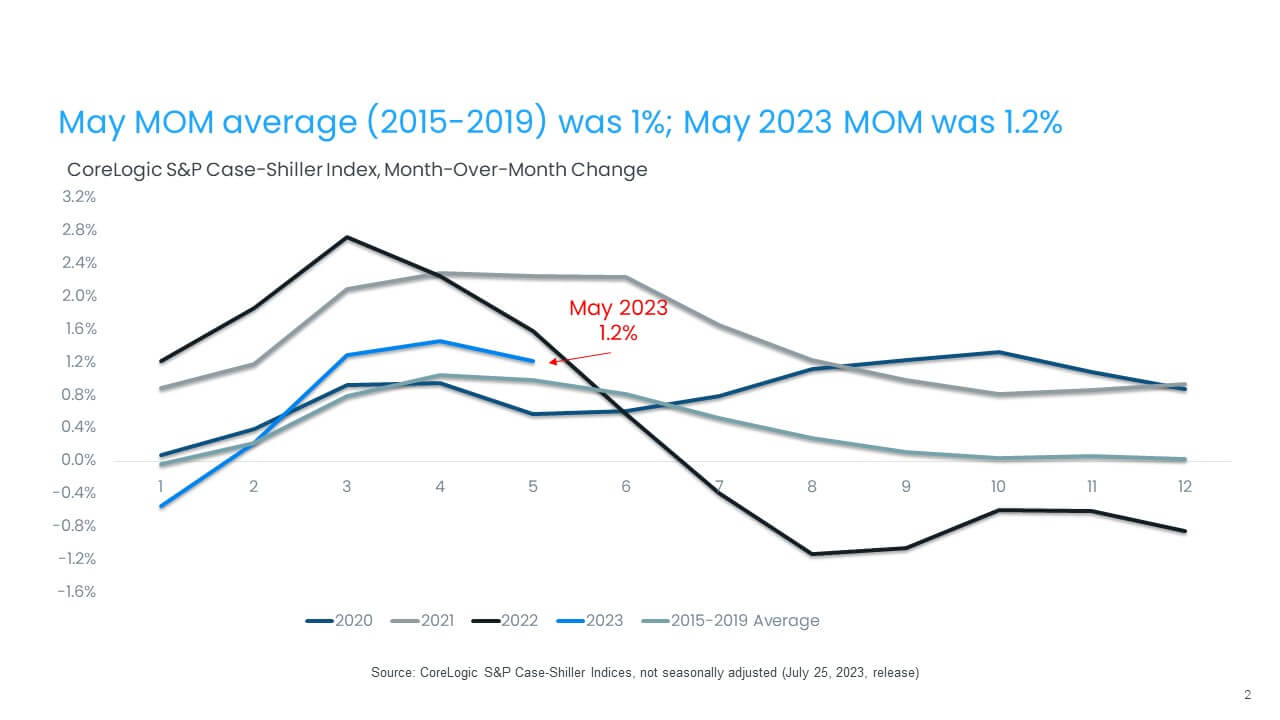

The non-seasonally adjusted month-over-month index, on the other hand, posted its fourth month of strong gains, up by 1.2% in May, a smaller increase than the 1.5% recorded in April. With four months of such gains, home prices are now up by 4% from February of this year, though they are still 1% below the 2022 peak. But while monthly gains have been unexpectedly strong this spring, the recent surge in mortgage rates suggests that appreciation may plateau going forward. Between 2015 and 2019, the monthly index changes from April and May have generally averaged 1% (Figure 2).

Strong price gains this spring also suggest that overall home price appreciation for 2023 is exceeding many initial expectations. CoreLogic’s latest Home Price Index projects that home prices nationally will average a 4.5% increase in May 2023 compared with the previous year.

The 10- and 20-city composite indexes posted a third month of declines in May, down by 1% and 1.7%, respectively. The 20-city index has continued to show relatively larger declines in home prices over the last year, as smaller metro areas are more sensitive to affordability challenges. But again, over the previous month, both the 10-city index and the 20-city index were up by 1.5%. In addition, both indexes are also up 5% cumulatively since the beginning of 2023. The 10-city index includes currently better-performing metros, such as New York and Chicago, which have seen relatively stronger housing market performance since mid-2022, as the return to cities and offices has gotten underway.

Compared with the 2006 peak, the 10-city composite index is now 44% higher, while the 20-city composite is up by 51%. Adjusted for inflation, which is showing signs of easing, the 10-city index is now back to its 2006 level, while the 20-city index showed a 5% increase compared with its 2006 high point.

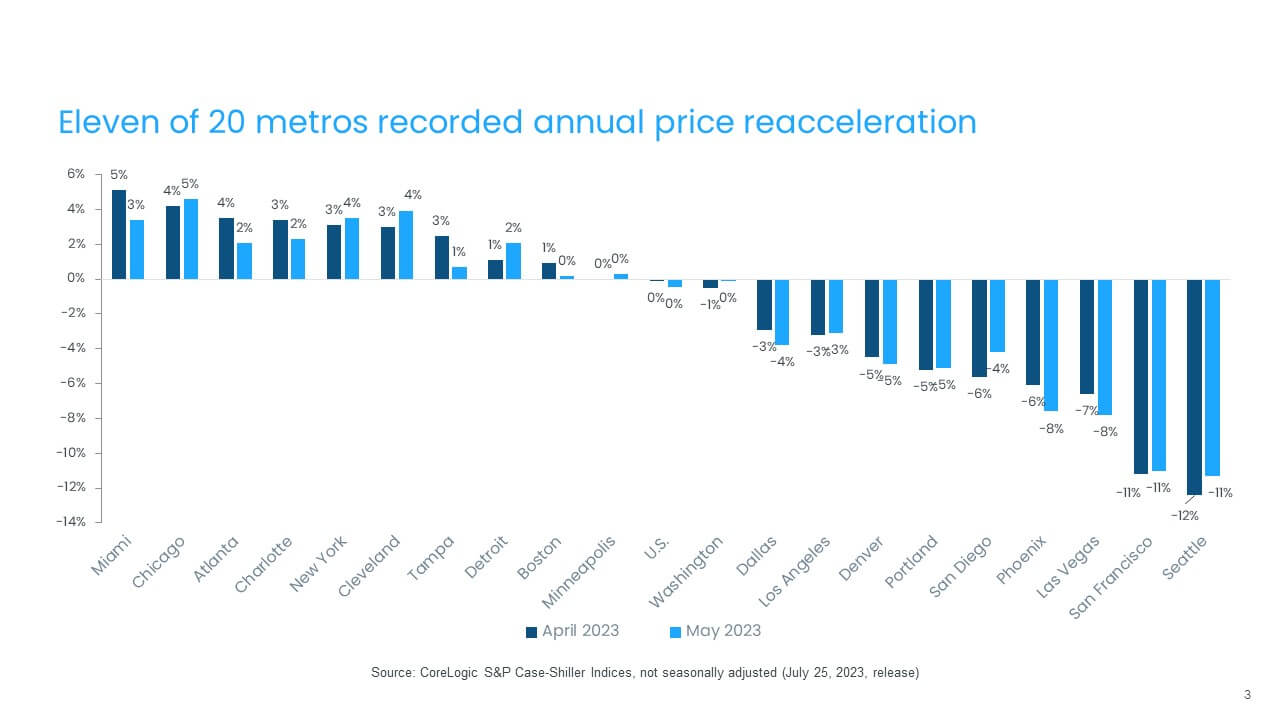

May was the first month of a notable variation in price changes across metros. In 11 areas, home price deceleration pivoted to indicate an inflection point and a reacceleration in annual price gains (Figure 3).

Chicago, Cleveland and New York were the three markets with largest annual appreciation, up by 4.6%, 3.9% and 3.5% year over year, respectively. Miami ranked fourth, followed by Charlotte, North Carolina. During the pandemic, Chicago posted some of the nation’s lowest home price appreciation, and the recent strength there reflects the region’s relative affordability. San Francisco and Seattle both continued to post annual declines, down by a respective 11% and 11.3% in May, but annual decreases in both metros pivoted and showed smaller declines than in the previous month.

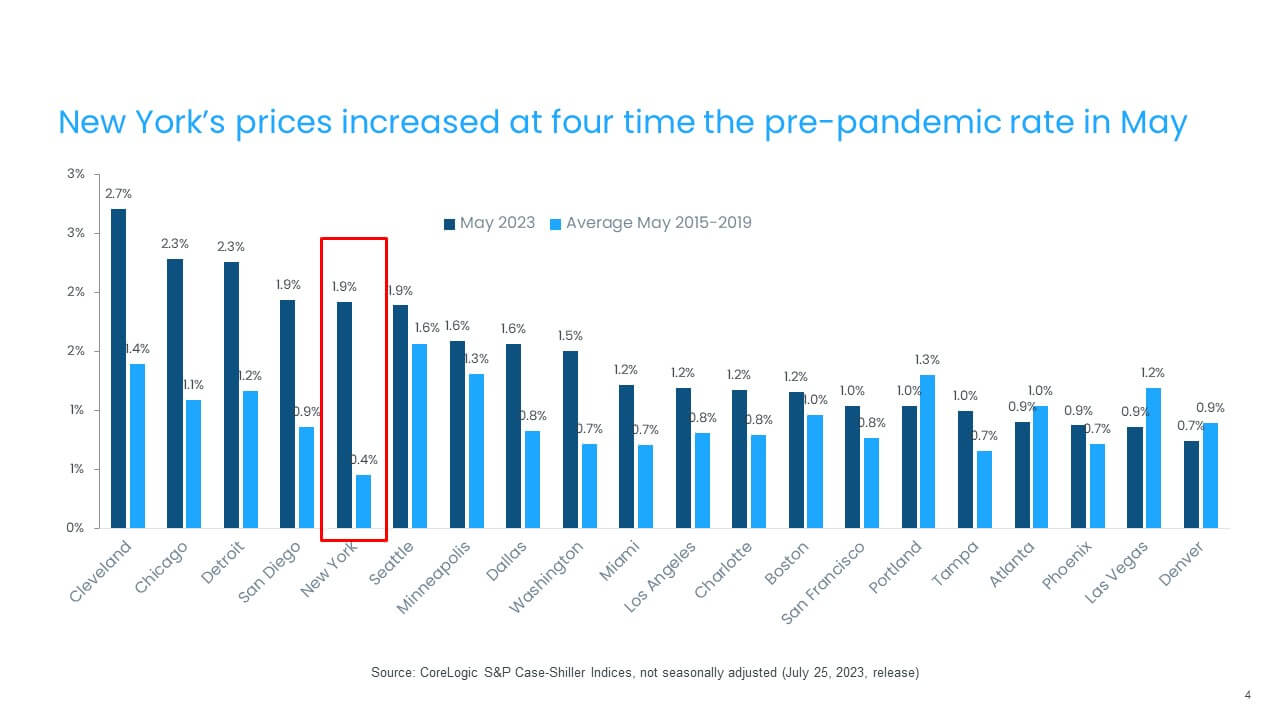

While home prices were up by 1.2% nationally from April, all metros also saw month-over-month home price boosts in May, albeit with some variation. Figure 4 shows the current year’s monthly gains in May compared with averages recorded between 2015 and 2019.

Cleveland and Chicago posted the nation’s largest monthly gains, at 2.7% and 2.3% respectively, while Denver, Las Vegas and Phoenix showed the smallest gains of less than 1%. And while Boston and Cleveland saw outsized increases this May, the gains in slower-growing metros are in line with seasonal increases that are historically recorded between April and May (Figure 4).

Across price tiers, the high tier continued to demonstrate relative weakness, with prices down by 2.9% year over year in May. The middle tier was unchanged, and the low tier was down by 0.6%.

The high tier showed the largest deceleration in annual gains compared with the spring 2022 peak, down by 27 percentage points. This is similar to trends observed in CoreLogic’s Single-Family Rent Index and may reflect the relative greater mobility of higher-income households during the pandemic, which has since cooled. In addition, the surge in demand for luxury and second homes seen in 2021 and 2022 also contracted relatively more since the increase in mortgage rates and the stall in home sales activity.

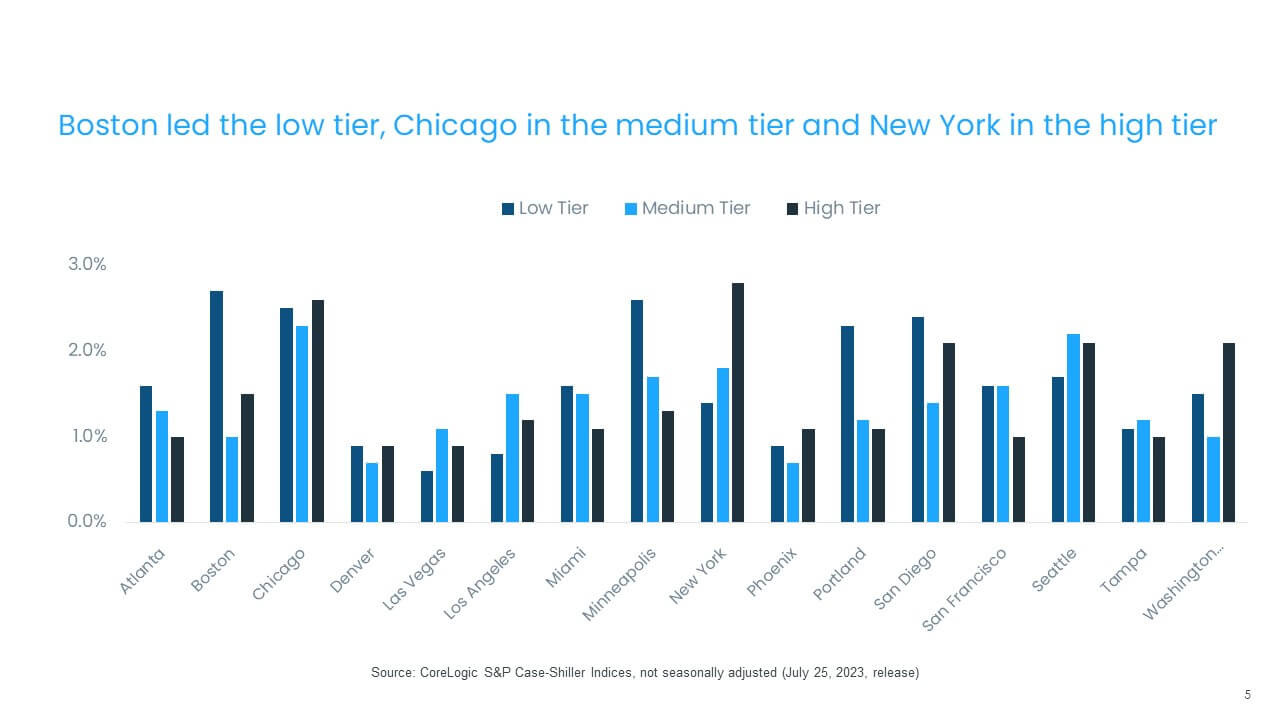

Nevertheless, while year-over-year gains reflect past declines, it’s interesting to note the recent strength in the high-tier price segment across many markets, though data also indicates some deceleration from previous months’ gains. The average monthly price gain for low-tier homes was 1.6%, while medium-tier homes were up by 1.4% (though those numbers are not seasonally adjusted). High-tier prices were up by 1.5% month over month on average, following two months of 1.8% monthly gains (Figure 5).

The month-over-month comparison of appreciation by price tier and location also reveals relative changes in demand across the country. In May, all metros posted increases across price tiers. While Chicago led with the largest increase across price tiers, New York’s high tier posted the biggest increase in prices across metros and tiers, up by 2.8% from April.

By contrast, Denver, Phoenix and Las Vegas continued to post the smallest monthly gains across all price tiers. Interestingly, many high-cost metros, such as Seattle and Washington, D.C. but also Chicago, saw the largest gains in high-priced segments of their respective housing markets.

The rest of 2023’s housing market activity will continue to depend on mortgage rates and the availability of for-sale homes, with neither likely improving for potential buyers in the near future. As a result, 2023 homebuying activity may end up being the slowest in about a decade.

And while home prices in early months of this year surprised with a rally, monthly gains are likely to plateau to historical averages as mortgage rates continue to impact affordability in many markets. Nevertheless, demographics, equity-rich baby boomers and a strong job market will ensure that housing demand outpaces inventory and that home prices remain elevated.