- Single-family rent growth continued to slow year over year in April to 3.7%, down from about 14% at the same time in 2022

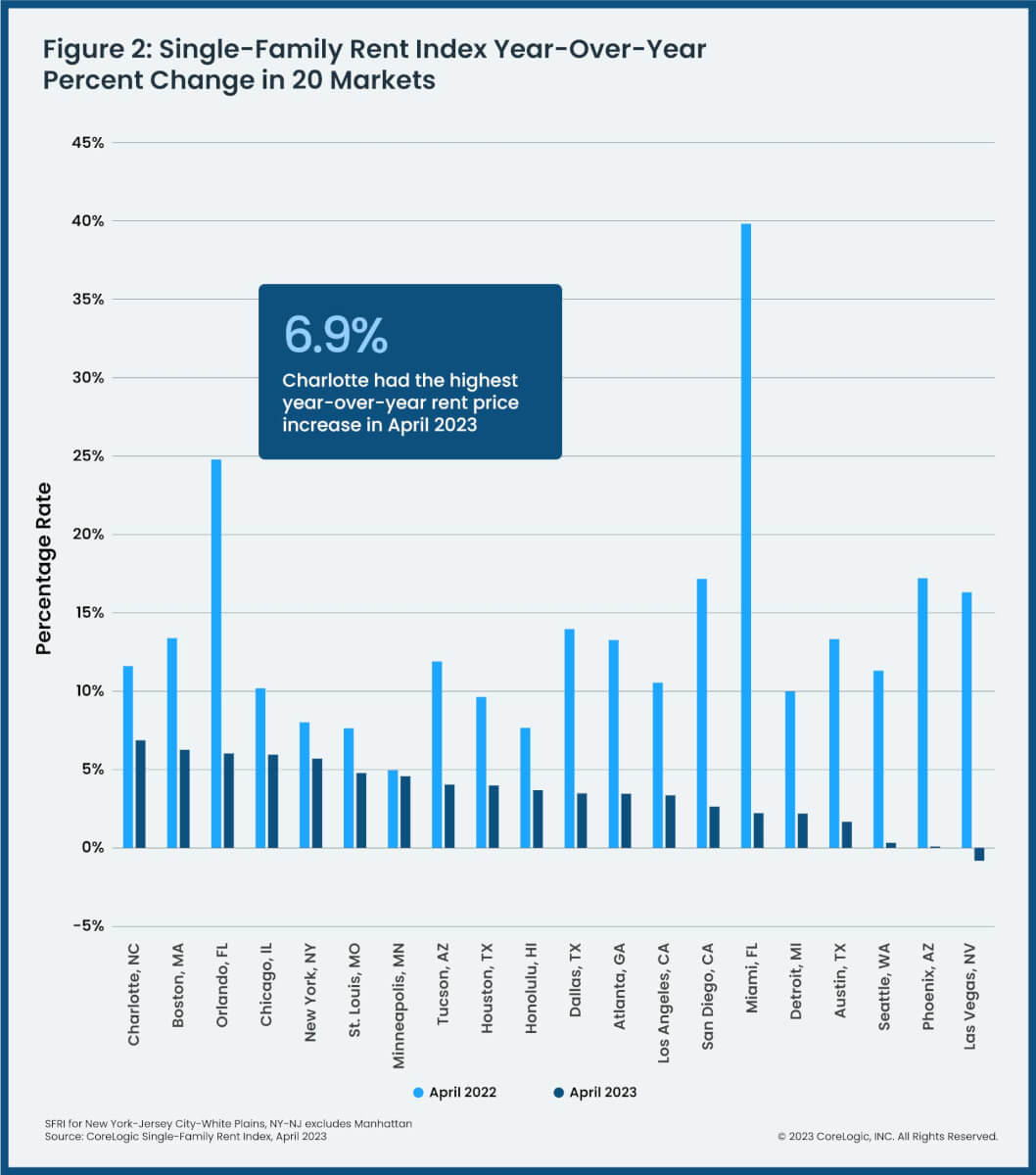

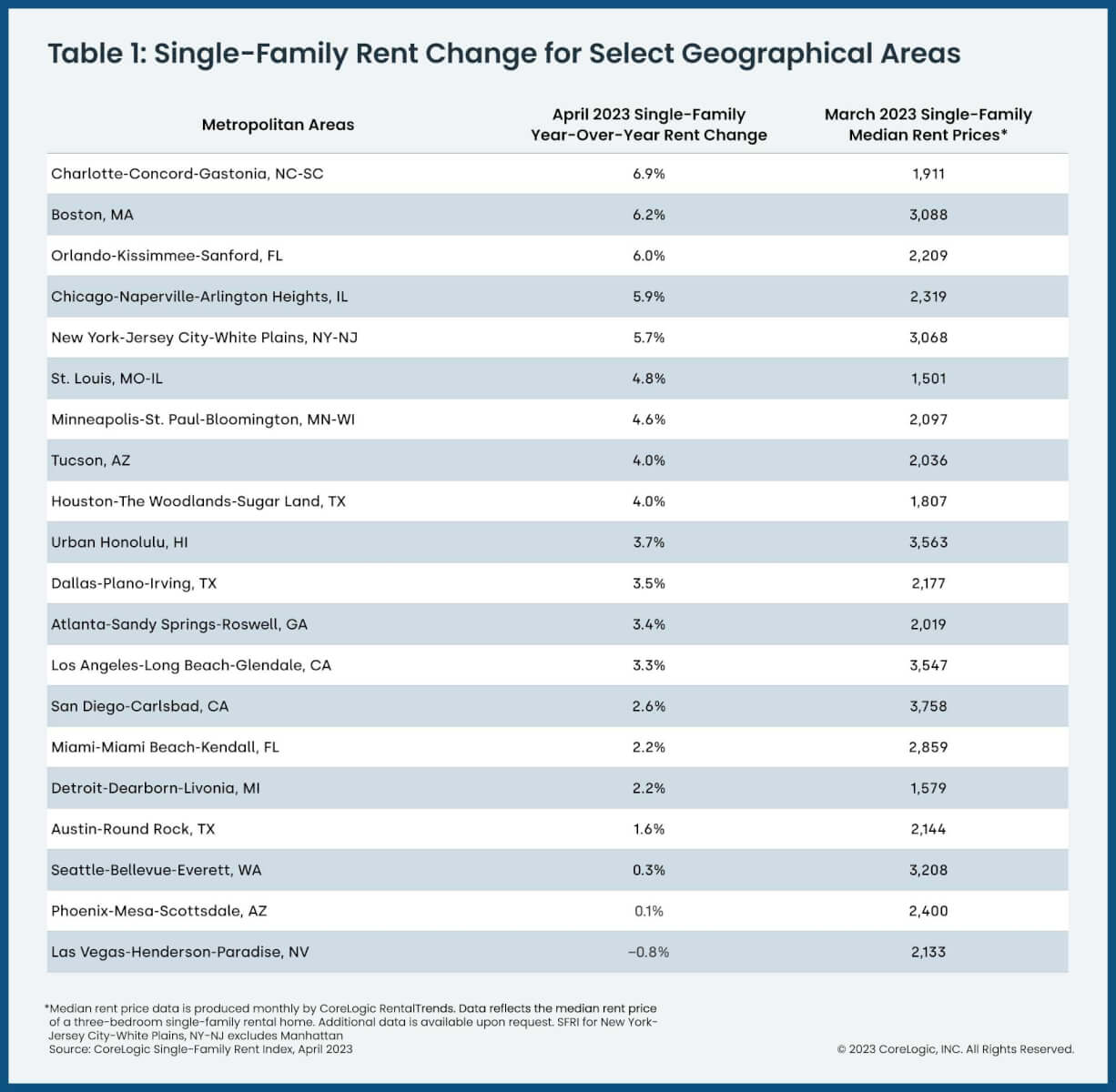

- All U.S. metros for which CoreLogic tracks data saw rents increase by single digits or less, except for Las Vegas, which posted a small annual loss

- Despite the slowing gains, single-family rental costs are still up by more than 25% since the onset of the pandemic

IRVINE, Calif., June 20, 2023—CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

U.S. single-family rent increases dropped on an annual basis for the 12th consecutive month in April, registering a 3.7% gain, significantly less than the 14.2% growth observed in the same month in 2022. Still, overall rental costs are up by 26% since before the pandemic, reflecting continued strong demand and low inventory. As in the previous three months, most of the metro areas for which CoreLogic tracks data saw single-digit annual increases in April, with the exception of Las Vegas, which recorded a decline of less than 1%.

“Single-family rent growth has slowed for a full year, and overall gains are approaching pre-pandemic rates,” said Molly Boesel, principal economist at CoreLogic. “Prior to 2020, single-family rent gains increased in the range of 2% to 4% for nearly a decade. However, even though growth has slowed over the past year, rents have increased by 26% since February 2020.”

“Furthermore, it appears that rent growth is bottoming out, meaning that increases in single-family rents over the past three years are more or less permanent,” Boesel continued. “The increases, especially at lower price levels, erode affordability and cause tenants to devote more of their monthly budget to rents, leaving fewer funds for other necessities.”

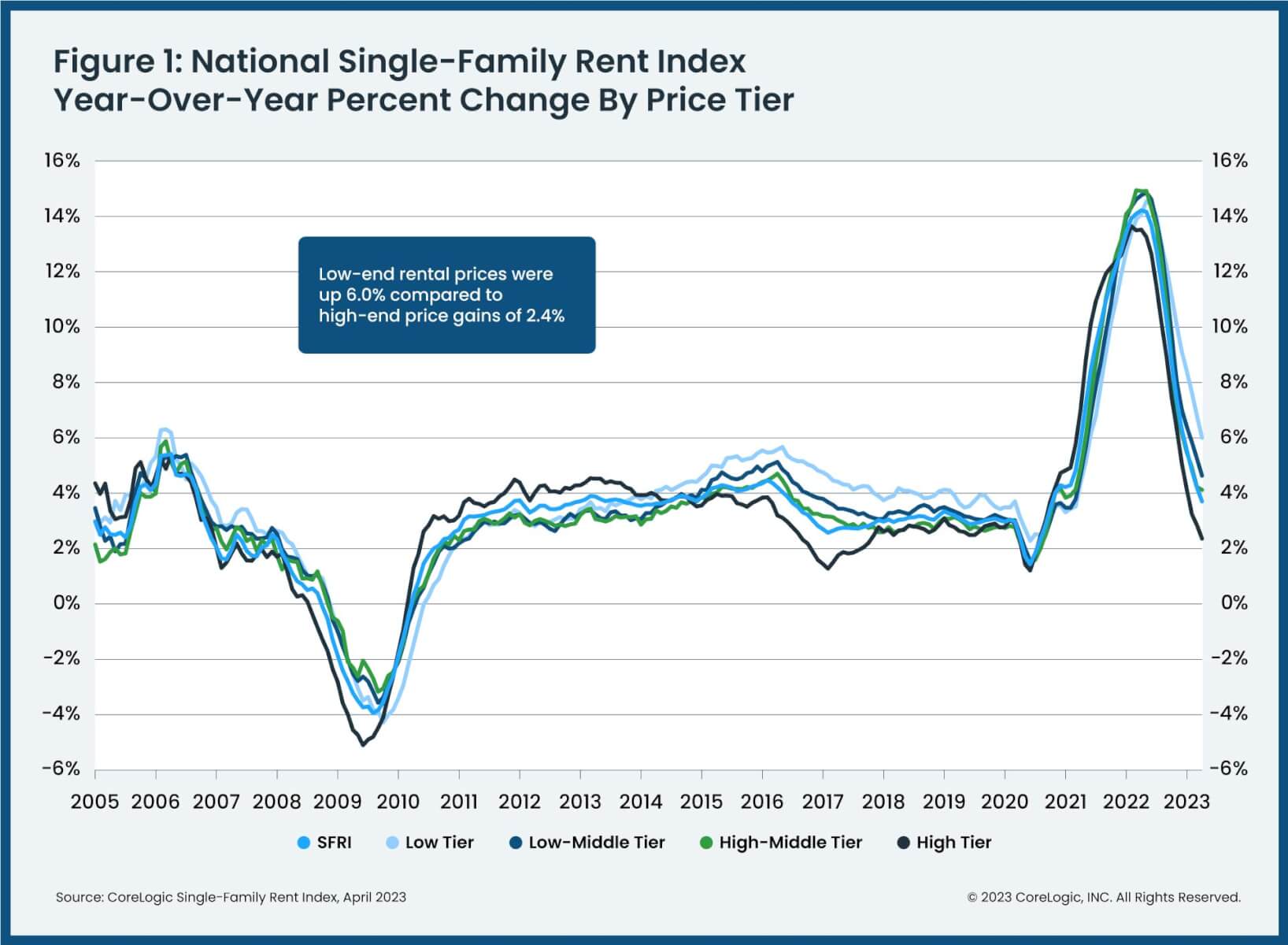

To gain a detailed view of single-family rental prices across different market segments, CoreLogic examines four tiers of rental prices and two property-type tiers. National single-family rent growth across those tiers, and the year-over-year changes, were as follows:

- Lower-priced (75% or less than the regional median): up 6%, down from 14.1% in April 2022

- Lower-middle priced (75% to 100% of the regional median): up 4.6%, down from 14.8% in April 2022

- Higher-middle priced (100% to 125% of the regional median): up 4.1%, down from 14.9% inApril 2022

- Higher-priced (125% or more than the regional median): up 2.4%, down from 13.5% in April 2022

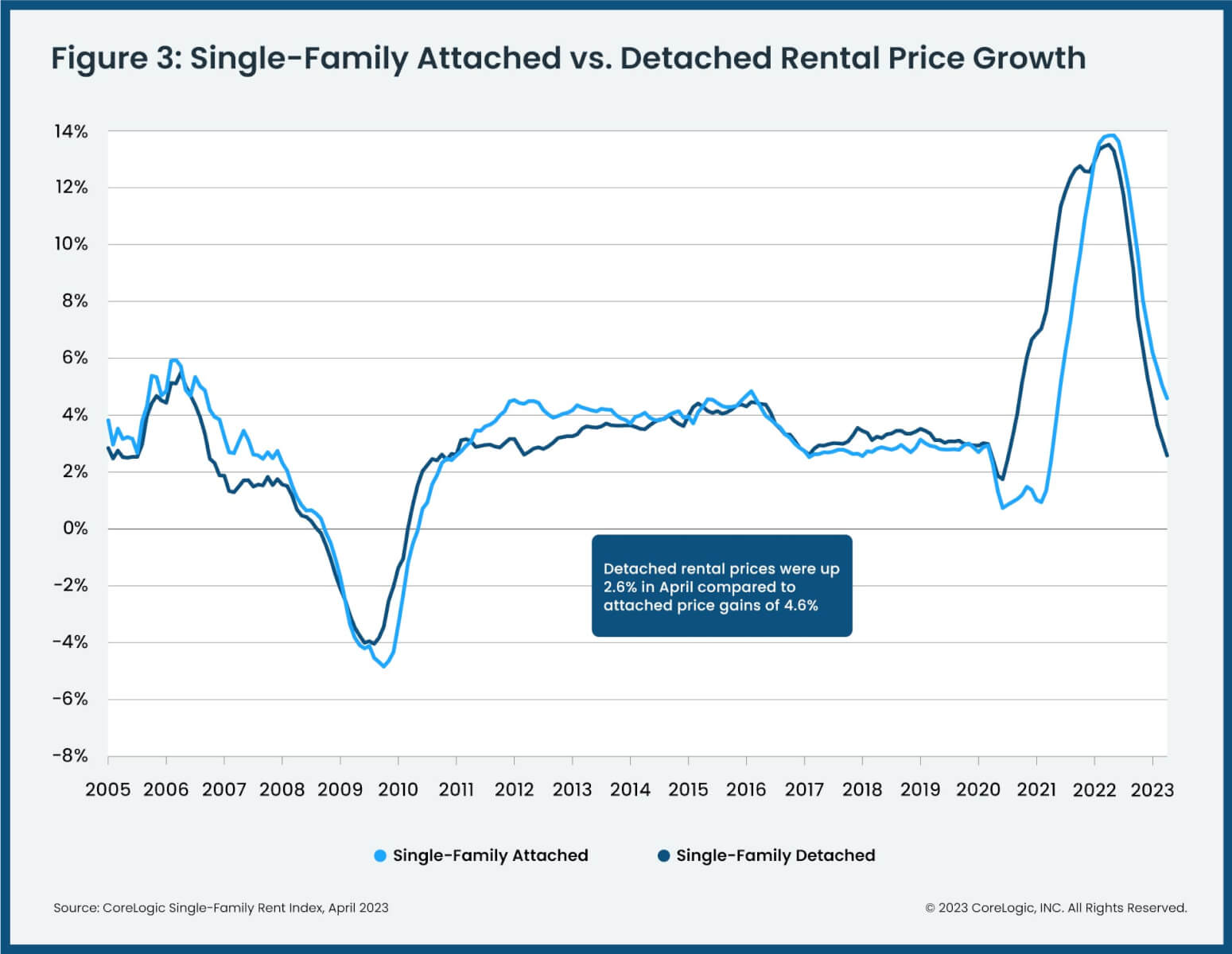

- Attached versus detached:Attached single-family rental prices grew by 4.6% year over year in April, compared with the 2.6% increase for detached rentals

Of the 20 metro areas shown in Table 1, Charlotte, North Carolina posted the highest year-over-year increase in single-family rents in April 2023, at 6.9%. Boston and Orlando, Florida registered the next highest annual gains, a respective 6.2% and 6%. Las Vegas saw an annual rent price decline of -0.8%.

The next CoreLogic Single-Family Rent Index will be released on July 18, 2023, featuring data for May 2023. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The single-family rental market accounts for half of the rental housing stock, yet unlike the multifamily market, which has many different sources of rent data, there are minimal quality adjusted single-family rent transaction data. The CoreLogic Single-Family Rent Index (SFRI) serves to fill that void by applying a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. CoreLogic constructed the SFRI for close to 100 metropolitan areas — including 47 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The CoreLogic Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by CoreLogic RentalTrends. RentalTrends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Robin Wachner at [email protected]. For sales inquiries, please visit https://www.corelogic.com/support/sales-contact/. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Media Contact

CoreLogic[email protected]