After 32 consecutive months of the nation’s strongest home price gains, appreciation in Phoenix slows

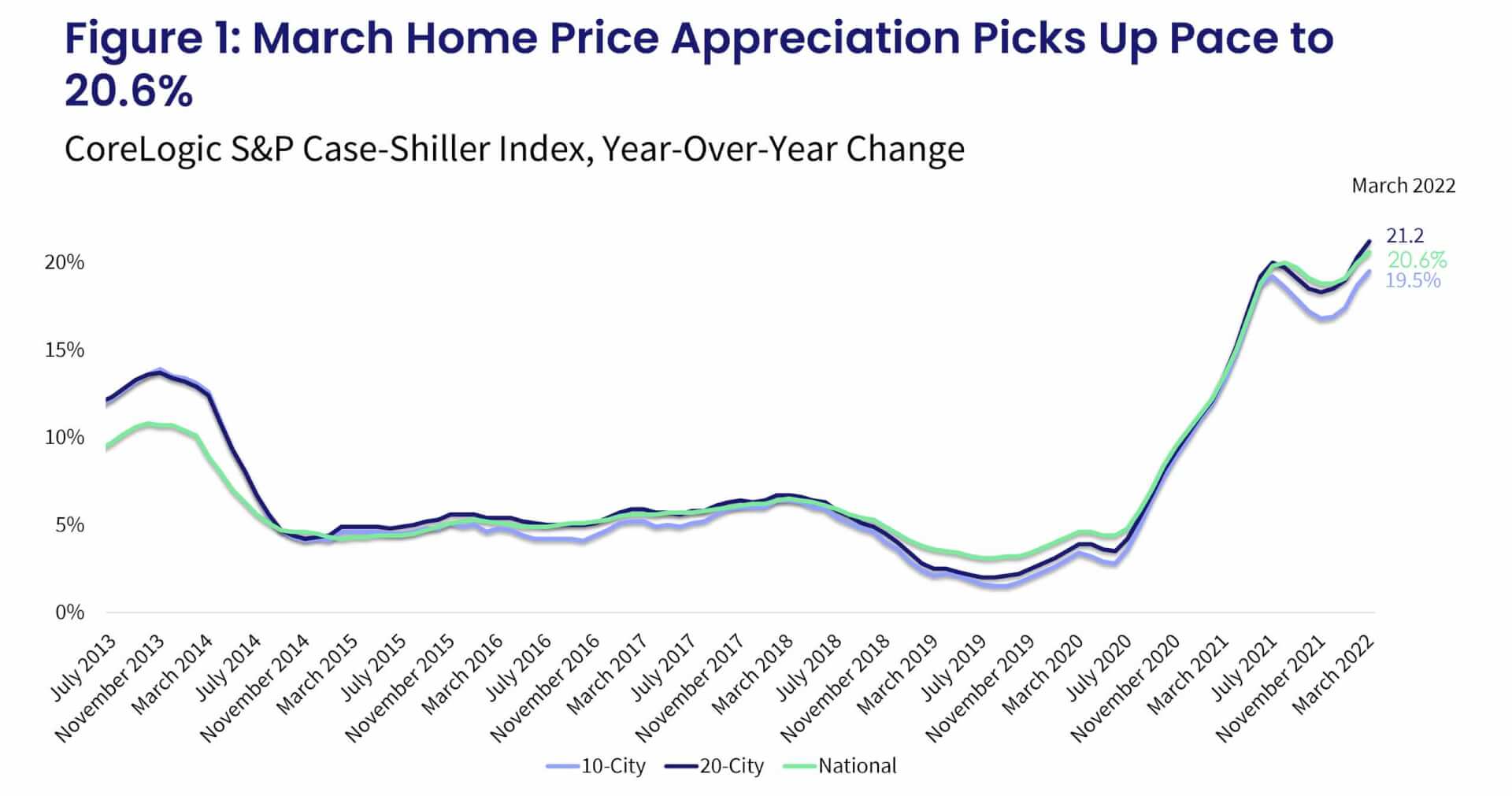

The first quarter of 2022 was marked by some of the most competitive housing market conditions since the onset of the pandemic. Homebuyer frenzy reached another new high, as eager buyers tried last-ditch efforts to secure a home before mortgage rates surged. The S&P CoreLogic Case-Shiller Index posted a 20.6% increase in March, the third month of accelerated growth after a winter lull and the strongest March year-over-year increase since the beginning of the data series. Alarm about higher mortgage rates drove much of the early spring homebuying demand, which was characterized by sustained for-sale inventory and put more pressure on home prices. Some seven in 10 homes sold for more than the original asking price.

The 10- and 20-city composite indexes similarly pushed upward, surging 19.5% and 21.2% year over year, respectively (Figure 1). The gains remained higher in the 20-city index, as buyers with larger budgets continue to flock to smaller and more affordable areas, particularly those in the Southeast and Florida.

Compared with the 2006 peak, the 10-city composite is now 40% higher, while the 20-city composite is up by 48%. Adjusted for inflation, which continues to remain a concern, the 10-city index is now up by 1%, while the 20-city index is up by 6% compared with the 2006 peak.

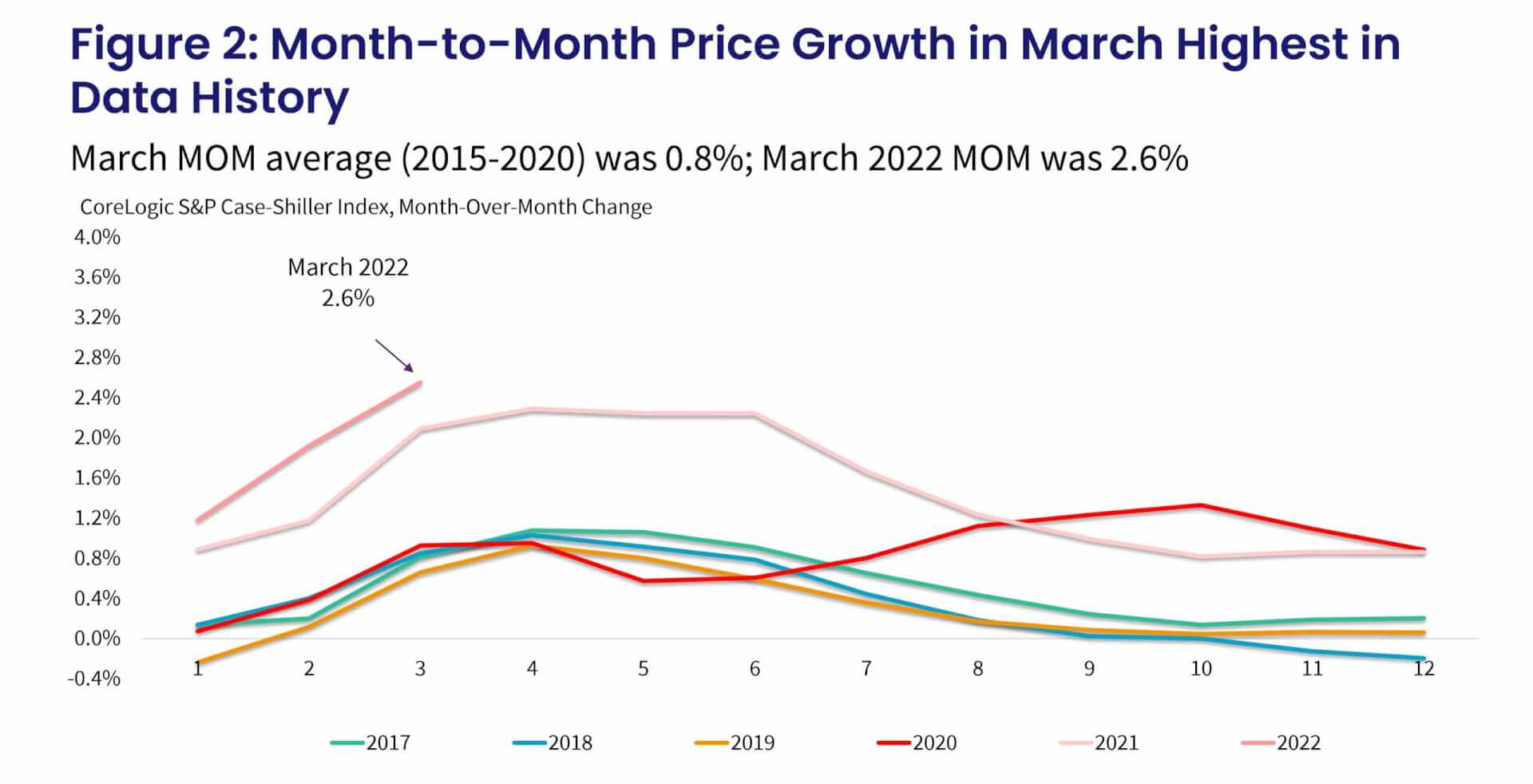

The non-seasonally adjusted month-to-month index picked up pace, up by 2.6% — and it also was the largest monthly increase in the data series. Between 2015 and 2020, the monthly index changes from February to March averaged about 0.8% (Figure 2).

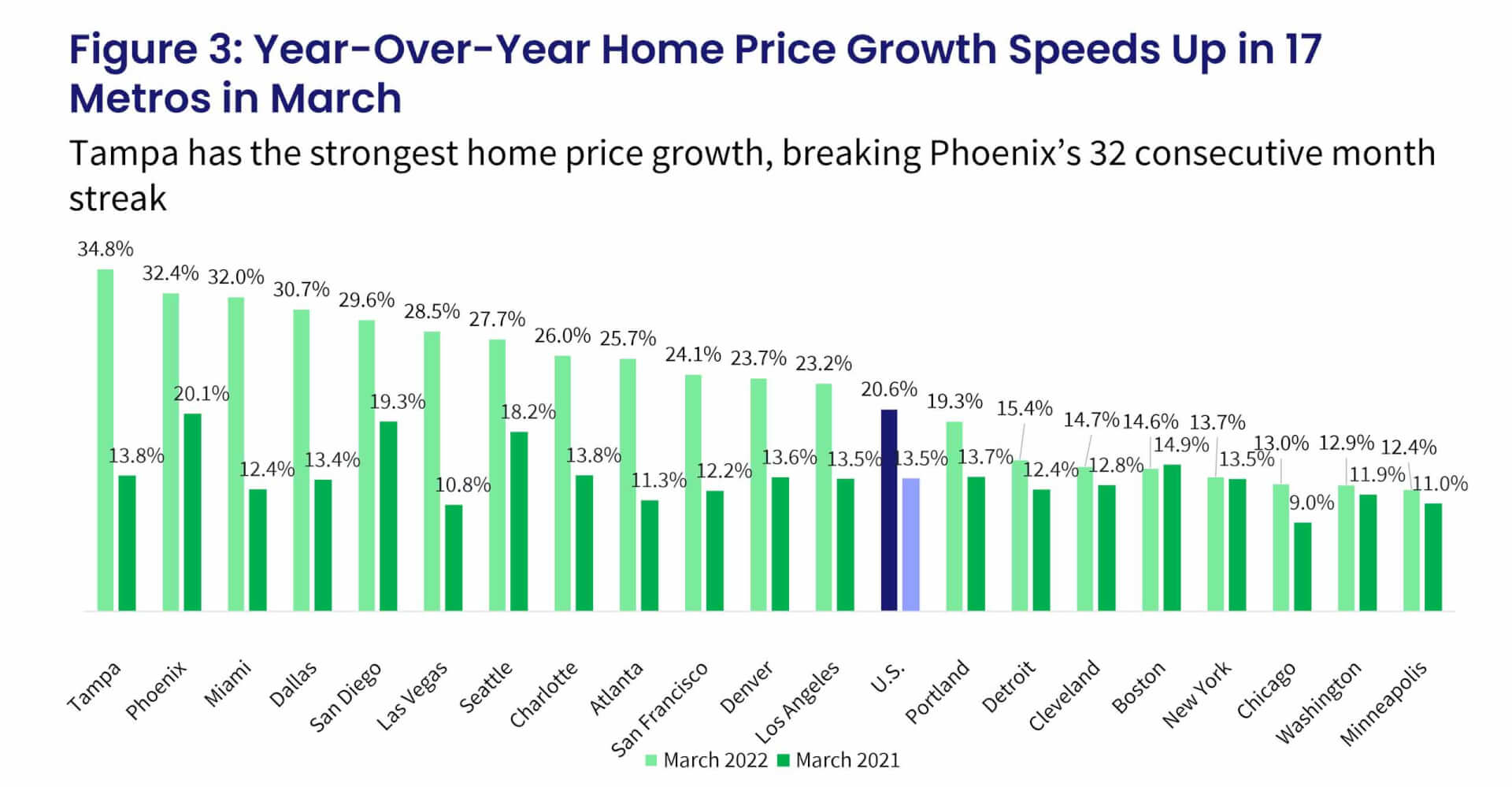

For the first time in 33 consecutive months, Tampa, Florida outpaced Phoenix with the strongest annual home price growth among the 20 tracked markets, surging 34.8% in March, up from February’s non-seasonally adjusted rate of 32.6%.

Phoenix now ranks second, with a 32.4% year-over-year gain in March, down from 32.9% the month before. Phoenix had the largest slowdown in year-over-year gains since February, down by 0.5 percentage points. The other two regions that also recorded slower annual gains in March were Chicago and Boston.

Miami continued to rank third, with a 32% increase in March, up from 29.7% annual growth in February. Miami and Tampa had the strongest acceleration in annual gains, both up by about 2.2 percentage points from the month before.

Washington, Minneapolis and New York continued to post some of the slowest increases in annual gains, ranging from 11.9% to 12.9%. Despite having the slowest rate of annual price increases, these areas have still experienced double-digit growth rates for 16 consecutive months.

Seventeen out of 20 metro areas experienced acceleration in annual gains from February. (Figure 3).

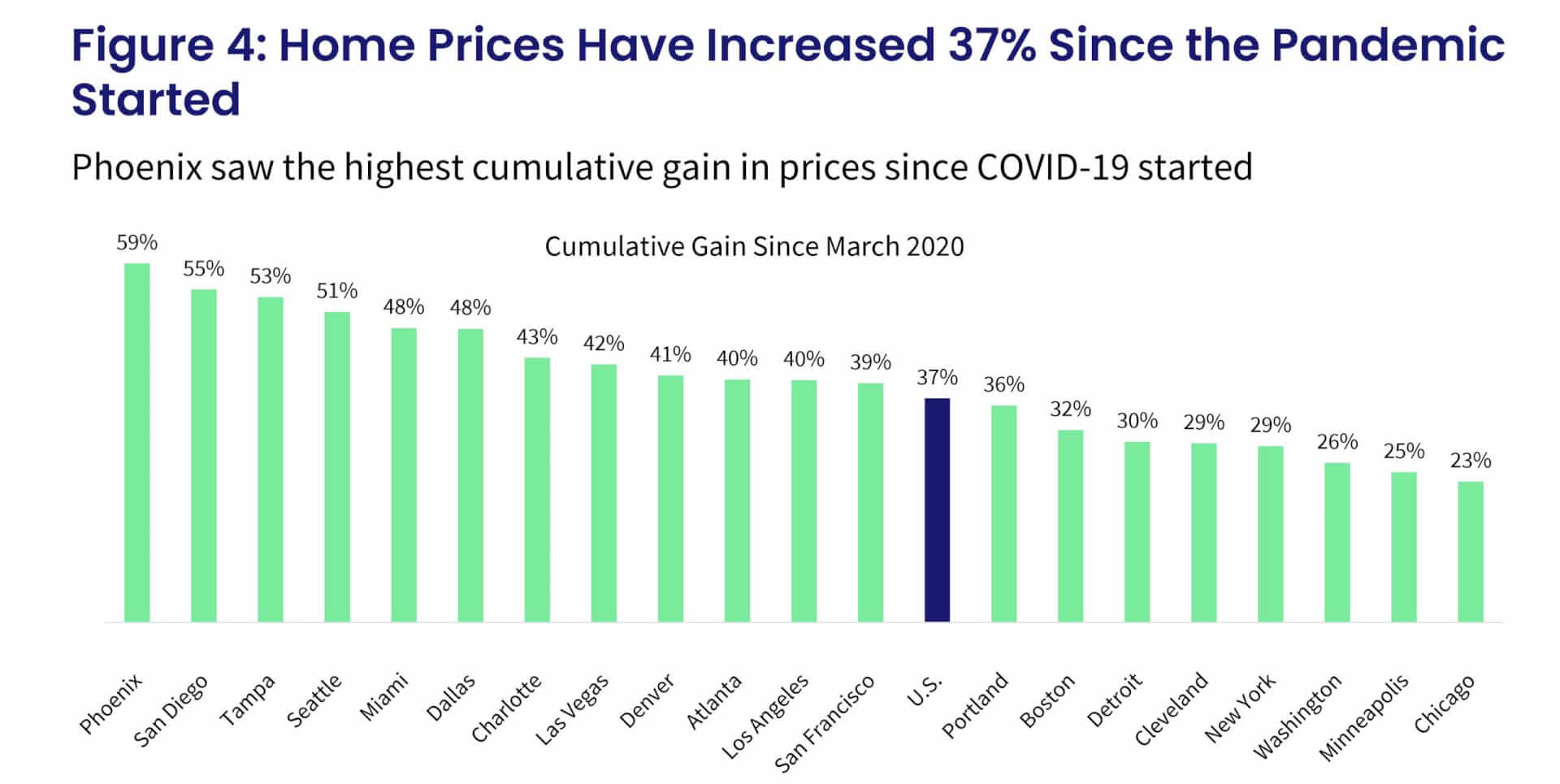

Cumulatively, home prices are up by 37% since March 2020 when the pandemic started. Given the strength of the Phoenix housing market for the last 33 months, which started prior to the COVID-19 outbreak, prices are now up by 59% compared with March 2020, the highest among the 20 metro areas tracked. San Diego follows, with a 55% cumulative gain. In contrast, but in line with year-over-year trends observed in previous releases, Chicago, Minneapolis and Washington had cumulative increases ranging from 23% to 26% (Figure 4).

Furthermore, all three price tiers saw acceleration in annual gains in March, with the high tier showing most of the growth, up 24% in March from 23% in February. The average growth in gains for low-tier homes was slower but still up by 21.2%. The slower price growth in the low tier reflects affordability challenges that home shoppers with limited budgets face after almost two years of robust price gains, mortgage rate increases and slim inventory.

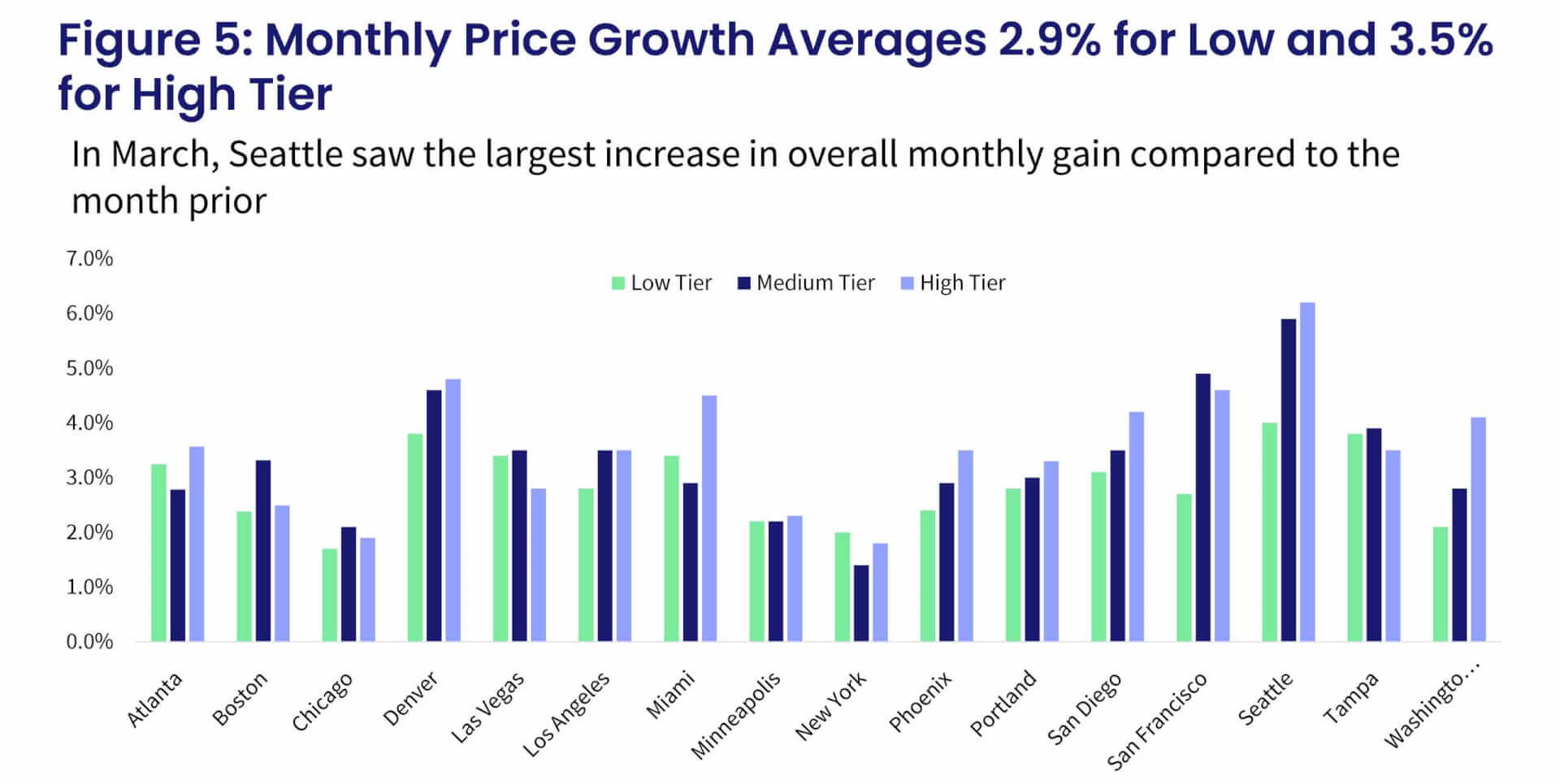

The month-over-month comparison of home price growth by price tier and location also reveals relative changes in demand across the country. From February to March, areas with colder climates, particularly Chicago, Minneapolis and New York, continued to show smaller monthly increases. For the fourth consecutive month, all metros had at least some gains across the price tiers, although some of the growth can be attributed to seasonality, since monthly increases are generally positive between February and March.

The largest monthly gains were in the West, including Seattle and Denver, which were both up notably in March, particularly among the higher-priced tiers. San Diego and San Francisco continued to see buyer enthusiasm after a few months of slower gains.

The average monthly gains among low-tier homes accelerated in March, up by 2.9%, though, again, that number is not seasonally adjusted. The high-tier monthly gains averaged 3.5% in March. The middle-tier monthly price increases averaged 3.3% (Figure 5).

With home price growth accelerating and mortgage rates between 5% and 6%, monthly expenses for most potential homebuyers are 30% or more higher from a year ago. Nevertheless, buyers who locked in a relatively favorable mortgage rate were determined to close on their loans, even if it meant bidding up the asking price against other buyers. Also, a number of other buyers rushed to the market in anticipation of much higher housing expenses. These two drivers will keep pressure on home price growth over the next couple of months. But the most recent evidence on the impact of higher rates on housing demand suggests that the buyer demand is slowing, with fewer buyers competing for homes. Homes staying on the market for more days also reflects slowing demand. The slowing of what has been considered overheated demand, along with home price growth, is the intended consequence of the Federal Reserve’s more aggressive financial tightening and is anticipated to bring about a better balance between buyers and sellers. Again, slowing demand means that total home sales in 2022 could be lower than 2021, though still making 2022 the strongest homebuying year since 2006. Also, home price growth is likely to slow in the coming months to lower double digits by the end of the year.