Monthly gain in home prices finally slows but is still at double the pre-pandemic pace

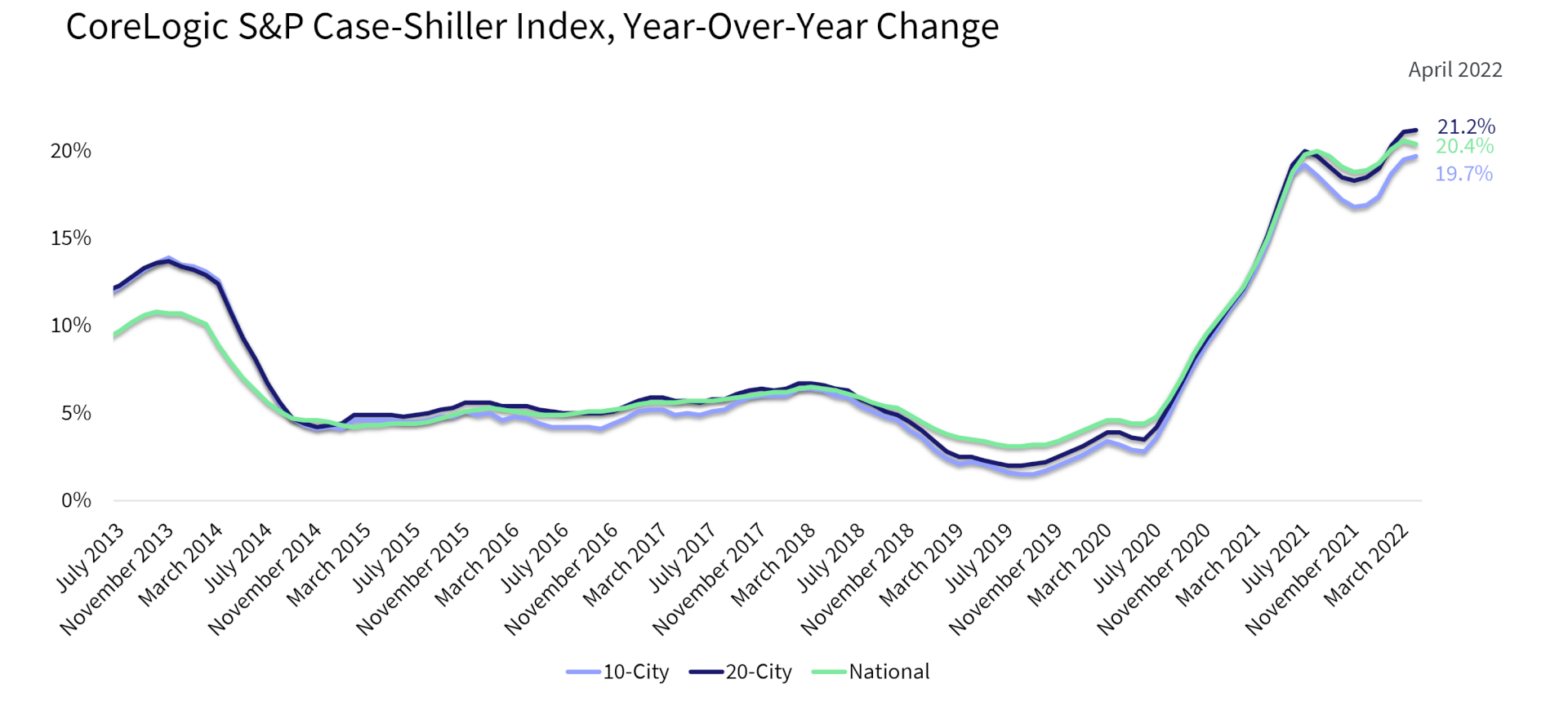

Despite the surge in mortgage interest rates and high home prices, buyers have remained resilient and continued to seek homes, keeping the market competitive. And while home sales have been slowing, the momentum in price growth since the beginning of the year is slow to adjust and will yield more notable declines only in the latter part of the year. But in April, the CoreLogic S&P Case-Shiller Home Price Index posted a 20.4% increase, indicating a tipping point after four months of accelerated growth following a winter pause. Still, April’s year-over-year increase was the strongest since the beginning of the data series (Figure 1).

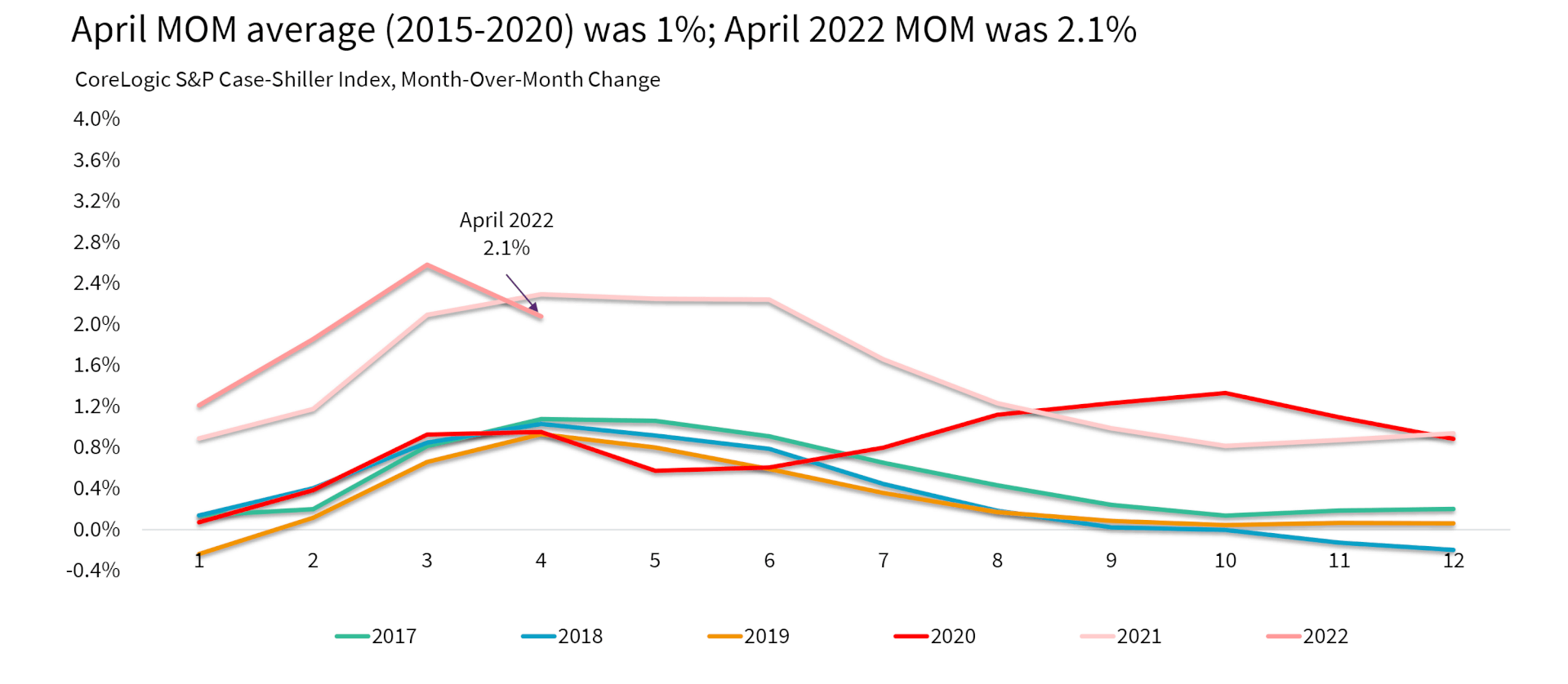

Also, the non-seasonally adjusted month-to-month index slowed as well, up 2.1% in April from a 2.6% jump in March. April’s increase was the second strongest in the data series following a 2.3% increase last April. Between 2015 and 2020, the monthly index changes from March to April averaged about 1% (Figure 2).

Nevertheless, signs of a tipping point in the housing market toward a greater balance between buyers and sellers are spreading wider, albeit only compared with some of the most competitive conditions seen since the early 2000s. More specifically, there is a buildup in overall active inventory, as fewer buyers are rushing to make offers, resulting in an increase in the number of homes that have had price reductions from the original list price.

The 10- and 20-city composite indexes remained strong and continued to accelerate, surging 19.7% and 21.2% year over year, respectively. The overall tendency for more price growth in smaller markets continues to drive the 20-city index growth higher, as buyers with larger budgets flock to smaller and more affordable areas, particularly those in the Southeast and Florida.

Figure 1: April Home Price Appreciation At a Tipping Point at 20.4%

Compared with the 2006 peak, the 10-city composite is now 43% higher, while the 20-city composite is up by 51%. Adjusted for inflation, which continues to remain a serious concern, the 10-city index is now up by 3%, while the 20-city index is up by 8% compared with the 2006 peak.

Figure 2: Month-to-Month Price Growth Slowing in April but Still Second Highest in Data History for April

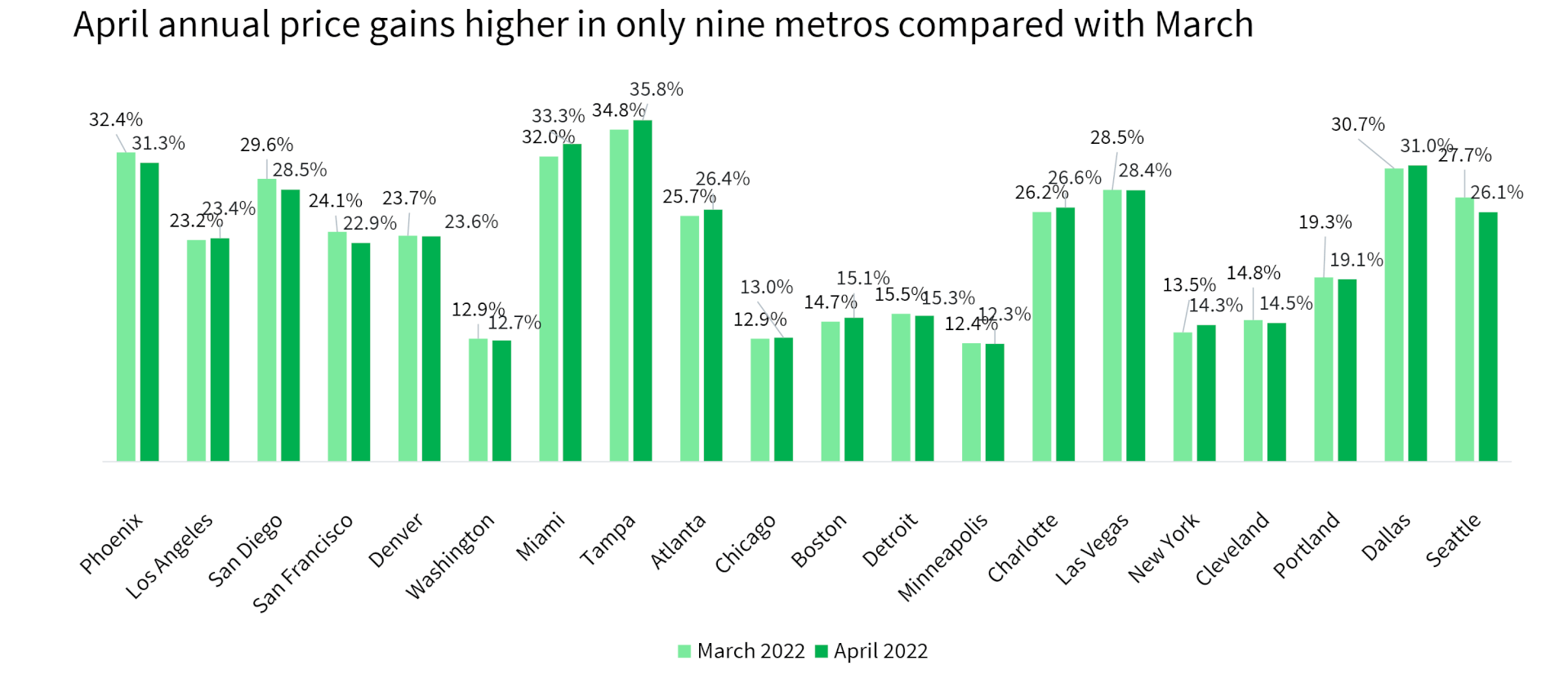

For the second month, Tampa, Florida posted the strongest annual home price growth among the 20 tracked markets, surging by 35.8% in April, up from March’s non-seasonally adjusted rate of 34.8%.

Miami ranked second, recording a 33.3% year-over-year gain in April, up from 32% the month before. Phoenix now ranks third, with a 31.3% increase in April. And while the rate of growth slowed from March, Phoenix didn’t post the largest slowdown in annual gains as it did in March.

Seattle, San Francisco and San Diego posted the largest slowdown in annual gains compared with March. On the other hand, Miami and Tampa again had the strongest acceleration in annual gains, both up by about 1 percentage point from the month prior.

Minneapolis and Washington continued to post some of the slowest increases in annual gains, ranging from 12.3% to 13%. Despite having the slowest rate of annual price increases, these areas have still experienced double-digit growth rates for 17 consecutive months.

Nine out of 20 metro areas experienced an acceleration in annual gains from April, down from 17 in March. (Figure 3).

Figure 3: Deceleration in Year-Over-Year Home Price Growth in 11 Metros

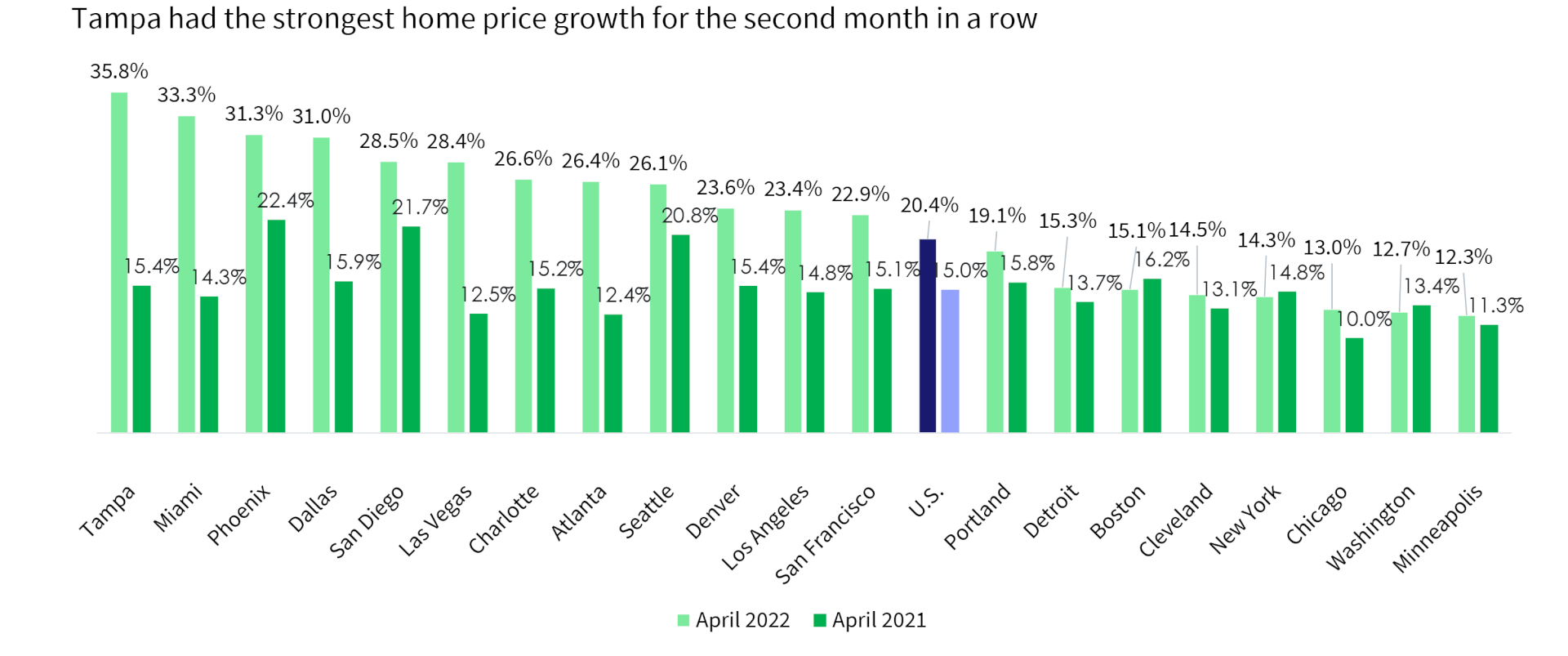

Compared with annual gains recorded last April, 17 metros continued to see stronger increases, while only three showed slowing annual gains. Boston posted the strongest slowdown, down by 1.1 percentage points, followed by Washington (down by 0.7 percentage points) and New York (down by 0.5 percentage points).

On the other hand, Tampa and Miami were up by as much as 20 percentage points in just one year (Figure 4).

Figure 4: Year-Over-Year Home Price Growth Higher in 17 Metros in April Compared With 2021

Furthermore, only the low-price tier saw acceleration in annual gains in April, up on average by 21.2%, while the middle tier slowed to 21.4% from 21.5% and the high tier remained flat at 24%. Acceleration in growth in the low tier compared with higher tiers reversed trends seen in previous months and could reflect a rush of buyers in the early months of the year prior to the mortgage rate surge. The budgets of low-tier buyers are more sensitive to changes in mortgage rates and the resulting affordability constraints.

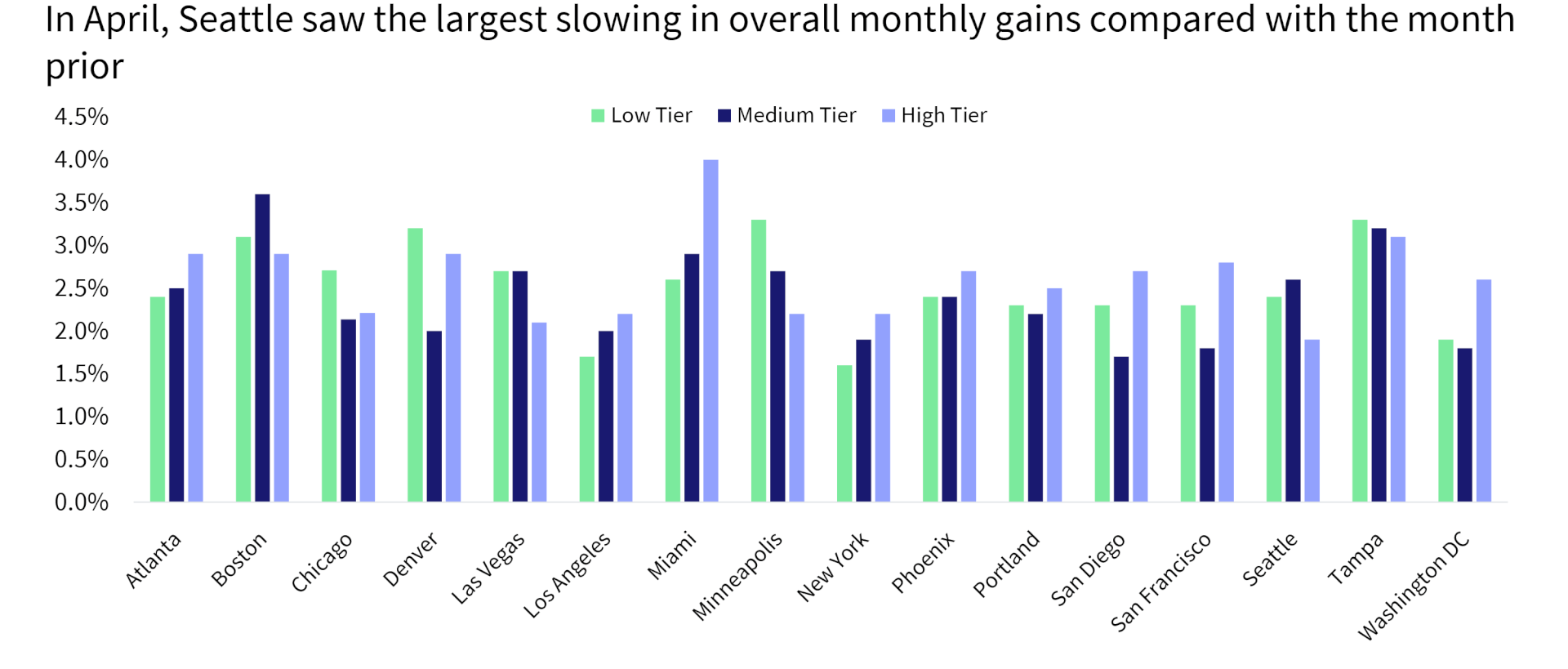

The month-over-month comparison of home price growth by price tier and location also reveals relative changes in demand across the country. From March to April, areas with colder climates, particularly Chicago, Minneapolis and New York, continued to show smaller monthly increases. For the fifth consecutive month, all metros had at least some gains across the price tiers, although some of the growth can be attributed to seasonality since monthly increases are generally positive between March to April.

The largest monthly gains were in the South, including Miami and Tampa, which were both up notably in April. Seattle, by contrast, showed the strongest slowing in monthly gains, particularly in the high tier.

The average monthly gains among low-tier homes were up by 2.5% April, though again that number is not seasonally adjusted. The high-tier monthly gains averaged 2.6% in April. The middle-tier monthly price increases averaged 2.4% (Figure 5).

Figure 5: Monthly Price Growth Averages 2.5% for Low and 2.6% for High Tier

Housing markets are showing a clear indication of a tipping point away from overheated early-spring conditions. Nevertheless, while there are fears of uncertainty that come with slowing housing markets, the reality is that many potential buyers are still interested in purchasing a home, which will keep the market competitive and continue to put pressure on home prices. According to the CoreLogic HPI Forecast, home price growth will remain in mid-to-high double digits for the remainder of the year. The key will be to keep an eye on slowing monthly gains, which remain three times higher than the historical average.