However, Markets in Warmer Climates Continue to Experience Price Accelerations

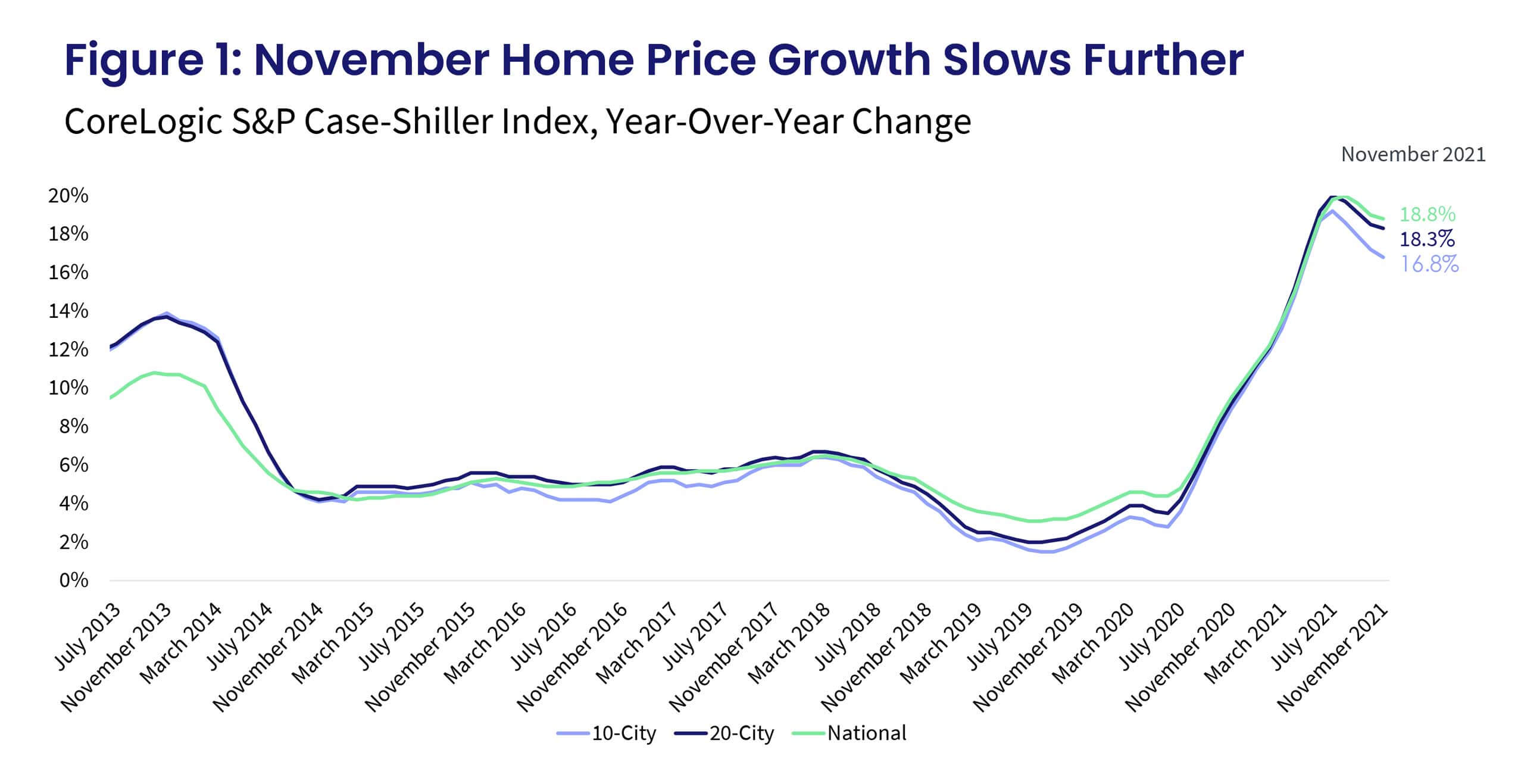

Despite some headwinds to the housing demand stemming from higher mortgage rates, affordability constraints and continued lack of supply, home price growth and home sales activity continued to track at record levels. The November S&P CoreLogic Case-Shiller slowed for the third consecutive month and was up 18.8% year over year, down from the 19.03% increase the month prior.

On the other hand, the month-to-month index picked up pace again to a non-seasonally adjusted 0.90%, up from a 0.82% increase in October. Except for last winter, the November monthly gain was strongest in the history of the data series. Generally, there is a decline between October and November, which averaged 0.44% between 2006 and 2019. Reacceleration in monthly gains is consistent with some other housing market indicators, which suggested demand picked up in the final month of 2021 as buyers became increasingly concerned that rising interest rates will make buying a home out of reach.

Nevertheless, it is interesting that while the annual change in the S&P CoreLogic Case-Shiller index has shown signs of deceleration, the CoreLogic HPI has continued to accelerate, albeit at a slower pace. The divergence in the two indexes reflects different weighting measures that are applied to the overall national growth rate. The S&P CoreLogic Case-Shiller tends to have a higher representation of large coastal markets, such as New York and Boston, which have had relatively more slowing in monthly price gains compared to areas in South and Southwest, which continue to experience acceleration in annual gains.

The 10- and 20-city composite indexes also continued to slow from summer peak gains, and were up 16.8% and 18.3% year over year, respectively. In July, the indexes recorded gains of 19.2% and 20%, respectively (Figure 1). Robust demand in smaller, warmer and more affordable areas is reflected in continually stronger gains in the 20-city index and slower deceleration in recent months.

Compared to the 2006 peak, the 10-city composite is now 30% higher, while the 20-city composite is 37% higher. Adjusted for inflation, the 10-city index is down 3%, while the 20-city index is up 2% compared to the 2006 peak.

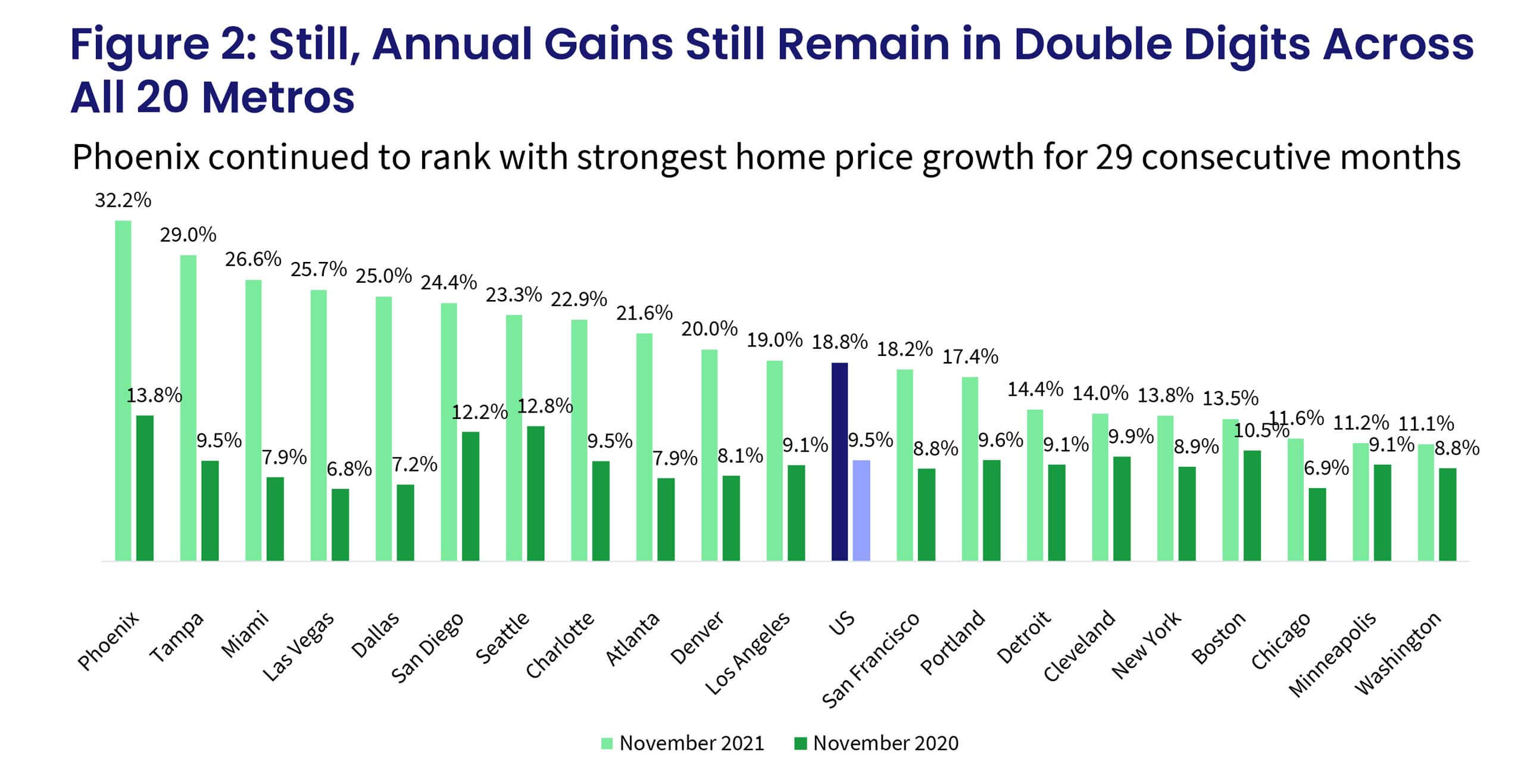

For the 29th consecutive month, Phoenix had the strongest home price growth among the 20 markets, surging 32.2% in November, barely down from October’s non-seasonally adjusted rate of 32.3%.

Tampa, Florida, still ranks 2nd with a 29% gain, up from 28% the month before, while Miami ranks 3rd with a 26.6% increase in November. The two cities have experienced the strongest acceleration in annual gains. In sum, 11 metro areas experienced acceleration in annual gains since October.

Washington and Minneapolis are on the bottom of the list, up 11.1% and 11.2% in November. Metros with the largest slowdown in annual gains from the month before are Boston (from 15.1% to 13.5%) and New York (from 14.9% to 13.8%). Despite having the slowest rate of annual price increase, these areas have still been experiencing double-digit rates for 12 consecutive months (Figure 2).

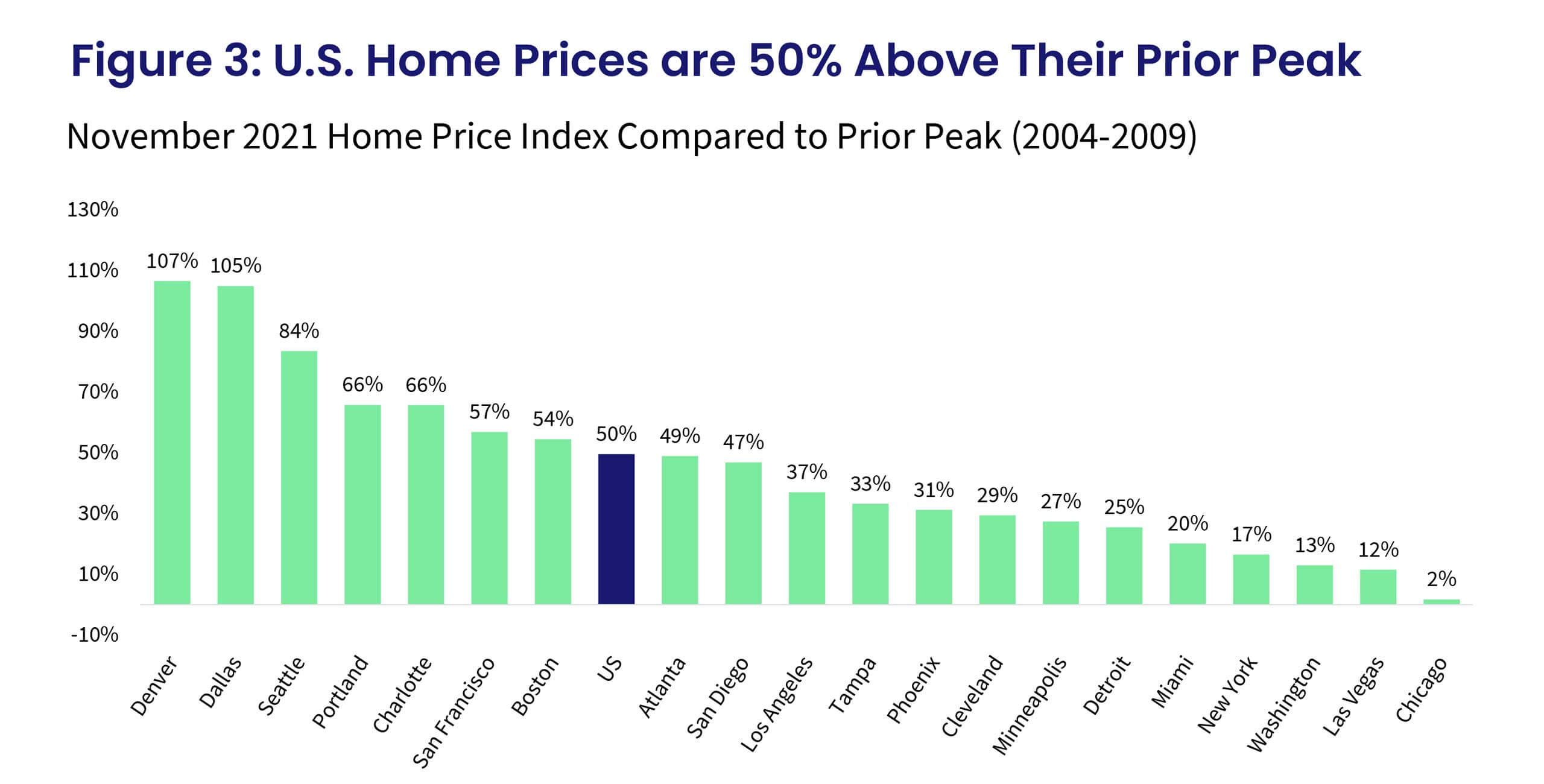

In November, national home prices were 50% higher than the previous peak. All metros are now at or above their previous peaks. Chicago is up 2%, while Denver’s prices are 107% above its 2006 peak, followed by Dallas at 105% (Figure 3). Nonetheless, while nominal prices have surpassed previous levels, national home prices are only 11% above the previous peak when adjusted for inflation. Inflation growth in the second half of 2021 led to a slowing of real price increase in recent months.

Further, low- and high-tier home price growth started showing signs of pressure in November. While low-tier price growth slowed from 19.9% to 19.7%, the high-tier price growth continued to accelerate from 10% to 20.1%. While these are marginal changes, they still reflect affordability challenges that those looking to buy low-tier homes are facing after a year of vigorous price gains. The middle tier, however, remained steady at an 18.8% year-over-year increase. Prior to the pandemic, low-tier price growth was generally accelerating at a faster rate than the high tier.

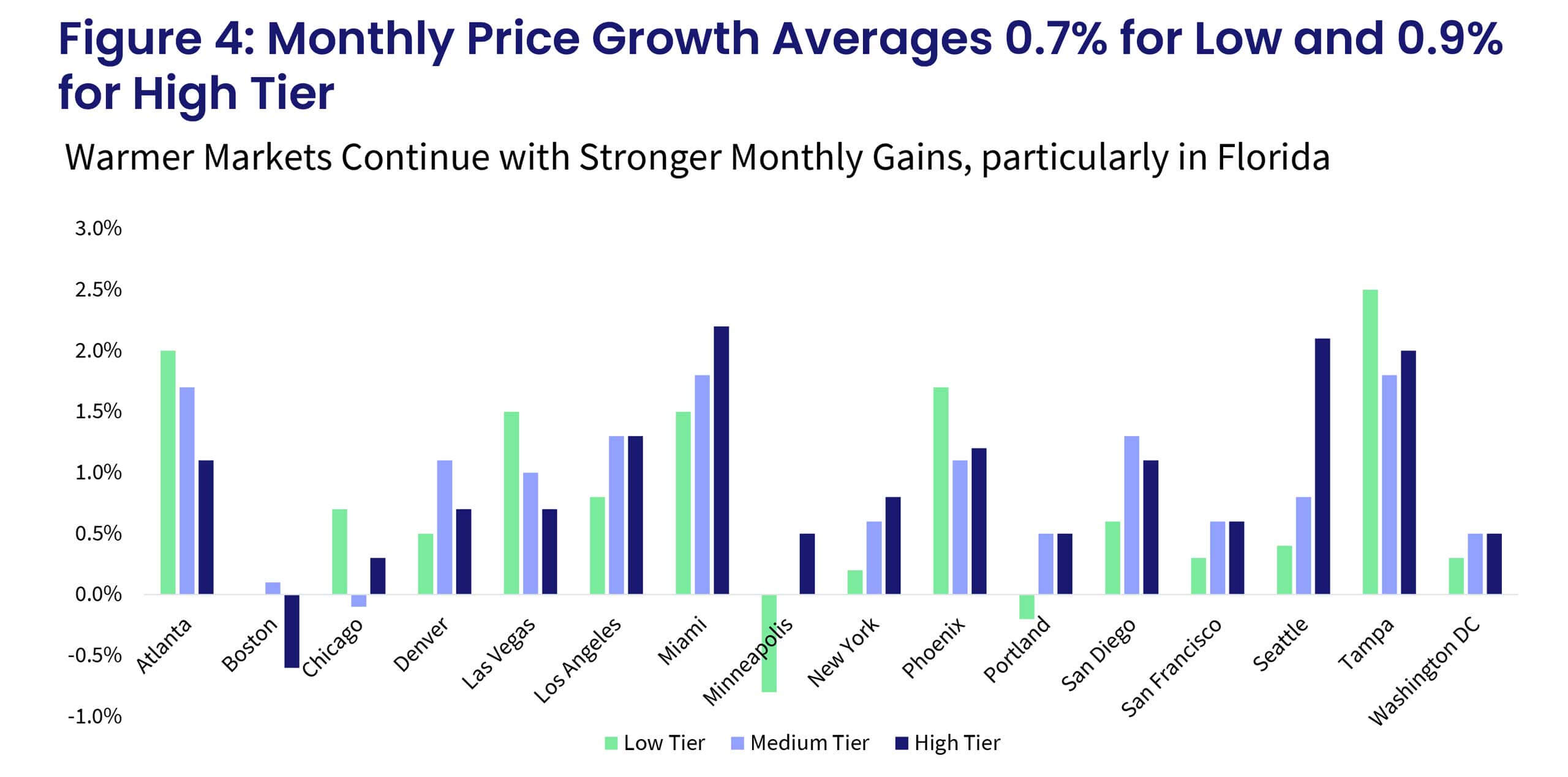

In addition, the month-to-month comparison of home price growth by price tier and location reveals where demand is slowing relatively faster. From October to November, areas with colder climates continued to experience deceleration or decline in home price growth, particularly Minneapolis, Boston and Chicago. In contrast, warmer cities, such as Atlanta, Miami, Tampa and Las Vegas continued to see increases in monthly gains.

The largest home price increase in the lower one-third price tier was in Tampa, up 2.5%, followed by Atlanta, up 2%. Minneapolis and Portland, Oregon, had a monthly decline in the low tier in November. The average monthly gains among low-tier homes have remained steady in November, up 0.7%, though these are not seasonally adjusted. The high-tier monthly gains averaged 0.9% in November — again, noting acceleration from October’s average of 0.6%. In the high tier, Miami led the monthly gains, up 2.2%, followed by Seattle, up 2.1% (Figure 5).

Coming into 2022, most housing market indicators, such as pending sales, list-to-price ratios and inventory levels, continue to suggest robust demand and worsening inventory levels than we saw at this time in 2021. Together, these factors will continue to drive strong price acceleration, even if it decelerates from its current, near-20% annual growth rate. Nevertheless, headwinds continue for the housing market and overall economy. Higher mortgage rates, which have jumped above 3.5% at the beginning of 2022, will likely exacerbate affordability issues and may deter some potential sellers from selling their homes. In addition, the continued risk of elevated inflation may lead to a strong monetary policy reaction by the Federal Reserve and further push the mortgage rates up and consequently weigh on housing demand. Slowing demand could put a damper on prices as well.

Nevertheless, recent S&P CoreLogic Case-Shiller and CoreLogic HPI data suggests that markets in Southwest, warmer markets in the Southeast, particularly in Florida, and higher-tier price ranges have remained relatively more resistant to economic forces, mortgage rates and COVID-19-related demand changes and continue to be magnet markets for many buyers. Given that these areas have also had the relatively largest gains in in-migration, pressure on prices has persisted and will likely remain over the coming year.

2022 CoreLogic, Inc. , All rights reserved.