Increased Conforming G-Fee, Higher Jumbo Credit Standard, and Risk-Based Pricing

Historically large-balance mortgage loans, known as ‘jumbo’ loans, had a higher interest rate than conforming loans.[1] However, since mid-2013 a jumbo loan has been cheaper to borrow than a conforming mortgage loan, by an average of 33 basis points during the first quarter of 2018.[2]

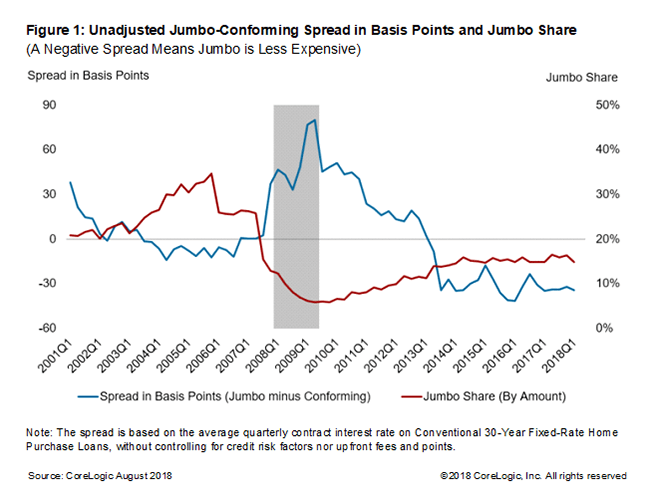

Figure 1 shows the unadjusted difference, or ‘spread’, between the average contract interest rate for jumbo loans and conforming loans during the last 17 years. Jumbo loans had a lower contract rate if the blue line is below zero and conforming loans were cheaper if this line is above zero. As seen in the figure, conforming loans were a better deal during the period of Q2 2007 to Q1 2013. The spread spiked during the Great Recession and reached its peak in Q2 2009, making conforming loans cheaper by almost 80 basis points. However, the spread declined and reversed in Q2 2013 when jumbo loans began to have a lower average contract rate. The difference continues to favor jumbo loans by about 30 basis points through Q1 2018. The red line in the figure shows that the share of jumbo loans plummeted as the spread widened and started to increase slowly as the spread narrowed and eventually turned negative. The share of jumbo loans has reached its highest since 2009 at about 15 percent of home-purchase originations (in dollars); in 2009 the jumbo share was just 6 percent.

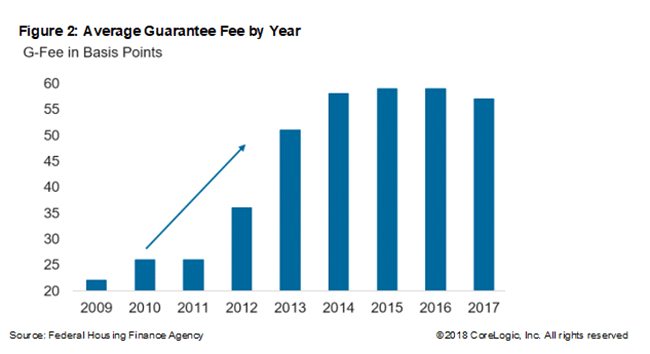

One of the reasons that the jumbo-to-conforming rate difference has declined is the increase in guarantee fees (also known as g-fees) for the loans bought by Fannie Mae and Freddie Mac for conforming and high-balance conforming loans.[3] The average g-fee has almost tripled since 2010 from 22 basis points to 57 basis points in 2017 (Figure 2).[4] Since jumbo loans are too big to be purchased by Fannie Mae and Freddie Mac, those fees have little or no impact on the note rate of the jumbo loans. Fannie Mae and Freddie Mac are pricing the credit risk of conforming loans, while banks are pricing the credit risk of jumbo loans. Thus, increase in guarantee fees has the effect of raising interest rates for conforming loans with little or no impact on the mortgage rates for jumbo loans.

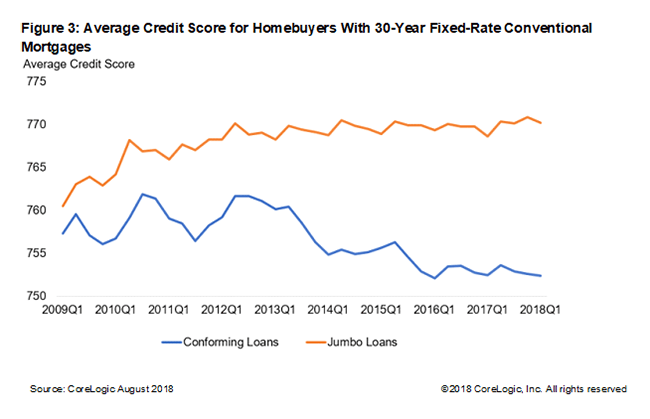

Another reason is the comparatively higher credit standard of jumbo loans. The credit risk characteristics of jumbo loans have evolved overtime. Today nearly all jumbo loans are full doc and made to prime borrowers, lowering credit risk across two dimensions. The average credit score for homebuyers with 30-year fixed-rate jumbo loans was 18 points higher than for homebuyers with conforming loans in Q1 2018, compared to just 4 points higher for homebuyers with jumbo loans in Q1 2009 (Figure 3). Thus, the jumbo-conforming spread may have been influenced by the higher-standard of jumbo loans and risk-based pricing, the process through which lenders tend to charge premiums for higher-risk mortgages and lower rates for lower-risk loans.

In our upcoming blog, we will estimate the spread between the contract interest rate for jumbo loans and conforming loans by controlling the other loan characteristics; such as credit score, loan-to-value ratio, debt-to-income ratio and loan size.

[1] The 2018 maximum conforming loan limit for one-unit properties for most areas is $453,100.

[2] Only 30-year fixed-rate conventional home-purchase loans were included for both conforming mortgage loans and jumbo mortgage loans for this analysis. For this analysis, we did not control for any risk factors such as credit score, loan-to-value ratio, or debt-to-income ratio; also, the analysis does not control for upfront fees or points paid. A basis point equals one-hundredth of a percentage point, or 1 basis point = 0.01 percentage point.

[3] G-fee is the additional cost reflected in the interest rate on a mortgage loan guaranteed by Fannie Mae and Freddie Mac. One purpose of this fee is to compensate for the credit risk associated with the conforming mortgage loans.

[4] The Federal Housing Finance Agency has been under pressure by the current majority in Congress to increase g-fees to ensure taxpayers are not “left holding the bag.” In fact, the Temporary Payroll Tax Cut Continuation Act of 2011 required increases in fees “by at least an average of 10 basis points.”

© 2018 CoreLogic, Inc. All rights reserved.