360 Property Data

CoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataCoreLogic powers businesses with unrivaled property data, insights and technology.

Explore Our DataDifferentiate with insights and analysis from CoreLogic property data.

Know MoreProperty. People. Potential. CoreLogic unlocks value for the entire property ecosystem.

Learn MoreHome / 360 Property Data / Market Intelligence

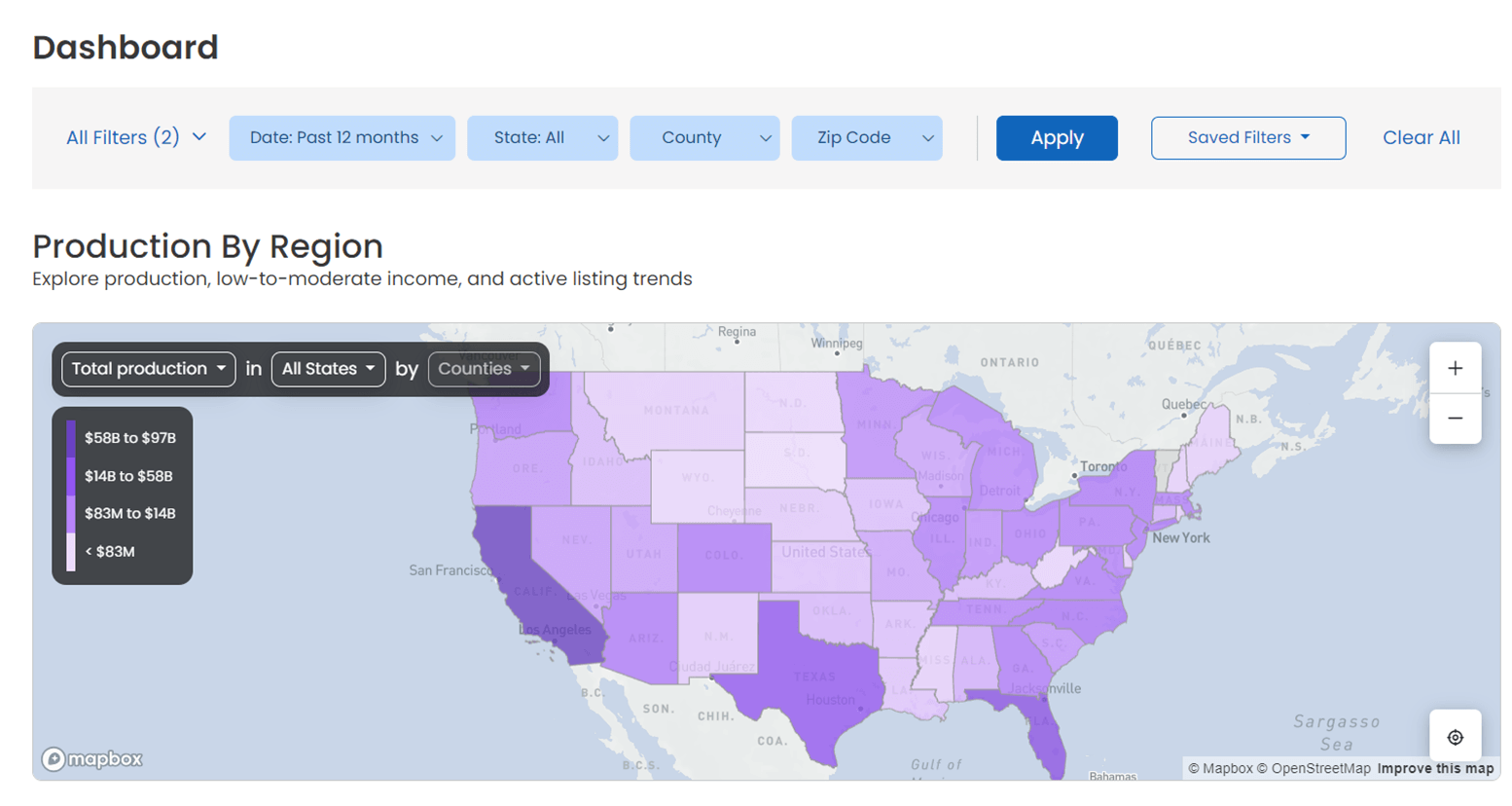

CoreLogic’s current and comprehensive mortgage data can give you everything you need to know about the market fit of your mortgage products and those of competitors in your area. Get transaction-level details on mortgages originated across the United States or down to your local area of interest to crush the competition.

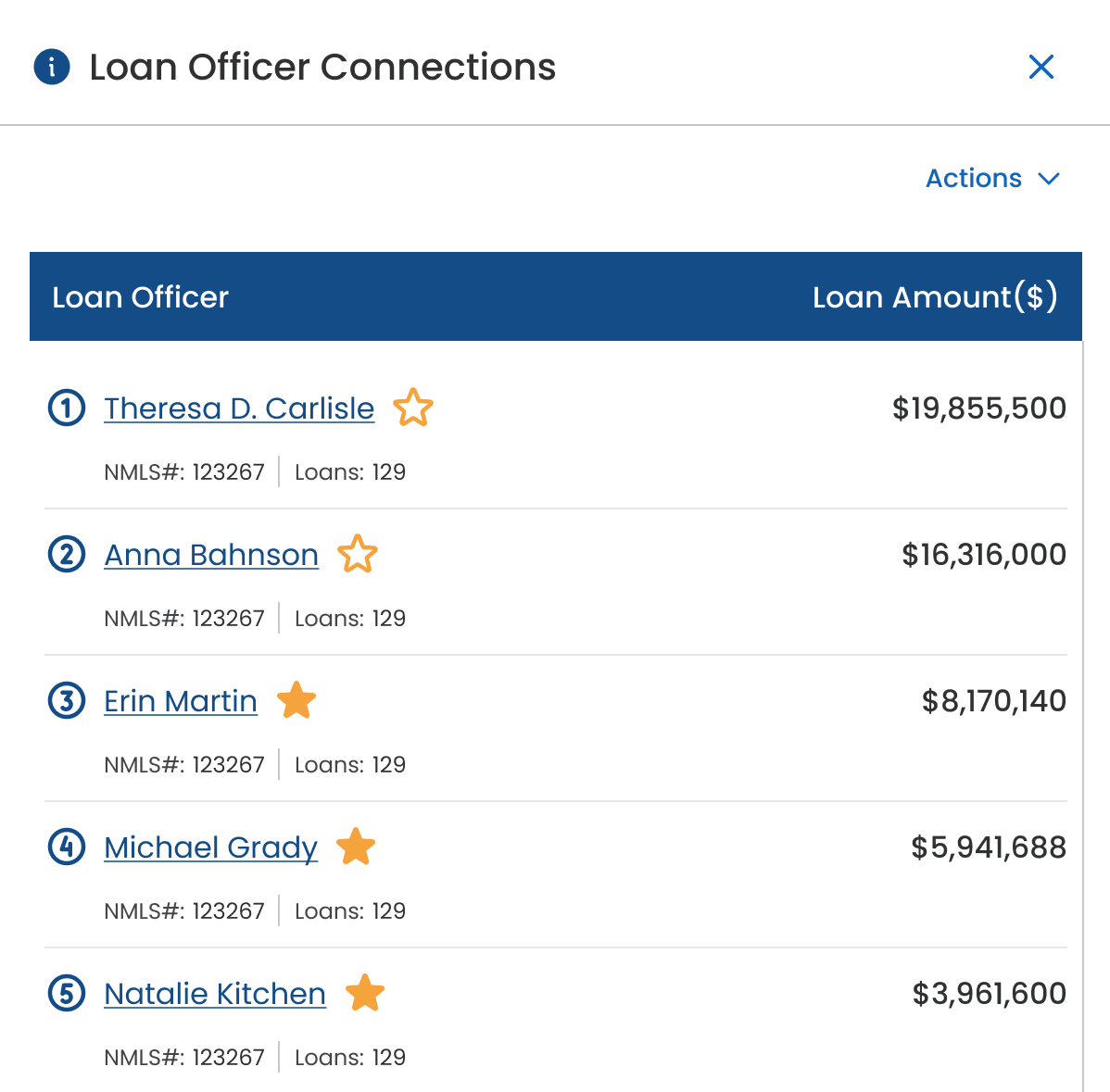

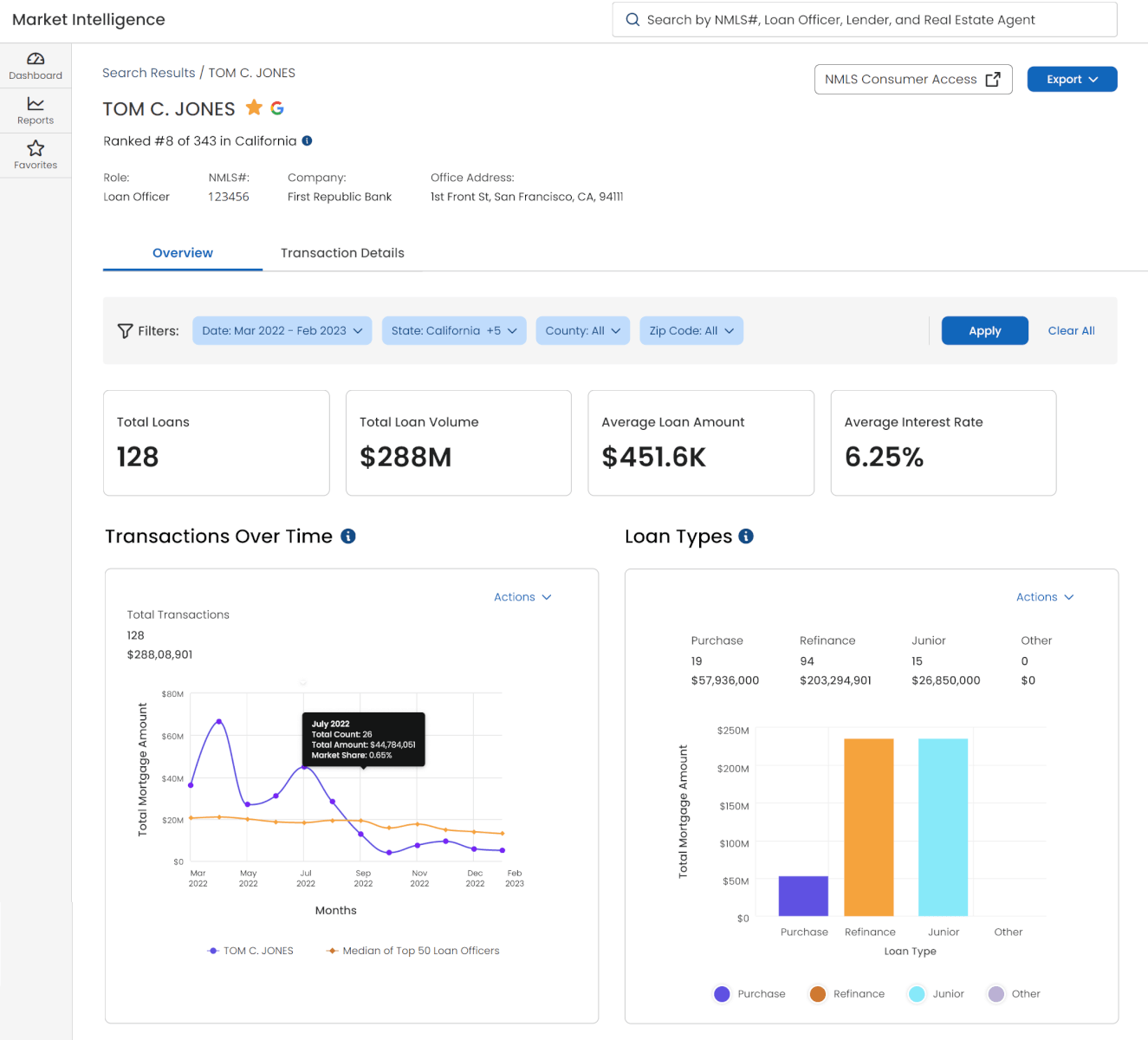

In a highly competitive mortgage environment, it is essential that you build a high-performing team capable of selling your strongest products. Discover top loan officers, track their performance trends over time, compare them against market averages, and dive into their relationships to determine if they are the perfect fit for your organization.

Strong relationships are the key to success in the mortgage market, and Market Intelligence can help empower your loan officers to grow and mature their mortgage originations pipeline. Build your next set of critical partnerships using CoreLogic’s robust listing data to find the top agents in your area, visualize their existing relationships, and familiarize yourself with their performance.

Market Intelligence is your roadmap to understanding the mortgage market, leveraging comprehensive datasets to pinpoint market threats and opportunities and fuel growth. Stay competitive with up-to-date market trends, assist with compliance efforts, and cultivate vital loan originator and real estate relationships. Detailed insights are provided in an easy-to-use interface that allows you to customize the vast array of data provided to focus on the content that’s important to you.

Harvest the power of CoreLogic’s vast and detailed datasets. View transaction-level mortgage and listing data from 99% of parcels and an extensive set of listings across the nation.

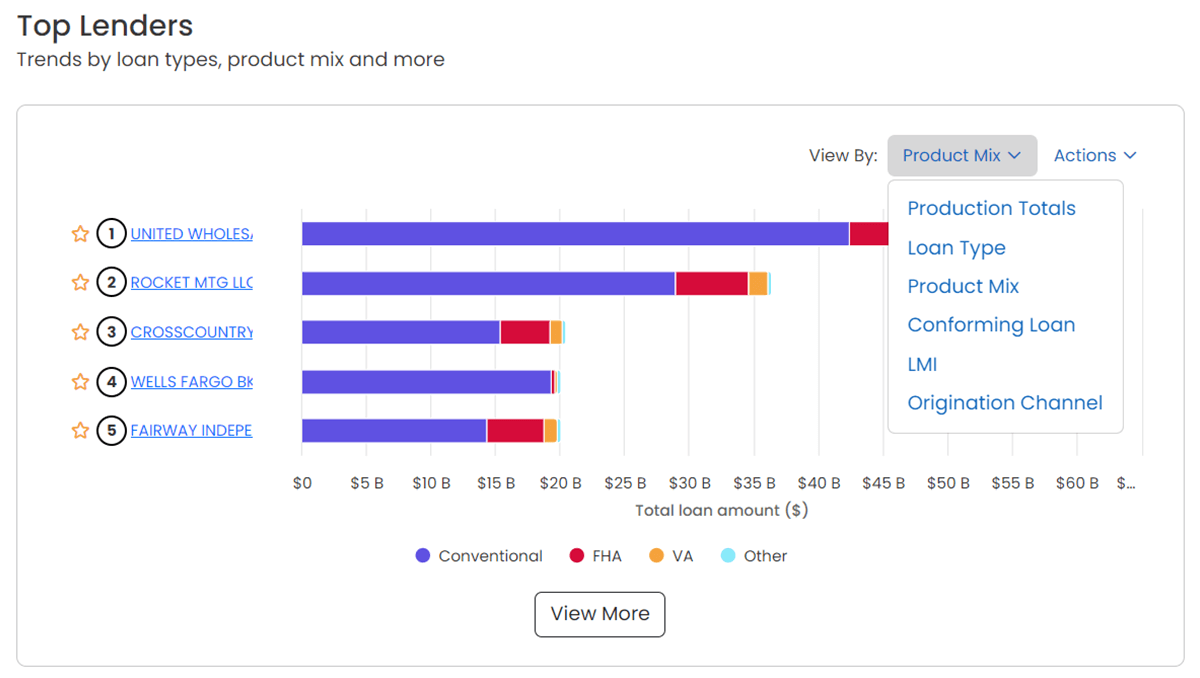

Get detailed insights into mortgage lenders and loan officer production. Understand their loan types, product mix, conforming or non-conforming loans, low-to-moderate income loans and much more so you can better identify areas of lending opportunity.

Benefit from our forward-thinking approach, predicting market trends in home values, new construction and active listings to help you prepare for your market’s unique opportunities and threats.

Our best-in-class CoreLogic Home Price Index and CoreLogic HPI Forecast help deliver information into future trends. And thanks to the in-depth data sources provided by CoreLogic, you can leverage this information from the national level all the way down to a specific census tract, helping you determine where you should focus your lending efforts in the coming year.

Top mortgage firms need top loan officers to stay at the top. Market Intelligence delivers detailed data on both loan officers and real estate agents throughout the country. This data can be a valuable asset when you are trying to recruit or hire loan officers that have specific areas of expertise, or are top performers in a region.

Using our custom relationship tracking feature, you also can identify opportunites to connect your loan officers to high performing real estate agents in their areas. Close relationships between real estate agents and mortgage lenders lead to increased business opportunities, especially in a competitive market.

Market Intelligence is equipped with advanced search and filtering capabilities, allowing you to customize your views to handle only the data you need. Filters can be saved for future use, providing a consistent experience.

For the Loan Officer view, these capabilities allow you to perform a Google search on the person, look up their information in the NMLS database, filter their information based on loan type or product mix and see their performance over time. The result is a powerful single view that provides the critical information you need to master your mortgage markets.

Market Intelligence customer support details:

Phone: 844-323-3783

Email: [email protected]

Hours: 6AM-5PM PST

Market Intelligence is designed to help businesses identify new market opportunities. By analyzing market trends, consumer preferences, and competitive landscapes, Market Intelligence can uncover untapped markets, emerging trends, and niche segments, providing valuable insights to drive growth and innovation.

Absolutely! Market Intelligence is designed to help you identify emerging trends, market gaps, and new opportunities. By staying current with the latest market insights, you can position your business for success.

CoreLogic’s transactions and listing data are generally updated daily within the Market Intelligence product. Due to public record reporting delays, certain counties may experience data latency, but CoreLogic works regularly with its source data providers to ensure that its transaction data is updated as frequently as possible.

Our Market Intelligence solution is web-based and accessible through a secure login. Once you subscribe to our service, you will receive access credentials and can start exploring the rich insights and functionalities it offers.

Market Intelligence is beneficial for businesses of all sizes. Market Intelligence helps level the playing field for small lending organizations by providing access to valuable market insights previously available only to larger organizations at an affordable cost.

Market Intelligence provides valuable insights into market trends, customer preferences, and competitive landscape. It helps businesses identify new opportunities, optimize strategies, mitigate risks, and stay ahead of the competition.

Fill in the form below to contact us.