Hurricane Ian will have an industry-changing impact on the future of real estate industry, infrastructure

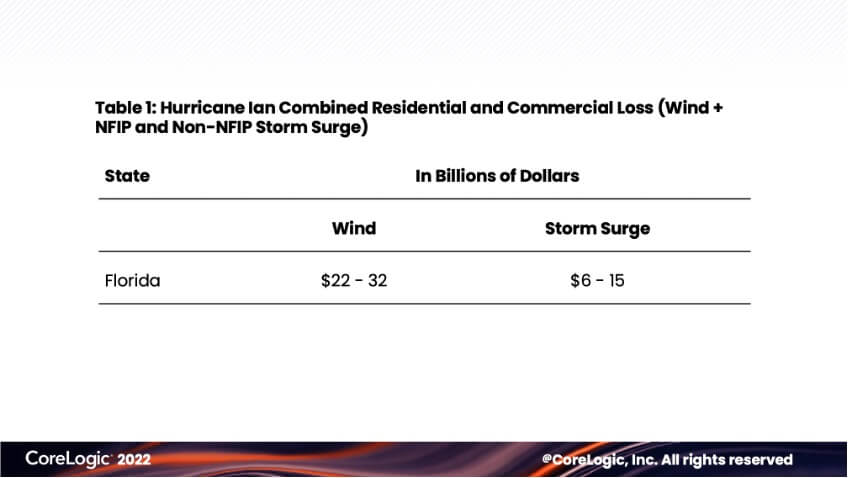

IRVINE, Calif., September 29, 2022—CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today announced residential and commercial wind and storm surge loss estimates for Hurricane Ian. According to this new data analysis, wind losses for residential and commercial properties in Florida are expected to be between $22 billion and $32 billion. Insured storm surge losses in Florida are expected to be an additional $6 billion to $15 billion.

“This is the costliest Florida storm since Hurricane Andrew made landfall in 1992 and a record number of homes and properties were lost due to Hurricane Ian’s intense and destructive characteristics,” said Tom Larsen, Associate Vice President, Hazard & Risk Management, CoreLogic. “Hurricane Ian will forever change the real estate industry and city infrastructure. Insurers will go into bankruptcy, homeowners will be forced into delinquency and insurance will become less accessible in regions like Florida.”

If forecasts hold steady, CoreLogic expects Hurricane Ian to continue bringing flash flood devastation across Florida and potentially into South Carolina and Georgia . Residents will experience standing water and sewer backups for days, slowing immediate recovery. Significant infrastructure damage will also impede local governments’ ability to respond.

The Implications of Hurricane Ian Recovery

With inflation at a 40-year high, interest rates nearing 7%, and labor as well as materials still in high in demand, CoreLogic anticipates recovery will be slow and difficult. Though recent legislation like the Inflation Reduction Act aims to improve infrastructure and resilience, the real estate industry is poised to evolve. “We’re at a crossroads with Hurricane Ian in terms of adapting to today’s catastrophe risk environment,” said Larsen. “Infrastructure and building codes will evolve so that we can be more resilient ahead of what are bound to be more history-making storms in the near future. We cannot just rebuild; we need to restore for resilience.”

Florida’s real estate market was healthier than average prior to Hurricane Ian, according to CoreLogic economists. “In the second quarter of 2022, Florida posted one of the highest home equity gains in the U.S., with an average of $100,000 in equity per homeowner,” said Selma Hepp, interim lead of the Office of the Chief Economist, CoreLogic. “Florida also had the highest home price gains in July. Gains in equity and record declines in loan-to-value ratios will provide many Florida homeowners with a financial buffer in case economic conditions worsen, as is typically the case following natural catastrophes.”

More on Hurricane Ian Loss Estimates

The post-landfall estimates below have been updated based on the September 29 8 a.m. PT National Hurricane Center (NHC) advisory of the storm. This analysis includes insured loss from damage to residential homes and commercial properties, including contents and business interruption and does not include broader economic loss from the storm. Ian was downgraded to a tropical storm as it moved across the Florida peninsula. However, flash flooding will be the primary concern until the storm reforms over the ocean with the potential to make another landfall as a hurricane in South Carolina. As such, CoreLogic will produce flood loss estimates next week.

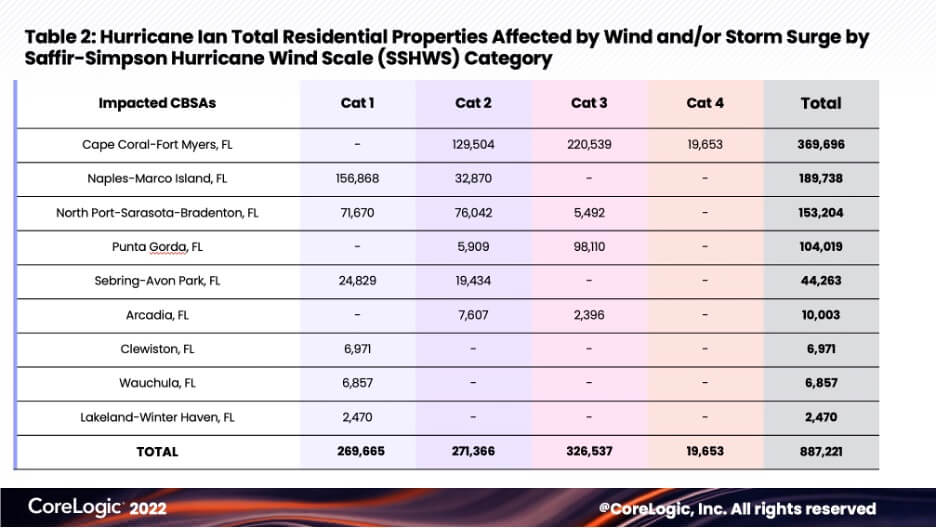

Table 1 shows the estimates for commercial and residential insured property losses by state. Table 2 shows the estimated number of homes exposed to hurricane-force winds.

Visit the CoreLogic natural hazard risk information center, Hazard HQ™, at www.hazardhq.com to get access to the most up-to-date Hurricane Ian storm data and see reports from previous storms.

Methodology

CoreLogic offers high-resolution location information solutions with a view of hazard and vulnerability consistent with the latest science for more realistic risk differentiation. The high-resolution storm surge modeling using 10m digital elevation model (DEM) and parcel-based geocoding precision from PxPoint™ facilitates this realistic view of risk. Single-family residential structures less than four stories, including mobile homes, duplexes, manufactured homes and cabins (among other non-traditional home types) are included in this analysis. Multifamily residences are also included. This is not an indication that there will be no damage to other types of structures, as there may be associated wind or debris damage and are not tabulated in this release.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact [email protected] or Caitlin New at [email protected]. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, Hazard HQ and PxPoint are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Media Contact

Robin Wachner

CoreLogic

[email protected]

Media Contact

Caitlin New

INK Communications

512-906-9103

[email protected]